It has been an unsettling summer for anyone with a stake in the movie, television and broadcasting businesses. The strike by screen actors and writers which started in July is now into almost into its third month, with no end in sight, putting at risk the pipeline of movies and shows that were expected to hit theaters and streaming platforms in the next few months. On August 31, Disney pulled its television channels from Spectrum (owned by Charter, the second largest cable company in the US, after Comcast) after a dispute about payments for carrying these channels. Tennis fans, getting ready to watch the US Open on ESPN, were apoplectic, as their televisions went blank in the middle of matches, and Disney, in addition to encouraging them to complain to Spectrum, offered them an option of switching to Hulu+ Live TV, a streaming service alternative to cable. While actors and writers have been on strike before, and contractual disputes between content makers and cable providers is par for the course, the news stories of this summer seem more consequential, perhaps because they reflect longer time shifts in the movie and broadcasting businesses.

Speaking of Disney, a company that has found itself in the crosshairs of political and cultural disputes, the stock hit $80 on September 7, close to a ten-year low. To add to the angst, the threat of artificial intelligence (AI) overhangs almost every aspect of the business, and is one of the contested issues in the strike. The recent troubles in entertainment, though, reflect a longer term disruption that has occurred in the business, with the rise of streaming as an alternative to the traditional platforms for movies and television shows. In this post, I will focus on how streaming has not only changed the way we consume content, but has also modified the way that content gets made. In the process, it has altered the financial characteristics of the companies in the business in ways that the market is still trying to come to terms with, which may explain the market turmoil this year.

A Cautionary Tale: The Music Business and Streaming

If, as you watch the broadcasting business go through its struggles with streamers, you get a sense of deja vu, it is because the music business in the 1990s found itself similarly challenged, and its upending by streaming may offer lessons for the movie business. In the twentieth century, the music business followed a well-honed script. It was composed of companies which scouted for music talent, signed these musicians to music label contracts and then worked with them in their studios to produce record albums that were sold in music stores across the country. The music companies provided marketing support, seeking out radio stations that would carry their music, and distributional backing to get albums to retailers. In many ways, it was impossible for a musician to break through, without studio backing, and that power imbalance allowed the latter to claim the lion’s share of the revenues.

The disruptor who upset the music business was Napster, a platform that delivered pirated streams of music to its customers, effectively undercutting the need to go into music stores and buy expensive albums. While Napster downloads left much to be desired in terms of audio quality, and the company walked to (and often beyond) the very edge of legality, it exposed the weaknesses in the music business, from how new artists were found and marketed, to how their music was packaged and finally, how that music was sold. When the music companies of the day were able to shut Napster down in 2001, citing digital piracy, they were undoubtedly relieved, but their weaknesses had been exposed. Apple created the iTunes Store in 2001, allowing customers to buy individual songs, rather than entire albums, and the unbundling of the music business began. In the years that followed, music albums and music retailers became rarer, and the advent of the internet allowed musicians to bypass the gatekeepers at the music studios and go directly to customers. As smart phones and personal devices became more plentiful, Spotify and Pandora introduced the music streaming model, and the game was forever changed, and the consequences for the music business have been staggering:

- The music business shrank and the center of gravity shifted: The entry of streaming companies changed the economics of music, since it largely removed the need to buy music, even in the single-song format. Spotifyand Pandora allowed subscribers access to immense music libraries, with high audio quality, and as they grew, revenues to existing music labels dropped:As you can see, music revenues shifted (unsurprisingly) from studios to music streaming, but in a more troubling sign, the aggregate revenues of the music business dropped by almost 40% between 2000 and 2016. On a more optimistic note, the revenues are now back to pre-2000 levels, albeit not on inflation-adjusted basis, and 65% of all revenues in 2021 came from streaming. It is undeniable that streaming, by removing many of the intermediaries in the old music business model, has shrunk the business.

- The status quo crumbled: As revenues shrunk, and moved from the studios to the streamers, the companies that represented the status quo imploded. The music studio business, which had a dozen or more active players in the last century, has consolidated into a handful of firms, most of which are small parts of much bigger entertainment companies (Sony. Vivendi), and many of the biggest labels in music (Abbey Roads, Motown) are historical artifacts that have sold their music rights to others. The music retail business was decimated, as music retailers like Tower Records shut down, and as artists looking to replace lost revenues from record sales with live performances and merchandising sales, companies like LiveNation stepped in to fill the need.

