Some of my Brazilian readers seem to be upset that I used "No Mas", Spanish words, rather than Portuguese ones, in the title. To be honest I was not thinking about language, but instead about a boxing match from decades ago, where Roberto Duran used these words to give up in his bout with Sugar Ray Leonard.

I have used Vale as an illustrative example in my applied corporate finance book, and as a global mining company, with Brazilian roots, it allows me to talk about how financial decisions (on where to invest, how much to borrow and how dividend payout) are affected by the ups and downs of the commodity business and the government’s presence as the governance table. In November 2014, I used it as one of two companies (Lukoil was the other one) that were trapped in a risk trifecta, with commodity, currency and country risk all spiraling out of control. In that post, I made a judgment that Vale looked significantly under valued and followed through on that judgment by buying its shares at $8.53/share. I revisited the company in April 2015, with the stock down to $6.15, revalued it, and concluded that while the value had dropped, it looked under valued at its prevailing price. The months since that post have not been good ones for the investment, either, and with the stock down to about $5.05, I think it is time to reassess the company again.

Vale: A Valuation Retrospective

In November 2014, in a post titled “Go where it is darkest”, I repeated a theme that has become a mantra in my valuation classes. While it easiest to value mature, money-making companies in stable markets, I argue that the payoff to doing valuation is greatest when uncertainty is most intense, whether that uncertainty comes from the company being a young, start-up without a business model or from macroeconomic forces. The argument is based on the simple premise that your payoff is determined not by how precisely you value a company but how precisely you value it, relative to other people valuing the same company. When faced with boatloads of uncertainty, investors shrink from even trying to do valuation, and even an imprecise valuation is better than none at all.

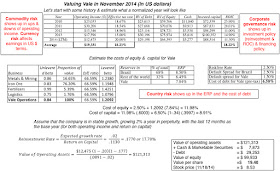

It is to illustrate this point that I chose Vale and Lukoil as my candidates of doom, assaulted by dropping commodity prices (oil for Lukoil and iron ore prices for Vale), surging country risk (Russia for Lukoil and Brazil for Vale) and plummeting currencies (Rubles for Lukoil and Reais for Vale). I valued both companies, but it is the valuation of Vale that is the focus of this post and it yielded a value of $19.40/share for a stock, that was trading at $8.53 on that day. The narrative that drovemy valuation was a simple one, i.e., that iron ore prices and country risk would stabilize at November 2014 levels, that the earnings over the last twelve months (leading into November 2014), which were down 40% from the previous year’s numbers, incorporated the drop in iron ore prices that had happened and that eventually Vale would be able to continue generating the mild excess returns it had as a mature mining company.

I did buy Vale shares after this analysis, arguing that there was a buffer built into earnings for further commodity price decline.

In April 2015, I revisited my valuations, as the stock prices of both companies dropped from the November 2014 levels, and I labeled the post “In search of Investment Serenity”. The post reflected the turmoil that I felt watching the market deliver a negative judgment on my initial thesis, and I wanted to check to see if the substantial changes on the ground (in commodity prices, country risk and currency levels) had not changed unalterably changed my thesis. Updating my Vale valuation, the big shifts were two fold. First, the trailing 12-month earnings that formed the basis for my expected value dropped a third from their already depressed levels six months earlier. Second, the implosion in Petrobras, the other large Brazilian commodity company, caused by a toxic combination of poor investments, large debt load and unsustainable dividends, raised my concern that Vale, a company that shares some of the same characteristics, might be Petrobrased. Again, I made the assumption that the trailing 12-month numbers reflected updated iron ore prices and revalued the company, this time removing the excess returns that I assumed in perpetuity in my earlier valuation, to arrive at a value per share of $10.71.

I concluded, with a nod towards the possibility that my conclusions were driven by my desire for confirmation bias (confirming my earlier judgment on Vale being under valued), that while I might not have been inclined to buy Vale in April 2015, I would continue to hold the stock.

