There are three realities that you cannot avoid in business and investing. The first is that your returns and value are based upon the cash flows you have left over after you pay taxes. The second is that the taxes you pay are a function of both the tax code of the country or countries that you operate in and how you, as a business, work within (or outside) that code. The third is that the tax code itself can change over time, as countries institute changes in both rates and rules. The upcoming year looks like it will be more eventful than most, especially for US companies, as there is talk about major changes coming to both corporate and individual taxation.

Why taxes matter

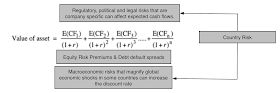

While we are often casual in our treatment of taxes, the value of a business is a affected substantially by tax policy, with our measures of expected cash flows and discount rates both being affected by taxes.

While we are often casual in our treatment of taxes, the value of a business is a affected substantially by tax policy, with our measures of expected cash flows and discount rates both being affected by taxes.

- In the numerator, you have expected cash flows after taxes, where the taxes you pay will reflect not only where in the world you generate income (since tax rates and rules vary across countries) but how the country in which you are incorporated in treats that foreign income. The US, for instance, requires US companies to pay the US tax rate even on foreign income, though the additional tax is due only when that income is remitted back to the US, leading to a predictable result. Multinational US companies leave their foreign income un-remitted, leading to the phenomenon of trapped cash (amounting to more than $2 trillion at US companies at the start of 2017).

- The denominator, which is the discount rate, is also affected by the tax code. To the extent that tax laws in much of the world benefit debt over equity, using more debt in your financing mix can potentially lower your cost of capital. In computing this tax benefit from debt, there are two points to keep in mind. The first is that interest expenses save you taxes at the margin, i.e., your dollar in interest expense offsets your last dollar of income, saving you taxes on that last dollar, making it imperative that you use the marginal tax rate when computing your tax benefit from borrowing. The second is that companies have a choice on where to borrow money and not surprisingly choose those locations where they get the highest tax benefit (with the highest marginal tax rate). Is it any surprise that while Apple generates its income globally and finds ways to pay an effective tax rate of 21% on its taxable income in 2016, almost all of its debt is in the United States, saving taxes at an almost 40% marginal tax rate?

Following up, then, the values of all companies in a country can change, some in positive and some in negative ways, when tax codes get rewritten. Even if the corporate tax codes don’t change, a company’s decisions on how to structure itself and where geographically to go for growth will affect its cash flows and discount rates in future years.

Marginal Tax Rates

If the marginal tax rate is the rate that a business pays on its last dollar of income, where in its financial statements are you most likely to find it? The answer in most companies is that you do not, and that you have to look in the tax code instead. Fortunately, KPMG does a yeoman job each year of pulling these numbers together and reporting them and the most recent update can be found here. The map below lists marginal tax rates by country and you also download a spreadsheet with the latest numbers at this link:

|

| Link to live map |

As you survey the world's marginal tax rates, you can see why trapped cash has become such a common phenomenon at US companies. The US has one of the highest marginal tax rates in the world at 40% (including a federal tax rate of 35%, topped off with state and local taxes) and is one of only a handful of countries that still insist on taxing companies incorporated in their domiciles on their global income, rather than adopting the more defensible practice of territorial taxation, where you require businesses to pay taxes in the countries that they generate their income in. As Congress looks at what to do about “trapped cash”, with many suggesting a one-time special deal where companies will be allowed to bring the cash back, they should also realize that unless the underlying reason for it is fixed, the problem will recur. That will mean either lowering the US marginal tax rate closer to the rest of the world (about 25%) or changing to a territorial tax model.

The marginal tax rate is the number that you use to compute your after-tax cost of debt but that practice is built on the presumption that all interest expenses are tax deductible (and that you have enough taxable income to cover the interest deduction). That is still true in much of the world but there are parts of the world, where you either cannot deduct interest expenses (such as the Middle East) or you have taxes computed on a line item like revenues (thus nullifying the tax benefit of debt), where you will have to alter the practice of giving debt a tax benefit. For multinational companies that face different marginal tax rates in different operating countries, my recommendation is that you use the highest marginal tax rates across countries, since that is where these companies will direct their borrowing.