- The divergence in musician take became larger: As revenues shrunk and partially recovered, not all musicians have shared in the new pie equally. The top one percent of musicians account for ninety percent of all music streams and close to sixty percent of revenues from concerts. A business that has always been top heavy in terms of rewarding success, has become even more so.

- Personalities became bigger than music labels: The advent of social media has allowed the highest profile performers to break free of most of the intermediaries in the music business. When you are Beyonce, and you have 15.3 million followers on Twitter and 317 million followers in Instagram, you have more reach and persuasive powers than any music company on the face of the earth. While it is true that social media has allowed a few musicians to break through and become successes, I think it is undeniable that social media is exacerbating the differences between big name musicians and unknowns more than it is helping close the gap.

Movie and Broadcasting - The Twentieth Century Lead In

The movie business had its beginnings in the early 1900s, when the first movies were made and Hollywood became the destination of choice for movie makers, at least in the United States. In the years after, the great movie studios had their beginnings, with the precursor to Paramount being created by Cecil B. DeMille and others in 1915, followed soon by Metro Goldwyn Mayer (MGM), RKO, 20th Century Fox and Warner Bros (creating the Big Five), as well as by smaller players (Universal, United, Columbia), . In the golden age (at least for the studios), these five studios controlled almost every aspect of the movies, including content, distribution and exhibition, with movie actors effectively owned and controlled by the studios that discovered them. It took the US Supreme Court and use of the anti-trust law, in 1948, to first force studios out of the movie theater ownership business, and then to release movie stars from their bondage, and in the process, it ended the Studio Age.

Forced to divest themselves of movie theaters and of their control of movie stars, the studios were able to offset the negatives with the positives from new technologies (Technicolor, stereo sound) and an almost unchallenged claim on American leisure time, with close to two-thirds of Americans going to the movies at least once a week in the 1950s. In the 1970s, Hollywood discovered the payoff from blockbuster movies, and the movie business became increasingly dependent on the biggest blockbusters delivering enough revenues and profits to cover a whole host of movies that either lost money or broke even. While Jaws and the first three Star Wars movies (A New Hope, The Empire Strikes Back, The Return of the Jedi) were not the first mega-hits in history, they accelerated the trend towards the blockbuster phenomenon that continues through today. In the 1980s, the birth of video players created ways for studios to supplement revenues at movie theaters with revenues from selling videos and DVDs, while opening the door to illegal copying and piracy.

Through this period, the big studios still controlled a large share of the content business, but independent studies, often more daring in choice of topics and settings, took a share. That said, the movie business remained concentrated, with the biggest players dominating each segment of the business.

That movie business was built around box office receipts at movie theaters, split between the movie makers and the theater owners. The latter were capital intensive, since they occupied valuable real estate, owned or leased by the theater companies. Though the theater-owners were nominally independent, studios retained significant bargaining power with these exhibitors and the sharing of supplemental revenues.

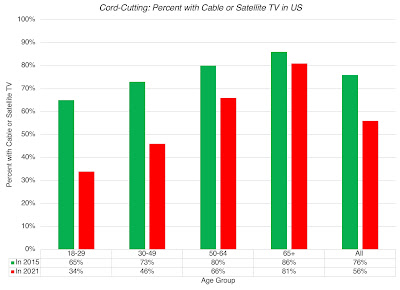

The broadcasting business lagged the movie business, in terms of development, because televisions did not start making their way into households in sufficient numbers until the 1950s, but it too was built around a system of content-production, distribution and exhibition, but with advertising at the heart of its revenue generation. The dominance of the three big networks (ABC, CBS and NBC) in television viewing meant that television shows had to reach the broadest possible audiences to be successful, and television show success was measured with (Nielsen) ratings, measuring how much they were watched, and an entire business was built around these measurements. That business was disrupted in the 1970s and 1980s with the arrival of cable television, and cable's capacity to carry hundreds of channels, some of which catered to niche markets, shaking the major network hold on viewers and changing content again. At the start of 2010, it was estimated that close to 75% of all US households received their television through a cable or satellite provider, setting the stage for the next big disruption in the business.