Vale: The September 2015 Version

The months since my last valuation (in April 2015) have not been good for Vale, on any of the macro dimensions. The price of iron ore has continued to decline, albeit at a slower rate, over the last few months. That commodity price decline has been partially driven by the turmoil in China, a country whose massive infrastructure investments have been responsible for elevating iron ore prices over the last decade. The political risk in Brazil not only shows no signs of abating, but is feeding into concerns about economic growth and the capacity of the country to repay its debt. The run-up that we saw in Brazilian sovereign CDS prices in April 2015 has continued, with the sovereign CDS spread rising above 4.50% this week.

The ratings agencies, as always late to the party, have woken up (finally) to reassess the sovereign ratings for Brazil and have downgraded the country, Moody’s from Baa2 to Baa3 and S&P from BBB to BB+, on both a foreign and local currency basis. While both ratings changes represent only a notch in the ratings scale, the significance is that Brazil has been downgraded from investment grade status by both agencies.

Finally, Vale has updated its earnings yet again, and there seems to be no bottom in sight, with operating income dropping to $2.9 billion, a drop of more than 50% from the prior estimates. While it is true that some of the write offs that have lowered earnings are reflections of iron ore prices in the past, it is undeniable that the earnings effect of the iron ore price effect has been much larger than I estimated to be in November 2014 or April 2015. Updating my numbers, and using the sovereign CDS spread as my measure of the country default spread (since the ratings are not only in flux but don’t seem to reflect the assessment of the country today), the value per share that I get is $4.29.

I was taken aback at the changes in value over the three valuations, separated by less than a year, and attempted to look at the drivers of these changes in the chart below:

The biggest reason for the shift in value from November 2014 to April 2015 was the reassessment of earnings (accounting for 81% of my value drop), but looking at the difference between my April 2015 and September 2015 valuations, the primary culprit is the uptick in country risk, accounting for almost 61% of my loss in value.

Vale: Time to Move on?

If I stay true to my investment philosophy of investing in an asset, only if its price is less than its value, the line of no return has been passed with Vale. I am selling the stock, but I do have to tell you that it was not a decision that I made easily or without fighting through my biases. In particular, I was sorely tempted by two games:

- The “if only” game: My first instinct is to play the blame game and look for excuses for my losses. If only the Brazilian government had behaved more rationally, if only China had not collapsed, if only Vale’s earnings had been more resilient to iron ore prices, my thesis would have been right. Not only is this game completely pointless, but it eliminates any lessons that I might be extract from this fiasco.

- The “what if” game: As I worked through my valuation, I had to constantly fight the urge to pick numbers that would let me stay with my original thesis and continue to hold the stock. For instance, if I continue to use the rating to assess default spreads for Brazil, as I did in my first two valuations, the value that I get for the company is $6.65. I could have then covered up this choice with the argument that CDS markets are notorious for over reacting and that using a normalized value (either a rating-based approach or an average CDS spread over time) gives me a better estimate.

After wrestling with my own biases for an extended period, I concluded that the assumptions that I would need to make to justify continuing to hold Vale would have to be assumptions about the macro environment: that iron ore prices would stop falling and/or that the market has over reacted to Brazil’s risk woes and will correct itself. If there is anything that I have learned already from my experiences with commodity companies and country risk, it is that my macro forecasting skills are woeful and making a bet on them magically improving is wishful thinking. In fact, if I truly want to make a bet on these macro movements, there are far simpler, more direct and more lucrative ways for me to exploit these views that buying Vale; I could buy iron ore future or sell the Brazil sovereign CDS. I like Vale's management but I think that they have been dealt a bad hand at this stage, and I am not sure that they can do much about the crosswinds that are pummeling them. If you have more faith in your macro forecasting skills than I do, it is entirely possible that Vale could be the play you want to make, if you believe that iron ore prices will recover and that the Brazil's risk will revert back to historic norms. In fact, given my abject failure to get these right over the last few months, you may want to view me as a contrary indicator and buy Vale now.

