In my last post, I pointed to the shift towards passive investing that has accelerated over the last decade and argued that much of that shift can be explained by the sub-par performance of active investors. I ended the post on a contradictory note by explaining why I remained an active investor, though the reasons I gave were more personal than professional. I was taken to task on two fronts. The first was that I should have spent less time describing the problem (poor performance of active investors) and more time diagnosing the problem (the reasons for that poor performance). The second was that my rationale for being an active investor, i.e., that I enjoyed investing enough that I would be okay not earning excess returns, could never be used if I sought to manage other people's money and that a defense of active investing would have to be based on something more substantial. Both are fair critiques and I hope to address them in this post.

The Roots of the Active Investing Malaise

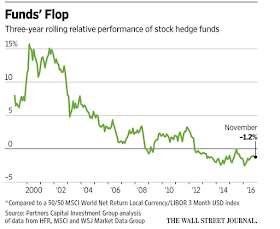

There is no denying the facts. Active investing has a problem not only because it collectively under performs passive investing (which is a mathematical given) but also because the drag on returns (from transactions costs costs and management fees) seems to be getting worse over time. Even those few strands of active investing that historically have outperformed the market have come under siege in the last decade. While there are many reasons that you can point to for this phenomenon, here are some that I would highlight:

- A "Flatter" Investment Word: The investment world is getting flatter, as the differences across active investors rapidly dissipate. From information to processing models to trading platforms, professionals at the active investing game (including mutual funds and hedge funds) and individual investors are on a much more even playing field than ever before. As an individual investor, I have access to much of the information that an analyst working at Merrill Lynch or Fidelity has, whether it be financial statements or market rumors. I am not naive enough to believe that, SEC rules against selective information disclosure notwithstanding, there are no channels for analysts to get "inside" information but much of that information is either too biased or too noisy to be useful. I have almost as much processing power on my personal computer as these analysts do on theirs and can perhaps even put it to better use. In fact, the only area where institutions (or at least some of them) may have an advantage over me is in being able to access information on trading data in real time and investing instantaneously and in large quantities on that information, leading to breast beating about the unfairness of it all. If history is any guide, the returns to these strategies fade quickly, as other large players with just as much trading power are drawn into the game. In fact, while much ink was spilt on flash trading and how it has put those who cannot partake at a disadvantage, it is worth noting that the returns to flash trading, while lucrative at first, have faded, while attracting smaller players into the game. In summary, if the edge that institutional active investors have had over individual active investors was rooted in information and processing power, it has almost disappeared in the United States and has eroded in much of the rest of the world.

- No Core Philosophy: There is an old saying that if you don't stand for something, you will fall for anything, and it applies to much of active investing. Successful investing starts with an investment philosophy, a set of core beliefs about market behavior that give birth to investment strategies. Too many active investors, when asked to characterize their investment philosophies, will describe themselves as "value investors" (the most mushy of all investment descriptions, since it can mean almost anything you want it to mean), "just like Warren Buffett" (a give away of lack of authenticity) or "investors in low PE stocks" (confusing an investment strategy with a philosophy). The absence of a core philosophy has two predictable consequences: (a) a lack of consistency, where active investors veer from one strategy to another, often drawn to whatever strategy worked best during the last time period and (b) me-tooism, as they chase momentum stocks to keep up with the rest. The evidence for both can be seen in the graph below, which looks at the percentages of funds in each style group who remain in that group three and five years later and finds that about half of all US funds change styles within the next five years.

Source: SPIVA - Bloated Cost Structures: If there is a core lesson that comes from looking at the performance of active investors, it is that the larger the drag on returns from the costs of being active, the more difficult it is to beat passive counterparts. One component of these costs is trading costs, and the absence of a core investment philosophy, referenced above, leads to more trading/turnover, as fund managers undo entire portfolios and redo them to match their latest active investing avatars. Another is the overhead cost of maintaining an active investing infrastructure that was built for a different market in a different era. The third cost is that of active management fees, set at levels that are not justified by either the services provided or by the returns delivered by that management team. Active money managers are feeling the pressure to cut costs, as can be seen in expense ratios declining over time, and the fund flows away from active money managers has been greatest at highest cost funds. I can only speak for myself but there is not one active investor (nope, not even him, and not even if he was forty years younger) in the world that I have enough reverence for that I would pay 2% (or even .5%) of my portfolio and 20% (or 5%) of my excess returns every year, no matter what his or her track record may be. To those who would counter that this is the price you have to pay for smart money, my response is that the smart money does not stay smart for very long, as evidenced by how quickly hedge fund returns have come back to earth.