Effective Tax Rates: Country Level Differences

If the marginal tax rate is the tax rate on your last dollar of income, what is the effective tax rate, the number that you often see reported in financial statements? In most cases, it is a computed tax rate that comes directly from the income statement and is computed as follows:

Effective Tax Rate = (Accrual) Taxes Payable / (Accrual) Taxable Income

Both number are accrual income numbers and thus can be different from cash taxes paid, with the differences usually visible in the statement of cash flows. Let’s start with looking at what companies pay as effective tax rates in the United States, a country with a marginal tax rate of 40%. In the most recent twelve months leading into January 2017, the distribution of effective tax rates paid by tax-paying US companies is captured below.

The most interesting numbers in this distribution are the average effective tax rate of 26.42% across profitable US companies, well below the marginal tax rate of 40%. and the fact that 88% of US companies have effective tax rates that are lower than the marginal. The most important reason for this difference, in my view, is foreign operations with those firms that generate revenues outside the United States paying lower taxes, simply because the tax rate on income outside the United States is much lower (and that differential tax is not due until the cash is remitted). While there are some who suggest that a simple fix for this is to force US firms to pay the entire marginal tax rate when they make their income in foreign locales immediately (rather than on repatriation), this will be a powerful incentive for US companies to move their headquarters overseas.

In these populist times, you may be convinced that US companies are not paying their fair share of taxes but is that true? To make that judgment, I looked at effective tax rates paid by companies in different countries in the picture below and you can download the data in a spreadsheet in the link below:

|

| Link to live map |

At least, based upon the data on taxes paid in 2017, US companies measure up well against the rest of the world, in terms of paying taxes, with only Japanese companies paying significantly more in taxes; Indian and Australian companies pay about what US companies do and the rest of the world pays less.

| Sub Group | Effective Tax Rate | Sub Group | Effective Tax Rate |

|---|---|---|---|

| Africa and Middle East | 15.48% | India | 27.65% |

| Australia & NZ | 26.76% | Japan | 31.07% |

| Canada | 19.68% | Latin America & Caribbean | 22.91% |

| China | 21.72% | Small Asia | 21.59% |

| EU & Environs | 23.03% | UK | 22.26% |

| Eastern Europe & Russia | 19.88% | United States | 26.22% |

As US companies market their products and services in other countries, it is true that some of this tax revenue is being collected by foreign governments, but that is the nature of a multinational business and is something that every country in the world with multinational corporations has as a shared problem.

Effective Tax Rates: Industry and Company Differences

As a final analysis, I compared the effective tax rates by US companies, categorized by industry. This table, which I have reported before, lists the ten industry groups that pay the highest effective tax rate and the ten that pay the lowest:

The entire list can be downloaded here. Again, there are many reasons for the differences, with companies that generate more income from foreign operations paying lower taxes than domestic companies being a primary one. It is also true that the US tax code is filled with sector-specific provisions that provide special treatment for these sectors in the form of generous tax deductions. Most of these tax deductions (like higher depreciation allowances) show up as expenses in the income statement and the taxable income should already reflect them and so should the effective tax rate, but in some cases it does show up as a marginal tax rate.

While in most years, these differences across sectors is a just a source of discussion or a reason to vent on the unfairness of taxes, I believe that investors, this year, should be paying particular attention to them. If Congress is serious about rewriting the tax code this year, there is reason to believe that the changed tax code is going to create winners and losers, and especially so, if it is designed to be revenue neutral. Those winners and losers will of course be different, depending on which version of corporate tax reform passes.