Investing Lessons

It is said that you can learn more from your losses than from your wins, but the people who like to dish out this advice have either never lost or don’t usually follow their own advice. Learning from my mistakes is hard to do, but let looking back at my Vale valuations, here is what I see:

- The dangers of implicit normalization: While I was careful to avoid explicit normalization, where I assumed that earnings would return to the average level over the last five or ten years or that iron ore prices would rebound, I implicitly built in an expectation of normalization by taking the last twelve-month earnings as indicative of iron ore prices during that period. At least with Vale, there seems to be a lag between the drop in iron ore prices and the earnings effect, perhaps reflecting pre-contracted prices or accounting lethargy. By the same token, using the default spread based on the sovereign rating provided a false sense of stability, especially when the market's reaction to events on the ground in Brazil has been much more negative.

- The Stickiness of Political Risk: Political problems need political solutions, and politics does not lend itself easily to either rational solutions or speed in resolution. In fact, the Vale lesson for me should be that when political risk is a big component, it is likely to be persistent and can easily multiply, if politicians are left to their own devices.

- The Debt Effect: All of the problems besetting Vale are magnified by its debt load, bloated because of its ambitious growth in the last decade and its large dividend payout (Vale has to pay dividends to its non-voting preferred shareholders). While the threat of default is not looming, Vale's buffer for debt payments has dropped significantly in the last year, with its interest coverage ratio dropping from 10.39 in 2013 to 4.18 in 2015.

There are two lessons that I had already learned (and that I followed) that helped me get through this experienced, relatively unscathed.

- Spread your bets: The consequences of the Vale misstep for my portfolio were limited because I followed my rule of never investing more than 5% of my money in any new stock, no matter how alluring and attractive it looks, a rule that I adopted because of the uncertainty that I feel in my valuation judgments and that the market price moving towards my value. In fact, it is the basis for my post on how much diversification is the right amount.

- Never take investment risks that are life-style altering (if you fail): Much as I would like to make that life-altering investment, the one whose payoff will release me from ever having to think about investing again, I know it is that search that will lead me to take "bad" risks. Notwithstanding the punishment meted out to me by my Vale investment, I am happy to say that it has not altered my life choices and that I have passed the sleep test with flying colors. (I have not lost any sleep over Vale's travails).

Closing Thoughts

If I had known in November 2014 what I know now, I would obviously have not bought Vale, but since I don’t have that type of hindsight , that is an empty statement. I don’t like losing money any more than any one else, but I have no regrets about my Vale losses. I made the best judgments that I could, with the data that I had available in my earlier valuations. If you disagreed with me at the time of my initial valuation of Vale, you have earned the right to say "I told you so", and if you went along with my assessment, we will have to commiserate with each other.

This is not the first time that I have lost money on an investment, and it will not be the last, and I will continue to go where it is darkest, value companies where uncertainty abounds and hope that my next excursion into that space delivers better results than this one.

YouTube

Previous Blog Posts

This is not the first time that I have lost money on an investment, and it will not be the last, and I will continue to go where it is darkest, value companies where uncertainty abounds and hope that my next excursion into that space delivers better results than this one.

YouTube

Previous Blog Posts

- Go where it is darkest (November 2014)

- In search of Investment Serenity (September 2015)

Aswath, great post. However i find kind of insulting the No mas, No mas, which is spanish. We brazilians speak portuguese.

ReplyDeleteThanks.

The issue is in valuation model . You have used a tool that can work wonders for consumer goods company with relative stable demand for commodity company .

ReplyDeleteCommodity companies are best invested in when they are bottom of cycle . How you know you are at bottom of cycle . Rule of thumb is overall global or regional ( depending upon relevant commodities) capacity reduction by Min 20% .

These stocks one needs enter once in a decade and move out when operating margins are @ 3 /5 years high and capacity increase plan is faster rate than demand rate projections

Dear Professor. I am glad that you penned this post just now. I am "involved" with another commodity fiasco of my own, Chemours, a recent spinoff from Dupont. While it doesnt have country risk, it does share two features with Vale. It has a lot of debt and due to a steep drop in titanium dioxide, iits ebitda has fallen from a peak of more than two billion in 2011 to approx 600 million, perilously close to it violating its debt covenant. It has a third dimension of risk, litigation, which will be the hardest to forecast. Anyway, i will attempt to go back to your previous posts on Vale and try to learn from them to value CC.