Movie and Broadcasting: The Streaming Era

Netflix, which is now synonymous with the streaming threat to movies, started its life as a video rental company, more of a threat to Blockbuster video, the lead player in that business, than to any of the larger players in the content business. It is worth remembering that Netflix entree into the business was initially on the US postal system, with the innovation being that you could have the videos you wanted to watch mailed to you, instead of going into a video rental store. As the capacity of the internet to send large files improved, Netflix shifted to digital distribution, albeit with angst on the part of some existing customers, but it still relied entirely on rented content (from the traditional studios). It was in response to being squeezed by the studios on payments for this content that Netflix decided to try its hand at original content, with House of Cards and Orange is the new Black representing their first major forays, and set in sequence the events that have led us to where we stand today.

The Netflix Disruption

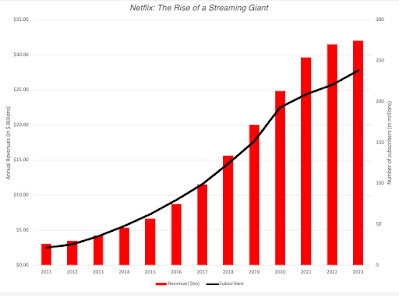

The rise of Netflix as a streaming giant has been meteoric, and it can be seen both in the growth in subscribers and revenues at the company, especially in the last decade.

As streaming disrupts both the broadcasting and movie businesses, let us look at how it is changing these businesses from the inside, starting with content (types of movies, movie budgets, number of movies), moving on to talent (actor and writer demand and compensation) and then to customers (how much and how we watch content).

Content

The growth of streaming platforms has altered content (movies and broadcasting) in significant ways., with the first being an increase in the total volume of content, as streaming platforms try to fill their content libraries. With Netflix leading the way on original content, this has translated into a jump in movies being made, as can be seen in the graph below, from an annual average of 367 movies a year, in the United States, between 2000 and 2012 to 1200 movies a year between 2013 and 2023.

|

| Source |

If you are wondering why you have not seen an explosion of movies at theaters, it is because fewer of these movies are being made for movie theaters, with big studios, reducing theater movie production by almost 30%, from 108 movies a year, on average from 2000 to 2012, to about 75 movies a year, from 2013 to 2023. While independent studies increased their production over the period, the overall number of movies reaching movie theaters has seen a significant drop off.

|

| Source |

Finally, the most interesting effects of streaming may be occurring under the surface in terms of the content that is produced, and they can be traced to the very different economics of making movies for theaters (or shows for broadcasting) as opposed to creating content for streaming services. With the former, the question of whether to make content can be answered by forecasting the revenues that will be generated by that content, either as gate receipts and ancillary revenues (for movies) or in advertising revenues (for broadcasting). With streaming, the end game with new content (movies or shows) is to add new subscribers to the service, and/or induce existing subscribers to renew their subscriptions, and it is difficult to link either directly to individual shows. Even within streaming services, there seems to be no consensus on what strategy best delivers these results, perhaps because success is so difficult to measure.

- Netflix has chosen what can be best described as the shotgun approach to content, producing vast amounts of content, often in the form of entire seasons, for shows, with the hope that some portion of that content would be a binge-watching hit. That approach has delivered results in terms of higher subscriber count, but at a huge content cost, with content costs growing at the same rate, or higher rates, than subscriber count, until very recently.

- HBO has used a more curated approach to content, making fewer shows, albeit with less divergence in quality, and releasing episodes on a weekly basis, hoping for more viral reach from successful shows (Game of Thrones and Succession qualify as big successes). The plus of this approach is lower content costs, but with much lower subscriber numbers than in the shotgun model.

- Disney Plus started with the premise that a massive library of content would allow the platform to draw and keep subscribers, but early on, the company discovered that to compete with Netflix on subscriber numbers, it needed new content, and much of that content has come from high-profile, expensive shows from its Avengers and Star Wars franchises. If success is measured in subscriber count, Disney Plus has succeeded, but the spending on content has exploded, dragging Disney’s profitability down with it.

- With Apple TV+ and Amazon Prime, the game is even more difficult to gauge. Both companies spend large amounts in content and clearly lose money on their streaming platforms, but their benefits may come from tying users more closely into their platforms. with benefits showing up other products and services they sell to those in their ecosystems.

