If, as you read this post, it feels like you have read it or a close variant before, it is because you have. Each year, ahead of teaching my classes at NYU's Stern School of Business in the spring, I invite readers to accompany me on my journey, and this year is no different. Starting in late January 2023, I will be back in the classroom, teaching valuation and corporate finance to the MBAs and valuation to the undergraduates, and these classes will continue through May 2023. If you are curious about the content of these classes, and may want to partake, I will use this post to lay out my teaching philosophy, to describe the classes that I teach and provide options that you may be able to use to take them.

Teaching Philosophy

I have heard the old saying that "those who can do, and those who cannot teach", and I won't get defensive in response, because it may be true. I would like to believe that I am capable of both doing and teaching valuation and corporate finance, but I will leave that judgment for you to make, since my valuations and corporate finance assessments are in the public domain (on my blog and in my lecture notes). If your query is why I would continue to teach rather than seek out more lucrative careers in investing or banking, my answer is a simple one. I love teaching and if you follow my classes, I hope it shows, and my teaching philosophy can be summarized in six precepts:

- Preparation is key: Paraphrasing Edison, teaching is 90% perspiration and 10% inspiration. If you are prepared for your class, you are well on your way to being a good teacher.

- Respect your students: I believe that anyone who sits on my classroom is as capable as I am, though perhaps not as experienced, and is passionate about learning.

- Be fair: I don't believe that students dislike or punish tough teachers, but I do believe that they dislike and punish teachers who are unfair, either in the way they test students or in the way they grade them. I know that I will make mistakes, but as long as I keep an open door and correct my mistakes, I think that students will cut me some slack.

- Have empathy: It has been a long time since I was a student in a classroom, but I try to keep my memory fresh by remembering the things I disliked in my classes and trying not to repeat them.

- Teaching is not just in the classroom: My impact on students does not come just from what what I do in the classroom. It is affected just as much but what I do outside the classroom, in my office hours and in my interactions (online and in person) with my students.

- Have fun: If you look at the joy that young children show when they learn something new, it is obvious that human beings enjoy learning (though our education systems are often designed to stamp out that joy). I want my classes to be meaningful, impactful and profound, but I also want them to be fun. For that to happen, I have to have fun teaching and I will!

Older, though not wiser, as I start my 37th year teaching at NYU, I am looking forward to class just as much as I did the very first year that taught, as a visiting lecturer at the University of California at Berkeley in the fall of 1984.

Course Offerings

I am a dabbler, someone who knows a little bit about a whole host of subjects, without being close to an expert on any one of them. In a world where specialization is the norm, this does put me at a bit of a disadvantage, since there are many who know a great deal more about almost any topic that I choose to talk about, but I do think that it gives me a big-picture perspective that helps me find answers. As you will see in this section, I teach a range of courses, and I hope that my teaching of each course is informed by thinking about and teaching of the other courses.

1. Pre-game Prep

If there is a lesson be learnt from the last few years of market mayhem, it is that far too many investors, professional as well as retail, seem to have lost their moorings (or never had them in the first place), when it comes to the basics of accounting, finance and statistics. In the last few years, I have created my own versions of each of these disciplines, reflecting the tools and skills that I draw upon in my valuation and corporate finance classes.

a. Accounting

Much of the raw data that you use in corporate finance and valuation comes from accounting statements, and if you do not understand the difference between operating and net income, you are fatally handicapped. If your accounting basics are strong, you can move right along, but if they are shaky, I have an abbreviated online accounting class, with twelve sessions that around built around using the financial statements (income statement, balance sheet and statement of cash flows) to assess a firm’s financial standing, as a prelude to analyzing or valuing it.

|

| Link to accounting class |

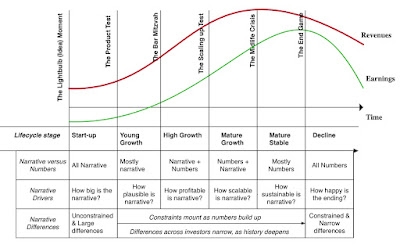

b. Foundations of Finance

I also have a 12-session foundations of finance class, where I introduce two structures that I draw on all through my classes - the financial balance sheet (as opposed to an accounting balance sheet) and a corporate life cycle. I provide an introduction to cash flows and risk, and how they play out in the time value of money, and the basics of valuing contractual cash flows (bonds), residual cash flows (equity) and contingent cash flows (options). Finally, I carve out simple (even simplistic) sessions on inflation, interest rates and exchange rate, three macro variables that we are exposed to in almost all financial analysis and valuations.

|

| Link to Foundations class |

c. Statistics

The most recent addition to my class list is one on statistics, and it was motivated by the wanton misuse and misunderstanding of data that I see not only in investing, but in the rest of life. It is ironic, and perhaps telling, that our understanding of statistics seems to have hit rock bottom in the age of big data. In this class, I start by looking at data collection and data descriptives, before moving on to distributions and data relationships (correlations, covariances and regressions) and closing with probabilities and probabilistic tools.

|

| Link to Statistics class |

If you find yourself inundated by data in financial analysis, I hope this class helps you convert data to information, and data that matters from data that distracts.