ReplyDeleteI am curious about two things though. One, what made you pick Vale and lukoil to "go where it was darkest"? And two, why did you pick April of 2015 and then September 2015 to revalue the business? Perhaps the answers are "no particular reason" but I thought I'd ask.

Thanks

Prof, nice post, and rational thoughts.

ReplyDeleteHowever, I have noticed that investing where it is darkest has its share of (in fact loads of) uncertainties. I know, that's why you like it. Nevertheless, I have found that investing in stable businesses, those boring ones, do lend opportunities now and then and if you show some enterprise it can be very rewarding. Take for instance, during 2008 crisis we had enough time. Such opportunities are also available with individual stocks, as opposed to the entire market, since markets react too much once in a while, if not regularly. Why can't act then and rest of the time, may be play the guessing game with very little money that we can afford to gamble?

To be honest, I was not even thinking of language, when I said "No Mas". Instead, I was remembering Roberto Duran, in a boxing match with Sugar Ray Leonard, using these words after he was beaten up badly. Anyway, what is the Portuguese version of I have had enough!

ReplyDeleteDear Professor,

ReplyDeleteFirstly, I'd like to thank you for your blog, videos and articles. I also followed your Vale journey. I didn't invest myself as I felt the opportunity cost for myself was too high. But having read this recent post, there are so some flaws in it, and I'm quite surprised:

1) Firstly, your first valuation on VALE, takes no probabilistic estimates. So ultimately, the bias here lies in assuming +ive expected value. My principles of investment, lie on allocating capital to bets with the highest expected value, one can't consider opportunity cost with out this estimate.

2) Normalising the earnings made sense, but you have done it over 4 years only. 2010-2014. Even Ben Graham in the Intelligent Investor, suggests cyclically adjusting earnings over 10 years. In a commodity business it would be obvious to do so, and especially include 2008-2009.

3) Let's assume your ALL your initial assumptions were correct. Price is $8.53 and Value = $19.40; This arbitrage can exist but over a given time period. i.e. the estimate of intrinsic value will only be seen by the market by patience. You get paid for providing liquidity to the market and waiting. If you look at October 2008 VALE hit $11.94, It took to December 2009 to reach $29.03 [I'm just reading of Yahoo charts right now, so could be slight discrepancies] So, not even a full year has past yet...sure you went in early but that's when liquidity is highest.

4) VALE is leveraged, so it's going to get kicked down even more by Mr Market in a sell off. As a two edged sword, this company will rise also back fastest.

5) There are many reasons why VALE has sold off China, Brazil scandals, iron prices etc. It doesn't really matter, but you could have hedged the position if the price/value discrepancy was company specific by shorting Brazil, shorting other iron ore/steel companies etc.

Sentiment in Brazil will turn around next year anyway as they are hosting the Olympics.

Just a general point, when you're investing how soon are you expecting to double your money from $8.53 to $19.40....in one year?! (You've shown ROIC is 15.72% average over last 4 years...)

The growth in intrinsic value of a business will reflect the average/long term Return on Capital of that business.

And prices of companies over the long term do indeed reflect their intrinsic value. As Graham suggests "in the short run, the market is a voting machine, in the long run it is a weighing machine"

Aswath Damodaran,

ReplyDeleteThe portuguese (BR) version of it would be something like "Não da mais".

As a brazilian i have opposing views in the matter of the valuation. Although Vale is definitely struggling in recent years, it's management is being forced to cut costs and become more efficient on it's operation.

That combined with it's path towards producing better quality iron ores (higher margins), and it's almost monopoly of mining sites all over brazil makes me look to the future with a more optimistic view as i do think Vale is one of the company's that will be in the better positions to profit from the iron ore market in the world.

Another point is that market reactions to Brazil's political and economic crisis tend is currently on a snowballing negative effect with all the psychological biases that follows human behavior, also I don't believe it justifies that big impact in Vale operation on the long term neither that huge magnitude of effect in your valuation.