- At one extreme in the version that is least disruptive to the current system, the marginal tax rate for corporations will be lowered, perhaps with a loss of some tax deductions/credits and adjustments on how foreign income gets taxed to reduce the problem of trapped cash. If this change occurs, the effects on value will be mixed, with cash flows increasing for those firms that will have lower effective tax rates as a consequence and the costs of debt and capital increasing as the tax benefits of debt will decrease. The biggest beneficiaries will be firms that pay high effective tax rates today (see the table above for the sectors) and have little debt. The biggest losers will be firms that pay low effective tax rates today and fund their operations with lots of debt.

- At the other extreme, the House of Representatives is considering a more radical version of tax reform, where the current corporate income tax will be scrapped and replaced with a "Destination Based Cash-flow Tax" (DBCT), a value added tax system, with a deduction for wages, where the tax rate that you pay as a company will be a function of how much of your input material you import and where you sell your output. The first side product of the DBCT will be that debt will lose its historical tax-favored status, relative to equity. The second side product is that, if left unadorned, it will eliminate any incentives to move profits across countries or borders, since the tax is not based on income. Companies who produce their goods with inputs from the US that then export these goods and services will benefit the most, paying the lowest taxes, whereas companies that are heavily reliant on imported inputs that sell their products in the United States would pay the most in taxes. And firms that are heavily debt funded will be adversely affected, relative to those that are not debt funded.

- Keep it simple: When tax law gets complex, bad corporate behavior seems to follow. Unfortunately, the way legislative processes work seems to conspire against simplicity, as legislators trying to protect specific industries try to make sure that their ox does not get gored.

- The tax code is not an effective behavior modifier for businesses: I understand the desire of some to use tax law as a corporate behavior modification tool but it is not a very effective one. Thus, if Congress is serious about the DBCT, it should be because they believe it is a more effective revenue generating mechanism that the current complex system and not because it wants to encourage companies to move manufacturing to the United States. If that is a byproduct, that is a plus but it should not be the end game.

- Make it predictable: Companies have enough uncertainty on their plates to worry about without adding uncertainty about future tax law changes to the mix. It would help if the tax code, once written, was not constantly revisited and revised.

I am also a realist and believe that the likelihood of either of these pieces of advice being followed is close to zero.

Closing

In the process of computing an implied equity risk premium for the S&P 500, I collected analyst estimates of growth in earnings for the S&P 500 companies. Many of these analysts are predicting that earnings for the S&P 500 will grow strongly in 2017 and one shared reason seems to be that companies will pay less in taxes. Since legislative bodies are not known for speedy action, I am not sure that change, even if it does happen, will show up in 2017 earnings but I think that the ultimate test is not in what the tax code does to marginal tax rates (since I think it is a safe assumption that they will come down from) but the changed tax code will mean for effective tax rates. Assuming that the tax code does get rewritten, how will we know whether it is doing more good or harm? I have two tests. First, if companies think about, talk about and factor in taxes less in their decision making, that is a good sign. Second, if fewer people are employed as tax lawyers and in transfer pricers, that is an even better one. I won't be holding my breath on either!

YouTube Video

Datasets

Data 2017 Posts

- Data Update 1: The Promise and Perils of Big Data

- Data Update 2: The Resilience of US Equities

- Data Update 3: Cracking the Currency Code - January 2017

- Data Update 4: Country Risk and Pricing, January 2017

- Data Update 5: A Taxing Year Ahead?

- Data Update 6: The Cost of Capital in January 2017

- Data Update 7: Profitability, Excess Returns and Corporate Governance- January 2017

- Data Update 8: The Debt Trade off in January 2017

- Data Update 9: Dividends and Buybacks in 2017

- Data Update 10: The Pricing Game

Dear Professor,

ReplyDeleteI have one query. In the spreadsheet on sector-wise tax rate, that you have attached, where do the Managed Care Organizations - UNH, ANTM, AET, HUM, CI etc. lie? Are these under Healthcare Support Services category? If so what other kind of companies have you considered in this category?