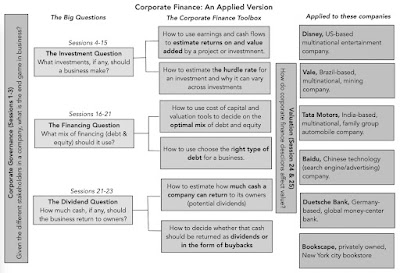

2. Corporate Finance

If the introductory classes in accounting, finance and foundations don’t exhaust you, you are welcome to my corporate finance class, which covers the first principles that govern how to run a business. The class starts with a question of what the end game should be for a business (profitability, value, social good?), and uses that endgame to cast light on the investing, financing and dividend decisions that all businesses, small or large, private or public, have to make.

3. Valuation

In 1986, when I taught the first semester-long valuation class at NYU, I was told that there was not enough material for a class that long. I persevered, and thirty seven years later, I think I can say, with some confidence, that I have enough material to fill a semester-long class. This is a class in search of pragmatic solutions, not purity or theory, and it is my intent is to value assets, companies and investments, not just talk about valuing them.

As with the corporate finance class, I cast my net wide, when it comes to my audience, and while the class will help prepare you for a valuation career, as an equity research analyst or appraiser, the class is designed for anyone who has ever struggled with understanding valuation and market pricing. This may surprise you, but we spend a significant amount of time in this class talking about telling business stories that pass the “fairy tale” test and tying stories to valuation inputs, and almost no time opening and closing spreadsheets. So, whether you are a number cruncher or story teller, I think you will find something to take away from the class.

4. Investment Philosophy

The last class that I teach, albeit only online, is one on investment philosophies, and it was born from two observing two investing realities.

- The first is that notwithstanding the hundreds of books on how to beat the market and the thousands of cannot-miss trading strategies that exist on paper, there are only a handful of investors and traders who have consistently beaten the market over long periods.

- The second is that these consistent winners have very little in common, in terms of market beliefs and strategies, with value investors, market timers and traders in the mix.

As with my corporate finance and valuation classes, I argue that your choice of investment philosophy will determine where in the corporate life cycle, you will find your investments.

Choices, choices, choices...

You have lives to live, work to do and families to be with, and it is unrealistic and arrogant of me to expect you to spend a large portion of your time, taking my classes. I will settle for what I can get, and offer my classes in multiple formats, tailored to different time constraints and diverse tastes.

Formats

There are three formats in which I offer my classes, though not all of the classes are available in every format.

Regular classes (Free): My corporate finance and valuation classes are taught, as semester-long classes, meeting twice a week for 80-minute sessions. While you need to be registered in the classes, as Stern students, to be able to sit in the classrooms, the sessions will be recorded and accessible by the end of the class day. You can take the class this upcoming semester, when the classes start late January 2023 and continue through May 2023, or watch the archived versions from spring 2022.

| Class | Webpage for class | Spring 2023 (Real time) | Spring 2022 (Archived) |

|---|---|---|---|

| Corporate Finance | Link | Link | Link |

| Valuation (MBA) | Link | Link | Link |

| Valuation (Undergraduate) | Link | Link | Link |

Note that the MBA and undergraduate valuation classes are identical in content, and you can take one or the other. If you decide to take the class, you will have access to everything that my students will have, from the slides that I use in the class, to the tests and exams that I give, with solutions that you can use to grade yourself, to the emails that I send my students on an almost daily basis. You can even do the projects (a corporate financial analysis in the corporate finance class or valuing & pricing a company in the valuation class) that are required for the classes. The downside is that this is the most time consuming of the choices, and much as I try, my 80-minute sessions cannot compete with The White Lotus for entertainment value.

Online classes (Free): If you find yourself unable to invest the time needed to take my regular classes or find the long sessions unwatchable (I don't blame you..), I have online versions of these classes that compress the 80-minute sessions into 12-15 minutes. It is a testimonial to the bloat in MBA programs that I can do this without compromising much on content, and these sessions also come with supporting material.

| Online Class | Webpage for class | YouTube Playlist |

|---|---|---|

| Accounting | Link | Link |

| Foundations of Finance | Link | Link |

| Statistics | Link | Link |

| Corporate Finance | Link | Link |

| Valuation | Link | Link |

| Investment Philosophy | Link | Link |

One downside is that many of these online sessions were recorded a few years ago, and you may find no mention of valuation challenges of today, from how the COVID crisis upended value and the steep fall in FANGAM stocks this year. Another is that even if you watch every video, take every post-class test and feel that you have mastered the material, I cannot offer you any official affirmation or certification for taking the class, but on the flip side, the courses are free!

