The Biden Administration's $ 2 trillion infrastructure plan, announced with fanfare a few weeks ago, has opened up a debate about not only what comprises infrastructure, but also about how to pay for it. Not surprisingly. it is corporate taxes that are the primary vehicle for delivering the revenues needed for the plan, with an increase in the federal corporate tax rate from 21% to 28% being the central proposal. I will leave the debate on what comprises infrastructure to others, and focus entirely on the corporate tax question in this post. I do this, knowing fully well that tax debates quickly turn toxic, as people have strong priors on whether corporations pay their fair share of taxes, and selectively find inforrmation to back their positions. I will begin by laying out the pathways through which corporate taxes affect company value, and then looking at how the 2017 tax reform act, which lowered the federal tax rate from 35% to 21%, has affected corporate behavior.

Taxes, Earnings and Value

At first sight, this section may seem useless, because the effect of tax rates on value seems blindingly obvious. As the corporate tax rate rises, all else being held constant, companies will pay more of their earnings in taxes, and should be worth less. That facile assessment, though, can falter for the following reasons:

- Feedback effect on taxable income: This may seem cynical, but it is nevertheless true that the amount that companies report as taxable income and how much they choose to defer taxes into future years is a function of the corporate tax rate. As tax rates rise, corporations use the discretion built into the tax code to report less taxable income and to defer more taxes to future years. It is for this reason that legislatures around the world over estimate how much additional revenue they will generate, when they raise taxes, and investors over estimate how much corporate earnings will rise when tax rates are decreased.

- Contemporaneous changes in the tax code: When corporate tax rates are changed, it is a given that there will be other changes in the tax code that may either counter the tax rate change or add to it. For instance, the 2017 US tax reform act, in addition to lowering the corporate tax rate, also changed the way that foreign income to US companies was taxed and put limits on the tax deductibility of debt.

- Financing Mix: Companies can raise capital either from equity or debt, and the costs of equity and debt can be altered when the tax rate changes. That is because interest on debt is tax deductible, and as the corporate tax rate rises, the after-tax cost of debt falls, making debt more attractive as a financing option for companies, relative to equity.

- Tax Deferral Options: Companies that have more options when it comes to deferring taxes than others can buffer the impact of higher corporate taxes by choosing to defer taxes and report less taxable income. The most significant of those options, in my view, is foreign sales, with companies that generate more of their income overseas acquiring more tax freedom than purely domestic companies. There are other options embedded in the tax code allowing for tax credits and deductions for some investments and expenses, with sectors like real estate being prime beneficiaries.

- Debt funding: Firms that are heavier users of debt financing will be able to offset some or even all of the impact of a higher corporate tax rate, by increasing their debt funding and using the tax advantages that come with the higher tax rate to lower their costs of capital.

Much of the discussion about corporate taxes is centered on the corporate tax rate, enumerated in the corporate tax code. As the proposal to raise the US corporate tax rate from 21% to 28% (or some number in the middle) is discussed, it is worth looking at the history of US corporate tax rates, going back to their inception early in the twentieth century:

While that system worked well for most of the twentieth century, it started to break down towards the end of that century, as the US became a less dominant player in the global economy, and other countries lowered their corporate tax rates. The first development meant that larger proportions of US corporate income was generated overseas, and the second increased the differential tax rates and thus the repatriation penalty. By 2014, when I wrote this post, the US tax code had become dysfunctional, as the trapped cash cumulated to trillions of dollars and some US companies sought to move their incorporation to other countries. This history is worth emphasizing, because the change in the US corporate tax rate in 2017, from 35% to 21%, accompanied by the abandonment of the global tax model just brought the US closer to the rest of the world in terms of both tax rates and treatment of foreign income. In fact, at the start of 2021, the picture below summarizes corporate tax rates around the world:

|

| Source: KPMG |

Effective Tax Rates

Governments set corporate tax rates, but companies use the tax code to full advantage to try to minimize taxes paid and delay the payment of taxes. The effective tax rate measures the actual taxes paid, relative to taxable income, and it is the number that determines how much governments collect as tax revenues.