The angst that many actors and writers about the sharing of streaming revenues can be best understood by considering how how they have historically received residual payments on content. Built around a pay structure negotiated in 1960, actors and writers are paid residuals each time a show runs on broadcast or cable TV, or when someone buys a DVD or videotape of the show. With streaming, that old structure has buckled, as the benefits from a show or movie are more difficult to measure, since subscription revenue or subscriber count cannot be directly connected to individual shows. (There are exceptions, where added subscriber numbers can be attributed to a hit show, say Game of Thrones at HBO, or even a high-profile individual, with Lionel Messi pushing up MLS subscriptions on Apple TV+.) To the counter that you can measure how many people watch a show or movie on Netflix or Disney+, note that streaming companies do not make money from viewers, but only from added subscription revenues. With the more diffuse link between viewership and revenues in streaming, the question of how to structure residuals to actors and writers has become a key point of contention, and one of the central elements of the current strike.

In 2019, the Screen Actors Guild made an agreement with Netflix that applied to any scripted projects produced and distributed by the platform where residuals were calculated based on the amount that a performer was originally paid and how many subscribers the streaming platform has. That agreement though has yielded wildly divergent payments to actors, with some taking to social media to showcase how little they received, even on widely watched shows, while other bigger name stars are being well compensated. One of the demands from strikers is that streaming services be more transparent about viewership on shows and that they tie compensation more closely to viewership, but this dispute will not be easily resolved. Given the stakes, an agreement will eventually be reached where actors and writers will receive more than what they are receiving now, but to the extent that streaming gets its value from adding and holding on to subscribers, I expect the divergence in pay between the stars of streaming shows and the rest of the content makers to get worse over time, just as it did in the music business.

Consumption

Has streaming changed the way that we watch movies and broadcasting content? I think so, and here are a few generalizations about those viewing changes:

- More choice, but less quality control: The fact that Netflix has built its content production around the shotgun approach, and is being copied by other streamers, you and I as consumers will be spending far more time starting and abandoning shows, before finding ones to watch than we used to. Not surprisingly, quite a few us are overwhelmed by that search for watchable content, and choose to go with the familiar (explaining the success of old network shows like The Office, Friends and Suits on Netflix) or with the herd, often watching what everyone else is watching (the ten most watched shows and movies that Netflix highlights every day create feedback loops that lead them to be watched more).

- Copycat Productions: The content business have never been shy about imitation and sequels, trying to remake successful content with slight variations or add sequels to hits, but that has notched up with streaming. Thus, the success of a show on Netflix gives rise not only to more seasons of that show, but to a whole host of imitations. If you add to this the reality that streaming platforms track what you watch, and have algorithms that feed you more of the same, you may very well have the misfortune of being caught in a version of Groundhog Day, where you watch the same movie, with mild variations, over and over again for the rest of your life.

- YouTube and TikTok: As the content on streaming platforms dilutes quality and shifts to reality shows, it should come as no surprise that viewers are spending less time on streaming platforms and more on Twitch, YouTube and TikTok, where you get to watch people put out reality shows of their own, sometimes in real time.

Finally, the early promise of streaming was that it would allow us to save money, by cutting the cable cord, but as with most things that technology has promised us, those financial savings have become a mirage. If you add together the cost of multiple streaming services to the higher price that you paid to get higher-spreed broadband, to watch your streaming shows, I am sure that many of you are paying more on your entertainment budget than you did in pre-streaming days.

The Streaming Effect: Business Models and Profitability

The effects of streaming on movies and broadcasting content and distribution are showing up in the financial statements of these companies and in the market pricing of these companies. In this section, I will start by looking at how the operating metrics of entertainment companies, with the intent of detecting shifts in growth and profitability, and then turn my attention to how investors are pricing in these changes.

Operating Effects

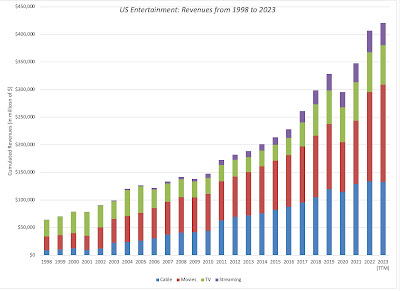

For those who are concerned about a music business-like implosion in movie business revenues, I will start with the good news. At least so far, the cumulative revenues across all entertainment companies c has held up to the streaming disruption, as can be seen in the graph below, where I look at the cumulative revenues of all movie and broadcasting related companies from 1998 to 2023:

Market Effects

As streaming has changed the movie and broadcasting businesses, financial markets have struggled to get a handle on how these changes affect the values of companies int these businesses. Looking at the cumulative market capitalization of all entertainment companies, there are two shifts that we can observe over time, one in the decade leading into COVID and one in the years after:

Corporate Governance

Corporate governance at companies rarely draws attention during the good times, where managerial mistakes are overlooked, and rising revenues and earnings can hide corporate flaws. However, in challenging times, and disruption clearly has created challenges for entertainment companies, it is not surprising that we are seeing more investor angst at these companies.