Thank you, Dr. Damodaran, for this brief course of education. It lights up many thoughts and ideas (and refreshers!) Airing your "dirty laundry" for the edification of others is very generous and noble.

ReplyDeleteJust out of curiosity, if I may, with ZIRP how do you derive the rate to use for basics such as CAGR, NPV, IRR, WACC?

Thanks for a good article. Like many investors I’ve long valued your text, Investment Valuation. I do have a couple of questions about the methodology you’ve used in valuing a commodity company.

ReplyDeleteWith a company, whose earnings and cash flow vary greatly depending on changing commodity prices, does it ever make sense to try to value the company using recent results and assuming a stable growth rate in perpetuity?

I suppose it might, if you really believe that commodity prices will change in a stable way going forward. However, that assumption is wrong far more often than not.

As uncertain as it might be, doesn’t it make more sense in most cases to try to forecast changing commodity prices and the effect on earnings and cash flow for at least three or four years, when the changes have the greatest effect on discounted present value, before assuming a stable growth rate in perpetuity?

Professor,

ReplyDelete"No more" in Portugese is "Não mais".

Thanks for your article - I wish that everybody would write a follow up post like that, on their ideas that didn't work out as well as those that did. It would do wonders for the quality of investment analysis online - and for humility, too.

One question - have you also sold Lukoil? And do you have any further thoughts on where the price of oil could be going?

Thanks,

Paul

The portuguese version would be something like: "Chega! Já é o suficiente!"

ReplyDeleteSomewhat related to the comment by Shailesh Naik and your statement: "After wrestling with my own biases for an extended period, I concluded that the assumptions that I would need to make to justify continuing to hold Vale would have to be assumptions about the macro environment: that iron ore prices would stop falling and/or that the market has over reacted to Brazil’s risk woes and will correct itself. If there is anything that I have learned already from my experiences with commodity companies and country risk, it is that my macro forecasting skills are woeful and making a bet on them magically improving is wishful thinking."

ReplyDeleteIsn't it (almost) always the case with natural resources companies (CXV, BHP, POT, CCJ, AEM, etc.) that a DCF valuation model makes assumptions about the price (trend) of the underlying commodities? If one's "guess" about the direction of the commodity's price is to optimistic, isn't the valuation, and hence the decision to buy the stock, going to appear to be an error in retrospect? Especially since the outcome is most sensitive to earnings estimates that are based on commodity price assumptions implicitly if not explicitly?

Professor, appreciated your insightful financial analysis.

ReplyDeleteI just wanna highlight one key business developments in vale and correction on your formula number (value of operating assets).

1) China account for over half of world seaborne market (iron ore). On July 2015, China lifted a three year ban on Vale's Valemax mega vessels. It will bring down the delivery cost for vale and put it competitive again (not on par but closer) against its Australia mining competitor who enjoy cheaper shipping cost. This will have a long term impact on the profit margin and shall substantiate your recovery assumption of its business in the long run.

Before the ban was lifted, the transportation costs from Brazil to China (through Malaysia) were estimated at US$22 per ton. Now, Vale would save about US$7 per ton for direct delivery.

Australian Iron ore producers have around US$10 per ton average in terms of freight cost before band lifting.

You always campaign to associate number with story, i am sure this will be a key consideration.

2) With reference to your most updated September valuation, i notice that in your formula presentation ("Value of Operating Assets"), you mistakenly quoted 16.42% (Reinvestment Rate) as Return on capital, while it should be 12.18%.

Just a wrong presentation, i checked your final output of $48,451, it is still computed based on 12.18% (ROC)

regards,

Jonathan (Singapore)

Now even more important question is would you short Vale at this point ? If not then, you shouldn't have closed your position

ReplyDelete>>It is said that you can learn more from your losses than from your wins, but the people who like to dish out this advice have either never lost or don’t usually follow their own advice

Not sure why you say that as this is one of the quotes from Soros

"To others, being wrong is a source of shame; to me, recognizing my mistakes is a source of pride. Once we realize that imperfect understanding is the human condition, there is no shame in being wrong, only in failing to correct our mistakes"

I think Vale highlights that some investment risks are the result of an interplay of factors which are inherently non linear and difficult to model.