Measures of Taxes Paid

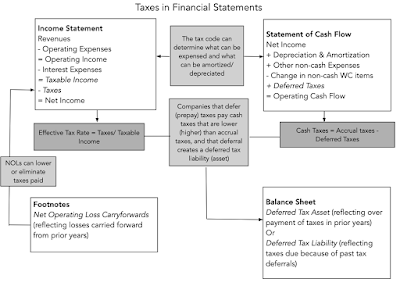

To measure how much companies pay in taxes, you have to start with the financial statements of the company, recognizing that these are reporting documents, not tax documents. Put simply, what you see as taxable income in the annual report or public financial filing for a company can be very different from the taxable income in the tax filings made by the same company. Since we have no access to the latter, at least for individual companies, there are clues in the reported financials that can nevertheless help us assess how much a company pays in taxes:

Note that effective tax rate is computed based upon the income statement, and is computed by dividing the accrual measure of taxes by the accrual taxable income. While that is the tax rate that most databases report, it may fail to capture the true tax burden for two reasons:

- Accrual income: It is worth remembering that accrual income is after accounting expenses, some of which are related to operations (cost of goods sold, marketing), some to financial (interest expenses) and some of which are determined by the tax code (depreciation and amortization, write offs, special charges). A company that is savvy about using tax provisions to lower its accrual income may be able to look like it is paying a high effective tax rate, but is actually paying very little in absolute terms.

- Cash taxes versus Accrual taxes: The actual taxes paid by to the government (cash taxes) can be higher or lower than the accrual taxes, and the difference should be visible in the cash flow statement in the form of deferred taxes.

- Past tax behavior: One final factor that can affect a company's tax burden is its past history. A company that has lost considerable amounts in prior years can accumulate net operating losses and reduce taxes paid in the current period. Alternatively, a company that has deferred taxes in prior years will find itself playing catch-up and paying more in taxes in the current year, just as companies that have pre-paid taxes in previous years may be able to pay far less in taxes in the current year.

- Taxes paid in dollar value (Accrual and Cash): This reflects the aggregate amount paid by all companies in a grouping during the most recent year. Ultimately, this is the number that matters most from a tax collection perspective.

- Average effective tax rate across all companies: This is the average tax rate across all companies in a grouping, including money losing companies. Not surprisingly, the average will be pushed down as the number of money losing firms increases.

- Average effective tax rate across money making companies: This deals with the problem of money losing companies, but it is a simple average and it weights very small companies and very large companies equally.

- Aggregate tax rate: This is the tax rate that best captures how much companies pay in a sector, and is computed by dividing the sum of taxes paid by all companies in a sector by the sum of taxable income. It thus weights bigger companies more than smaller companies.

US Effective Tax rates

The United States is fertile ground to examine how companies manage taxes for two reasons. The first is that until very recently, US companies faced among the highest marginal tax rates of companies anywhere in the world. The second is that the US tax code also has more credits and deductions, often put in by Congress with the best of intentions, that allow companies more discretion when it comes to computing taxable income and tax deferrals. To measure how much companies pay in taxes, I look at how much US companies have, in the aggregate, paid in taxes between 2016 and 2020, in the table below:

Note that while the corporate tax rate dropped by 14% (from 35% to 21%) from 2017 to 2018, the effective tax rate decreased by 6.8% and the cash tax rate by 2.75%. In a more telling statistic, the dollar value of taxes paid increased between 2017 and 2019 by 1.4% and cash taxes by almost 18%, as companies reported more taxable income. To put corporate tax behavior in larger perspective, I looked at corporate pre-tax income and taxes reported by the Bureau of Economic Analysis, going back to 1929:

While there are differences in year to year numbers, looking at this source rather than corporate filings, the story remains the same. Over time, the effective tax rate for companies has drifted down, with the decline accelerating over the last twenty years. It is also clear that the big disruptions in tax rates have come from economic shocks, with taxes collected and tax rates paid declining economic slowdowns and recessions. While the arguments about the right tax rate for US companies and whether they pay their fair share in taxes are legitimate ones, it has to start with a reality check. The perception that US companies are now paying significantly less in taxes than they were prior to 2017, while it may fit your preconceptions about corporate tax behavior, is not backed up by facts. Of course, you could believe that they should pay more than they have historically, but that discussion has to start with the recognition that lowering the tax rate in 2017 is not the reason, and that reversing it will not be the solution.