- CEO Turnover: There has been drama in the top ranks of Disney in the last few years, as Bob Iger first turned over the reins in the company to Bob Chapek in 2020, and then reclaimed it two years later. Some of that blowback can be traced to an expensive bet made by the latter on streaming, reorganizing the company around Disney+, and investing billions into streaming content, trying to attract new customers. While there are factors specific to Disney that can shed light on that company's CEO wars, I expect CEO turnover and turmoil to increase at entertainment companies, as investors look to replace management at companies that are struggling, in a sometimes futile effort to change their fortunes.

- Activist Presence: It is no surprise that activist investors are drawn to industries in turmoil, pushing companies to spend less on reinventing themselves and returning more cash to shareholders. Here again, the Disney experience is instructive, where Nelson Peltz's opposition to Chapek's plans clearly played a role in the CEO change this year. While Iger has been given some breathing room to fix problems after his return, the clock is ticking before activist investors return to the company. In fact, I expect the companies in the entertainment group to be prime targets for activist investors in the next few years.

- Spin-offs, Divestitures and Break-ups: In response to streaming challenges, entertainment companies have started exploring whether splitting up or spinning of businesses will improve their chances of survival and success in the streaming age. Warner Bros. was spun off by AT&T and merged with Discovery in 2022, precisely for this reason, and the push for Disney to spin off or divest ESPN is similarly motivated.

- Bankruptcy: For the companies whose financials have imploded as a result of streaming, and all have debt, you should expect to see dire news stories not just about layoffs and shrinkage, but about potential bankruptcy. In the theater business, this has become reality as Cineworld (owner of Regal, the second largest theater chain in North America) issued a bankruptcy warning in early 2023, and AMC (owner or both the largest theater chain and a streaming service) had to do a reverse stock split to keep itself from careening towards penny stock status.

- At one extreme, you may see the movie and broadcasting business follow the music business and see a collapse of revenues, a destruction of the status quo and a resetting of the competitive landscape. If this happens, some of the biggest names in movies and broadcasting will disappear as independent entities, either absorbed as pieces of much larger companies or cease to exist. The disruptors, including Netflix and Live Nation, will face different challenges, as they now become the status quo, and they will have to figure out how to make their business models profitable and sustainable, even as they themselves will become targets of new disruptors.

- At the other exhibit, you will see entertainment continue to grow as a business, but with status quo players (content makers and exhibitors) bringing their strengths into play to outflank the disruptors. In this scenario, the big names in the movie and broadcasting business will modify how they make and exhibit content, and come back, bigger, stronger and more profitable than they were in the pre-streaming era.

- There is a middle-ground, where success will require that you draw on the strengths of both the status quo and new technologies. The players in the status quo who are adaptable and willing to change will absorb those players who are not, and there will be a similar shake up among disruptors, with those disruptors who combine entertainment business wisdom with technological knowhow will win at the expense of disruptors who do not.

| Disney | Netflix | |

|---|---|---|

| Revenues (LTM) | $87,807 | $32,465 |

| Operating Income | $7,725 | $5,624 |

| Revenue Growth (last year) | 8.30% | 5.44% |

| Operating Margin (LTM) | 8.80% | 17.32% |

| Expected Revenue Growth (Yrs 1-5) | 10.00% | 15.00% |

| Expected Operating Margin | 16.00% | 20.00% |

| Sales to Capital | 1.46 | 3.00 |

| Value per share | $87.52 | $238.08 |

| Price per share | $80.00 | $443.10 |

| Spreadsheet | Download | Download |

No comments:

Post a Comment

Given the amount of spam that I seem to be attracting, I have turned on comment moderation. I have to okay your comment for it to appear. I apologize for this intermediate oversight, but the legitimate comments are being drowned out by the sales pitches and spam.