Certificate classes (Not free): If certification is what you seek, New York University offers my three main courses as certificate classes. The content is similar to that in my online classes, but the videos are more polished, the classes follow a calendar and I do have an online meetup on zoom every two weeks:

| Certificate Class | NYU Exec Ed Link | Semesters taught |

|---|---|---|

| Corporate Finance | Link | Fall Semester |

| Valuation | Link | Fall & Spring Semesters |

| Investment Philosophy | Link | Spring Semester |

In keeping with the adage that there is no free lunch, you will have to pay for the certification privilege, and if the price gives you sticker shock, please remember that I have no role in that pricing decision and offer a free version, with the same content.

Sequencing

Supporting Cast

Watching a video of a class is just the first step in learning. To help, I try to provide as much supporting material as I can. As you look down the list, please do not be intimidated by its length, since you may find a use for only a portion of what I offer:

- Lecture Notes: The only material that I require for the students in my class are the lecture note slides that I use in the class, and the only reason I require it is to reduce the amount of note-taking during class. The slides are available as full packets for my regular classes, on the webpages for the classes (see above), but they are also available with each session as links. As you review these slides, you will note that I break every rule in creating slides, cramming in way too much information on each slide. I am sorry for doing so, but my intent is to allow these slides to be the equivalent of class notes.

- Post-class test: Every session of each class comes with a post-class test. These tests take about 15 minutes to do, and are a review of the material covered during the class. If you have the time, it is worth taking these tests to reaffirm what you are learning.

- Data: The data that I reference during the class are available in their most updated formats on my webpage, under current data, with the next update due at the start of 2023.

- Spreadsheets: I almost never open an excel spreadsheet during my classes and spend little time on financial modeling, but I do use my limited Excel skills, when valuing companies and doing corporate financial analysis. To save you the trouble of building spreadsheets from scratch, I leave my spreadsheets online for you to access, adapt and change.

- Tools videos: As I noted earlier, my classes are applied, and to provide guidance on applying what I teach to real life, I have YouTube videos on almost every application, from how to read an annual report all the way to a full company valuation.

- Blog Posts: If you find the material in my classes of interest, you can read my blog on Google Blogger and Substack. I don't post often, but when I do, my posts tend to focus on valuation, corporate finance and investment philosophy topics.

- Books: I have books on each of the topics that I teach, but you do not need any of them to get through these classes. Some of these books are obscenely over-priced, and I don't require them for any of my classes.

Book | Publisher link | Webpage for book |

|---|---|---|

Valuation | ||

Damodaran on Valuation | Link | Link |

Investment Valuation | Link | Link |

The Dark Side of Valuation | Link | Link |

The Little Book of Valuation | Link | Link |

Narrative and Numbers | Link | Link |

Corporate Finance | ||

Corporate Finance | Link | Link |

Applied Corporate Finance | Link | Link |

Strategic Risk Taking | Link | Link |

Investment Philosophies | ||

Investment Philosophies | Link | Link |

Investment Fables | Link | Link |

All Classes | ||

The Corporate Life Cycle | Forthcoming in 2023 | Forthcoming in 2023 |

Group Work and Interaction

Starting on an online class is easy, but finishing the class is difficult. One obvious reason is time and commitment, and I will have to leave it to you to figure that one out, but another is that a class is more than a collection of lectures. There is a peer-group component to learning that includes class discussions and group interactions that is often absent in big online classes, leaving you not only with unanswered questions, but also missing the critical part of learning that comes from explaining concepts to, and bouncing ideas off, others in the class.

I do not have the bandwidth to be able to provide direct support to everyone taking my classes, but a few months ago, I was approached by Sebastian Marambio, who has set up a neat site called We are six, allowing people to set up groups to work with, for online classes, with apps available for Android and iOS. Once you register on the site, you can enter the class code for the class that you then proceed to create a group with others with similar time frames and compatible time zones for taking the class. Sebastian has been kind enough to set up free versions for my online classes and the links to them are below:

| Class | Course Code (for We are Six groups) |

|---|---|

| Corporate Finance (Online) | ADCorp |

| Valuation (Online) | ADValu |

| Investment Philosophies (Online) | ADPhil |

YouTube Video

Class List

| Subject | Online (Free) | Certificate (Not free) | Regular Class (Free to follow) |

|---|---|---|---|

| Accounting | Link | NA | NA |

| Foundations of Finance | Link | NA | NA |

| Statistics | Link | NA | NA |

| Corporate Finance | Link | Link | Link |

| Valuation | Link | Link | Link |

| Investment Philosophies | Link | Link | NA |

No comments:

Post a Comment

Given the amount of spam that I seem to be attracting, I have turned on comment moderation. I have to okay your comment for it to appear. I apologize for this intermediate oversight, but the legitimate comments are being drowned out by the sales pitches and spam.