International Tax Behavior

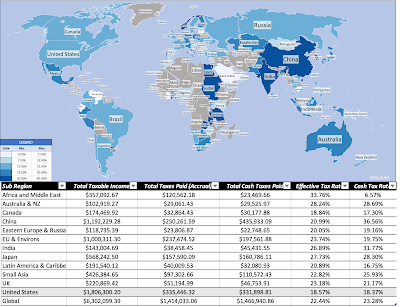

There is a widespread belief that US companies pay less in taxes than their global counterparts, and to see if that is true, I look at effective tax rates paid by companies in different countries in the map below:

On this measure, I do think that those who believe that US companies pay less than their "fair" share have a point, since the effective tax rate paid by US companies is lower than the effective tax rates of companies in much of the rest of the world (barring Canada). The differences are smaller when you look at the cash tax rate, but there is evidence here of the drag created by the tax credits and deductions added over multiple tax reform acts to the US tax code. The differences in tax rates across the world also underlie the challenge that Janet Yellen will face in trying to get companies to agree to a global minimum tax rate. The countries with tax rates much lower than the global average benefit because they draw in corporate subsidiaries that hope to benefit from the lower tax rates.

Sector-specific Tax Behavior

It is true that companies in different sectors are affected by the tax code differently, partly because there are tax credits and deductions that are directly specifically at specific sectors. To examine differences in tax rates paid by US companies in each industry grouping, I decided to go back to 2019, rather than 2020 numbers, because the COVID crisis wreaked havoc in some sectors.

|

| Data for all industries |

Thoughts on new tax laws

If Congress gets around to passing another tax reform act, I am sure that legislators will gets lots of opinions on what they should be doing, not to mention millions of dollars off lobbying directed at them. I am sure that my thoughts on what good tax legislation should look like matter little, but here they are:

- Pinpoint your mission: In keeping with the saying that if you do not know where you going, it does not matter how you get there, the starting point for all tax legislation has to be with the end game. Early on, legislators have to decide whether they consider corporate taxes to primarily a source of revenues to the government or a weapon to punish "bad" corporate behavior and to "reward" good corporate behavior. While I understand the urge to use the tax code to mete out punishment to "bad" companies or to encourage companies to pay a living wage and keep their operations in the United States, the resulting laws may actually result in less tax revenue to the government, with only fleeting benefits.

- All tax talk is agenda-driven: Undoubtedly, there will be research from the Congressional budget office on the revenue consequences of tax law changes and testimony from economists and tax experts. They will use numbers that back their arguments and look like facts, but in my experience, it is easy to lie with numbers, especially when it comes to taxes.

- Focus on removing tax deductions/credits, not on increasing tax rates: If the end game is to get companies to pay more in taxes, removing tax deductions and credits will be more effective than increasing the tax rate. In fact, raising the tax rate will not only raise the effective tax rate paid by companies far less than expected, but it will also have disparate effects across companies, with sectors (like retail) that have fewer degrees of freedom, when it comes to changing taxable income or deferring taxes, bearing the brunt of the pain. I know that this is easier said than done, since every tax deduction/credit has a constituency that will plead for its preservation, but one reason why the tax code has become the convoluted mess that it has become, is because we have not frontally dealt with this problem. An added benefit of doing this will be that there will be less work for tax accountants and lawyers and fewer tax-driven investments and decisions.

- You operate in a global economy: No matter how careful you write the tax laws, multinationals will retain a substantial amount of freedom to move their operations and income around the world. A country that is an outlier when it comes to taxes, as the United States was prior to 2017, will lose out in the competition for new businesses. While I do think that a global corporate minimum tax can reduce this cost somewhat, getting countries to sign on, especially when they realize that they will be "net losers" from being part of it, will be difficult.

- Provide long-term predictability: Whatever Congress decides to do with the tax code, it should also provide a degree of predictability for an extended period. Changes to the tax law that are temporary or come with sunset provisions create uncertainty for businesses trying to make investment decisions for the long term. In addition, changes in tax law take a while to work their way into corporate behavior. One of the better features of the 2017 tax act was that it had provisions designed to make debt financing less attractive, relative to equity, but we will not get a chance to see if companies become less dependent on debt, if tax rates are hiked and/or the limitations on interest tax deductions are eliminated.

- Marginal tax rate by country

- Effective tax rate by country

- Effective tax rate, by sector (US, Global)

No comments:

Post a Comment

Given the amount of spam that I seem to be attracting, I have turned on comment moderation. I have to okay your comment for it to appear. I apologize for this intermediate oversight, but the legitimate comments are being drowned out by the sales pitches and spam.