- Career Protection: Active money managers are human and it should come as no surprise that they act in ways that increase their compensation and reduce their chances of losing their jobs. First, to the extent that their income is a function of assets under management (AUM), it is very difficult, if not impossible, to fight the urge to scale up a strategy to accommodate new inflows, even if it is not scaleable. Second, if you are a money manager running an established fund, it is far less risky (from a career perspective) to adopt a strategy of sustained, low-level mediocrity than one that tries to beat the market by substantial amounts, with the always present chance that you could end up failing badly. In institutional investing, this has led some of the largest funds to quasi-index, where their holdings deviate only mildly from the index, with predictable results: these funds deliver returns that match the index, prior to transactions costs, and systematically under perform true index funds, after transactions costs, but not by enough for managers to be fired. Third, at the other end of the spectrum, if you are a small, active money manager trying to make a name for yourself, you will naturally be drawn to high-risk, high-payoff strategies, even if they are bad bets on an expected value basis. In effect, you are treating investing as a lottery, where if you win, more money will flow into your funds and if you do not, it is other people's money anyway.

There are macroeconomic factors that may also explain why active investing has had more trouble in the last decade, but it is not low interest rates or central banks that are the culprits. It is that the global economy is going through a structural shift, where the old order (with a clear line of demarcation between developed & emerging markets) is being replaced with a new one (with new power centers and shifting risks), upending historical relationships and patterns. Given how much of active money management is built on mean reversion and lessons learned by poring over US market data from the last century, it should come as no surprise that the payoff to screening stocks (for low PE ratios or high dividend yield) or following rigid investing rules (whether they be centered on CAPE or interest rates) has declined. In all of this discussion, I have focused on the faults of active institutional investors, be they hedge funds or mutual funds, but I believe that their clients bear just as much responsibility for the state of affairs. They (clients) let greed override good sense (knowing that those past returns are too good to be true, but not asking questions), claim to be long term (while demanding to see positive performance every three months), complain about quasi indexing (while using tracking error to make sure that deviations from the index get punished) and refuse to take responsibility for their own financial affairs (blaming their financial advisors for all that goes bad). In effect, clients get the active money managers they deserve.

A Pathway to Active Investing Success

If you accept even some of my explanation of why active investing is failing, at least collectively, there is a kernel of good news in that description. Specifically, the pathway to being a successful active investor lies in exploiting the weakness of the active investment community, especially large institutional investors. Here are my ingredients for active investing success, though I will add the necessary caveat that having all these ingredients will not guarantee an investment payoff.

- Have a core investment philosophy: In my book on investment philosophies, I argued that there is no best investment philosophy that fits all investors. The best investment philosophy for you is the one that best fits you as an investor, in sync not only with your views about markets but with your personal makeup (in terms of patience, liquidity needs and skill sets). Thus, if you have a long time horizon, believe that value is grounded in fundamentals and that markets under estimate the value of assets in place, old-time value investing may very well be your best choice. In contrast, if your time horizon is short, believe that momentum, not value, drives stock prices, your investment philosophy may be built around technical analysis, centered on gauging price momentum and shifts in it.

- Balance faith with feedback: In a post on Valeant, I argued that investing requires balancing faith with feedback, faith in your core market beliefs with enough of an acceptance that you can be wrong on the details, to allow for feedback that can modify your investing decisions. In practice, walking this tightrope is exceedingly difficult to do, as many investors sacrifice one at the expense of the other. At one extreme, you have investors whose faith is so absolute that there is no room for feedback and positions once taken can never be reversed. At the other extreme, you have investors who have no faith and whose decisions change constantly, as they observe market prices.

- Find your investing edge: It has always been my contention that you have to bring something uncommon to the investment table to be able to take something away. Drawing on the language of competitive advantages and moats, what sets you apart does not have to be unique but it does have to be scarce and not easily replicable. That is why I am unmoved by talk of big data in investing and the coming onslaught of successful quant strategies, unless that big data comes with exclusivity (you and only you can exploit it). Here are four potential edges (and I am sure that there others that I might be missing): (a) In sync with client(s): I was not being facetious when I argued that one of my big advantages as an investor is that I invest my own money and hence have a freedom that most active institutional investors cannot have. If you are managing other peoples money, this suggests that your most consequential decision will be the screening your clients, turning money away from those who are not suited to your investment philosophy (b) Sell Liquidity: To be able to sell liquidity to investors seeking it, especially in the midst of a crisis, is perhaps one of investing's few remaining solid bets. That is possible, though, only if you, as an investor, value liquidity less than the rest of the market, a function of both your financial security. (c) Tax Play: Investor price assets to generate after-tax returns and that effectively implies that assets that generate high-tax income (dividends, for instance) will be priced lower than assets that generate low-tax or no-tax income. If you are an investor with a different tax profile, paying either no or low taxes, you will be able to capture some of the return differential. Before you dismiss this as impossible or illegal, recognize that there is a portion of each of our portfolios, perhaps in IRAs or pension funds, where we are taxed differently and may be able to use it to our advantage. (d) Big Picture Perspective: As we become a world of specialists, each engrossed in his or her corner of the investment universe, there is an opening for "big picture" investors, those who can see the forest for the trees and retain perspective by looking across markets and across time.

If you are considering actively investing your money, you should be clear about what your own investment philosophy is, and why you hold on to it, and identify the scarce resource that you are bringing to the investment table. If you are considering paying someone else to actively manage your money, my suggestion is that while you should consider that person's track record, it is even more critical that you examine whether that track record is grounded in a consistent investment philosophy and backed up by a sustainable edge.

