In my last post, I pointed to currency confusion as one of the side effects of globalization. In this one, I will argue that as companies and investors globalize, investors and analysts have no choice but to learn how to deal with the rest of the world, both in terms of risk and pricing. One reason that I take a detailed look at country risk and pricing numbers every year is that my valuations and corporate finance rest so heavily on them.

Why country risk matters

It seems to me an intuitive proposition that a company’s value and pricing can depend upon the geography of its business. Put simply, cash flows generated in riskier countries should be worth less than equivalent cash flows generated in safer ones but there are two follow up propositions worth emphasizing:

It seems to me an intuitive proposition that a company’s value and pricing can depend upon the geography of its business. Put simply, cash flows generated in riskier countries should be worth less than equivalent cash flows generated in safer ones but there are two follow up propositions worth emphasizing:

- Operation, not incorporation: I believe that it is where a company operates that determines its risk exposure, not just where it is incorporated. Thus, you can have US companies like Coca Cola (through its revenues) and Exxon Mobil (from its oil reserves) with substantial emerging market exposure and emerging market companies like Tata Consulting Services and Embraer with significant developed market exposure. In fact, what we face in valuation increasingly are global companies that through the accident of history happen to be incorporated in different countries.

- Company, Country and Global Risks: Not all country risk is created equal, especially as you are look at that risk as a diversified investor. Some country risk can be isolated to individual companies and is therefore averaged out as you diversify even across companies in that country. Still other country risk is country-specific and can be mitigated as your portfolio includes companies from across the globe. There is, however, increasingly a portion of country risk that is global, where even a global investor remains exposed to the risk and more so in some countries than others. The reason that we draw this distinction is that risks that can be diversified away will affect only the expected cash flows; that adjustment effectively takes the form of taking into account the likelihood and cash flow consequences of the risk occurring when computing the expected cash flow. The risks that are not diversifiable will affect both the expected cash flows and also the discount rates, with the mode of adjustment usually taking the form of higher risk premiums for equity and debt. That may sound like double counting but it is not, since the expected cash flows are adjusted for the likelihood of bad scenarios and their consequences and the discount rate adjustment is to demand a premium for being exposed to that risk:

If you make the assumption that all country risk is diversifiable, you arrive at the conclusion that you don't need to adjust discount rates for country risk, a defensible argument when correlations across countries were very low (as in the 1980s) but not any more.

Thus, dealing with country risk correctly becomes a key ingredient of both corporate finance, where multinational companies try to measure hurdle rates and returns on projects in different countries and in valuation, where investors try to attach values or prices to the same companies in financial markets.

Country Default Risk

Since I have had extended posts on country risk before, I will not repeat much of what I have said before and instead focus this post on just updating the numbers. Simply put, the most easily accessible measures of country risk tend to be measures of default risk:

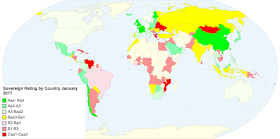

- Sovereign Ratings: Ratings agencies like S&P, Moody’s and Fitch attach sovereign ratings to countries, where they measure the default risk in government borrowing just as they do for individual companies. These ratings agencies often also provide separate ratings for local currency and foreign currency borrowings by the same government. The picture below summarizes ratings by country, in January 2017, and the linked spreadsheet contains the same data.

Link to live version of map - Government Bond Default Spreads: When a government issues bonds in a foreign currency, that are traded, the interest rate on those bonds can be compared to the risk free rate in a bond issued in the same currency to arrive at measures of default risk for the government. In much of Latin America, for instance, where countries has US-dollar denominated bonds, comparing the rates on those bonds to the US T.Bond rate (of equivalent maturity) provides a snapshot of default risk. The table below summarizes government bond default spreads as of January 1, 2017, for Latin American countries with US dollar denominated bonds:

- Sovereign CDS Spreads: This measure of default risk is of more recent vintage and is a market-determined number. It is, roughly speaking, a measure of how much you would have to pay, on an annual basis, to insure yourself against country default and unlike ratings can move quickly in response to political or economic developments in a country, making them both more timely and more volatile measures of country risk. In January 2017, sovereign CDS spreads were available for 64 countries and you can see them in the picture below and download them as a spreadsheet at this link.

Link to live version of the map

Country Equity Risk

There are many who use country default spreads as a proxy for the additional risk that you would demand for investing in equity in that country, adding it on to a base equity risk premium (ERP) that they have estimated for a mature market (usually the US).

ERP for Country A = ERP for US + Default Spread for Country A

The limitation of the approach is that there are not only are equities affected by a broader set of risks than purely default risk but that even default can have a larger impact on equities in a country than its bonds, since equity investors are the residual claimants of cash flows.