ReplyDeleteIt also highlights the importance of the context in which an investment is made, particularly with regard to macro factors in the case of commodities. An accurate assessment of demand from China, and putting that demand into proper historical context when determining a margin of safety for this investment, is the controlling variable for determining value in this case.

While using the trailing 12 month results as they existed last year may have seemed like a reasonable proxy for Chinese demand, in fact China's consumption of iron ore in recent years represented an epic bubble which is still in the process of being wound down. The widely reported existence of ghost cities and the obvious overcapacity in its steel industry were just two of the many clues that China's iron ore demand was likely to fall significantly going forward (the enormous rise of its debt post-2008 was another clue that infrastructure driven demand was unsustainable).

I recommend taking a look at the 25 year chart of Cliffs stock price (CLF). While it is not a perfect proxy for Chinese iron ore demand, I think it makes a compelling graphic statement that conditions in the iron ore business in the last decade got wildly out of whack, that extrapolating forward from a year ago based on the prior 12 months might not have been a reasonable assumption, and that a bigger margin of safety might be in order.

Lastly, I think this case highlight's the wisdom of Buffett's "too hard" pile. Your post implies that a successful investment in Vale required accurate assessments of commodity, currency and political risk. Getting any one of them right is enough of a challenge, getting all three right is a tall order. While conditions of uncertainty do generate opportunity, there are limits to how many uncertain vectors and their interplay we can reasonably model and estimate.

All that said, I appreciate the rigor and intellect that you put into all of your posts and appreciate the candor in assessing your investment process.

Sorry Professor, its the old story - crap in, crap out! Two obvious things you glossed over right at the start. (1) what DonutShorts says - your starting point for earnings was in the clouds - look at the long term price chart of FeO2 - it was 25 -35 in 2005/6 and was still over $80 in the LTM earnings base you had. Its currently $56/tonne. (2) in light of the bubble chart of FeO2, doesn't it strike you as wrong that you input an unlettered beta of 0.86 for the iron ore biz? Certainly does to me. It might be an oligopoly but theres only one major buyer and the political risk was amplified by the fact that buyer (China) keeps its high cost producers in business. Same old slides for BHP, Rio, Vale and FMG - "we are a low cost player and the high cost ones will inevitably close." Well if they are subsidised by theChinese Government, just not yet.

ReplyDeleteI actually love your piece because you bravely expose the mistakes made along the way, and do a good mea culpa. I'd rather buy FMG than Vale. BTW I love Vale's presentations about low gearing.....they have a stark familiarity with oil companies a couple of years ago.

Dear Professor,

ReplyDeleteI´m the first time on your block and have to say that I really enjoyed reading your valuation of Vale. I find the company interesting too!

But personally I think you missed one important point in your recent evaluation: Your evaluation is state of the art when it comes to the factor of using "old" data to evaluate the company. But it is missing some reasonable forecasts when it comes to revenues and costs in the upcoming years (e.g. Vale will try to generate earnings by more production in the future etc.). To put this into perspective, I see a trading range of USD 6-7 more realistic in the next 12 month.

Best wishes from Germany,

Fabian

Thanks Professor for sharing the post...and is a very more helpful when you show losses...thanks...

ReplyDeleteNo mas ...no mas...is the same like: "Não mais" in pourtuguese( BR) ...and i will tell you a little help....you can used because is the same that David Luiz told toThomas Mueller in the soccer match on Fifa 2014 game....7-1 ....

Hello Dr. Damodaran,

ReplyDeleteCould you do a follow up on your investment thesis for Lukeoil. Your posts are very educational.

Thanks,

Naser

Professor, great post, only one small factual correction, Brazil was only downgraded from investment grade status by S&P. Brazil was downgraded by Moodys, but still holds its investment grade status, at least for now.

ReplyDelete