There is much that I still do not know about investing but here are the lessons that I learn, unlearn and relearn every day. First, an investment cannot be a sure-bet and risky at the same time, and you can count me among the skeptical when presented with the next easy way of beating the market. Second, when I believe that I own the high ground in any investment debate, it is a sure sign that I have let hubris get the better of me and that my arguments are far weaker than I think they are. Third, much as I hate to be wrong on my investment choices, I learn more when I concede that "I am wrong" than when I contend that "I am right". For now, I will continue to invest actively, holding true to my investment philosophy centered on intrinsic value, while nurturing the small edges that I have over institutional investors.

Elusive ? Yes. Impractical ? No. I think that chasing alpha in an era of diminishing returns -to use an analogy-is like hunting an animal that exists in fewer numbers than before. Also, large gains are being diluted by magnified losses.

ReplyDeleteThe active managers that do best in equities, it has been shown, are those with 20 or fewer holdings.

It is just hard to do well with richly priced securities. When the prices will adjust to a more realistic level I think you can expect to have active managers shine at their craft.

Thank you for your post on the topic professor. During school, I had an opportunity to delve deeper into this topic. I came across the concept of 'Active share' - percent of your portfolio different than the index - analogous in some ways to tracking error. It appears that the under-performance of active strategies is caused by 'closet indexing'. Funds with high active share do seem to create alpha. Now whether it is due to higher 'risk' depends on how one defines 'risk'.

ReplyDeleteProf. Damodaran,

ReplyDeleteCommenting on the last 2 articles. I am in the industry and do bottoms up valuation on single stocks. Some will naturally cry bias but I truly do believe in the valuation approach. If it is what I believe, how else should I act?

Now that my bias is exposed, I like to take things to the extreme to test a hypothesis. I am not going to cover all of the inherent headwinds faced by mutual funds and the managers such as cash limitations, style limitations, retail fear led redemptions or retail greed led share purchases, egos, bonuses tied to indexes (Active Share), consultants trying to earn their keep focusing on quarterly results, unnecessarily high fees, etc.

I can't accept passive "investing' as a logical end-point although I do acknowledge the graphs and the data points in this article. As they say, the market is actually the expression of the average investor.

Investing is putting money to work in a company that has the balance sheet, products, processes and management to generate a return. With passive investing you are throwing it in a pool expecting more successes than failures spread-out over say 500 companies on the premise that all known factors and assumptions are priced in. Your investing is more statistical based relying on probabilities and correlations. While I think statistical analysis and MPT have some places in portfolio management I think them more the tail than the dog. I don’t see the following always priced in: accounting of fear and greed, management, business cycles, responses to regulation, interest rates, long-term impacts of CAPEX trends, changing technologies, the over payment for acquisitions and share buy backs , etc..

When buying stocks one should view putting the money to work as handing it over to a company to use that money to grow that company and generate cash flow. Analysis begins with establishing the base line of the business position, using numbers to try to gauge if there is a history of performing well and whether the numbers back up their rhetoric and claims and making assumptions on this historical picture. I can't believe that if I was looking to buy a private business to run that it is only blind luck as to whether I would pick a good business to purchase and that my better option is to get a syndicate together so that I could buy a bunch of businesses and hope some will work out.

If there is no economic value (and placing no value on the joy of the work of valuation) in active investing then valuation and reviewing of financial statements is completely useless. While we are throwing out valuation, why not throw out economics? That discipline surely has had some doubtful calls. For the time and effort spent on financial and economic theory, I don't see the ROI (sorry to the finance and econ PhDs.). It should be basically a quasi-dead industry run only by custodians, 3 or 4 ETF providers and coders. I suppose investment bankers may have a place but what happens to the capital raise and IPOs if there is no view to the upside? Who will take the risk? Maybe private equity is the new King of the Hill. What will the landscape look like if capital formation has all but dried up? Where does the capital come from for business to form and grow in a 90% passive world?

Now of course, I don't believe what I suggested above. I think that knowing the value of a company looked at from many angles enables you to act with conviction when the market overreacts.

I welcome this wholesale move to passive investing. I can't wait until a Time Magazine cover says "Active Investing is Dead". I can see how strategy type investing loses its edge as others pick up on it. Value investing is not a strategy per se as it is a process of hard work where the ground beneath you is constantly moving.

Over the years I have thought many times about getting your perspective and I finally used this article as the catalyst. Should I sign this Don Quixote?

Dear Dr. Damodaran, I am valuing GE and faced with this challenge that I'd like you to shed some light on, though it is not related to your post. For net CapEx, should I include the value of dispositions of business (GE Capital) into the calculation for the years it is expected to take place? This one-off incident of course will not be part of my long-term cash flow projections. I just think that dispositions represent a source of cash flow that can be used to return to shareholders or fund growth initiatives and can thus have an impact on share prices. Please let me know your thoughts on this. Sincerely. Tung (Jerry) Hoang

ReplyDelete