There are broader measures of country risk, taking the form of country risk scores that incorporate political, economic and legal risks, that are estimated by entities, some public (like the World Bank) and some private (like PRS and the Economist). The first is that they tend to be unstandardized, in the sense that each service that measures country risk has its own scoring mechanism, with World Bank scores going from low to high as country risk increases and PRS going from high to low. The second is that they are subjective, with variations in the factors considered and the weights attached to each. That said, there is information in looking at how the scores vary across time and across countries, with the picture below capturing PRS scores by country in January 2017. The numbers are also available in the linked spreadsheet.

I have my own idiosyncratic way of estimating the country risk premiums that builds off the country default spreads. I use a ratio of market volatility, arguing that default spreads need to be scaled to reflect the higher volatility of equities in a market, relative to government bonds in that market.

|

| Link to live map |

Since the volatility ratio can be both difficult to get at a country level and volatile, especially if the government bond is illiquid, I compute volatilities in an emerging market equity index and an emerging market government bond index and use the resulting ratio as a constant that I apply globally to arrive at equity risk premiums for individual countries. In January 2017, I started my estimates with a 5.69% equity risk premium for mature markets (set equal to the implied premium on January 1, 2017, for the S&P 500) and then used a combination of default spreads for countries and a ratio of 1.23 for relative equity market volatility (from the index volatilities) to arrive at equity risk premiums for individual countries.

For countries that had both sovereign CDS spreads and sovereign ratings, I was able to get different measures of equity risk premium using either. For countries that had only a sovereign rating, I used the default spread based on that rating to estimate equity risk premiums (see lookup table here). For those countries that also had sovereign CDS spreads, I computed alternate measures of equity risk premiums using those spreads. Finally, for those frontier countries (mostly in the Middle East and Africa) that were neither rated nor had sovereign CDS spreads, I used their PRS scores to attach very rough measures of equity risk premiums (by looking at other rated countries with similar PRS scores). The picture below summarizes equity risk premiums by country and the link will give you the same information in a spreadsheet.

|

| Link to live map |

Closing

The one prediction that we can also safely make for next year is that just as we have each year since 2008, there will be at least one and perhaps even two major shocks to the global economic system, precipitated by politics or by economics or both. Those shocks affect all markets globally, but to different degrees and it behooves us to not only be aware of the impact after they happen but be proactive and start building in the expectation that they will happen into our required returns and values.

YouTube Video

Datasets

YouTube Video

Datasets

- Sovereign Ratings by Country, S&P and Moody's on January 1, 2017

- Sovereign CDS spreads (ten-year) on January 1, 2017

- Political Risk Services (PRS) scores by country, January 1, 2017

- Equity Risk Premiums and Country Risk Premiums by country on January 1, 2017

Data 2017 Posts

- Data Update 1: The Promise and Perils of Big Data

- Data Update 2: The Resilience of US Equities

- Data Update 3: Cracking the Currency Code - January 2017

- Data Update 4: Country Risk and Pricing, January 2017

- Data Update 5: A Taxing Year Ahead?

- Data Update 6: The Cost of Capital in January 2017

- Data Update 7: Profitability, Excess Returns and Corporate Governance- January 2017

- Data Update 8: The Debt Trade off in January 2017

- Data Update 9: Dividends and Buybacks in 2017

- Data Update 10: The Pricing Game

Which risk-free rate should we use for calculating a firm in India (for example) cost of equity? If I'm using the 9.05% ERP do I use US Rf or India Rf. Thanks!

ReplyDeleteThanks! Is the bond default spread table missing? Also, is a link to the lookup table missing?

ReplyDeleteDear Professor Damodaran

ReplyDeleteAs always, your posts are interesting and informative.

Given the use of sovereign data, I am curious about your views on this 2015 paper that makes the case that there is still double counting of risks.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2659257

Regards,

Marko

Am I using your data correctly? I am estimating the Cost of Equity of a firm in Paraguay from the perspective of a US investor looking to acquire that firm. Assuming a beta of 1.5 and a U.S. risk-free rate (normalized) of 4.0% (Duff & Phelps recommended guidance) and using your spreadsheet for the ERP (US = 5.69%) and CRP (Paraguay = 3.55%), I get 16.1%, as follows:

ReplyDeleteke, Paraguay = Rf, US + (Beta,US x ERP,US) + CRP

ke, Paraguay = 4.0% + (1.5 x 5.69) + 3.55%

ke, Paraguay = 16.1%

Are the mechanics correct? Thanks!

Dear Prof Damodaran,

ReplyDeleteWhen you calculate the Relative Equity Volatility, you divide the Annual Standard Deviation of the 'S&P Emerging BMI Index' by the Coefficient of Variation of the 'BAML Public Sector US Emerging Markets Corporate Plus Index Yield'.

Why didn't you divide Std Deviation by Std Deviation OR divide Coef of Variation by Coef of Variation?

Thank you very much for you attention.

R.