I am not much of a car person and view cars primarily as a mode of transportation. I drive a 2010 Honda Civic, a perfectly serviceable vehicle that is never going to get oohs and ahas from onlookers, but I feel no urge to value Honda. I don't own a Tesla, and have only driven someone else's Tesla, but as readers of this blog know, I valued Tesla for the first time in 2014, and I keep returning to the scene of the crime. One reason is that no matter what you think of Elon Musk and Tesla, they are never boring, and interesting companies are much more fun to value than boring ones. Another is that when valuing companies, I am, in addition to valuing a company to see if it is fairly priced, interested into the broader insights about business and valuation that emerge from the company. Thus, almost everything I know and practice, when valuing young and start-up companies, I learned in the process of valuing Amazon in the 1990s. In the same vein, I have learned a great about the power of disruption and the capacity of a young company (and its founder) to change the way a large, inertia-bound business is run, in the process of valuing Tesla. As I will note in more detail in the post, I have been wrong, and sometimes hopelessly so, in some of my earlier valuations of Tesla, but that does not stop me from trying anew. It is also true that Tesla is a company that attracts strong and very divergent views, and consequently, I get more pushback on my valuations of Tesla than on any other company, but as in last few attempts with this company, I have structured my valuation to allow you to incorporate your disagreement. My last valuation of Tesla was in November 2021, towards its market peak, and given its steep fall from grace, in conjunction with Elon Musk's Twitter experiment, it is time for a revisit.

Tesla: A Revolution Unfolds

In evaluating Tesla's climb to domination, at least in market value terms, of the automobile business, it is worth remembering how impervious this business was to disruption in the decades leading up to Tesla's arrival. In the United States and Europe, domestic competitors to the established players did not get far, largely brought down by requirements of large capital investments and a distribution system built to favor established players. When Tesla was founded in 2006, with a stated intent of building electric cars, the traditional auto companies were quick to dismiss it as a potential competitor. Tesla's rise is summarized in the graph below, where we look at the company's revenues and earnings over time, with earnings measured in gross and operating terms, and EBITDA capturing operating cash flows:

|

| 2022 numbers updated to reflect 4th quarter earnings call on 1/25/23 |

Between 2010 and 2020, Tesla grew revenues from $117 million to $31.5 billion, a remarkable achievement by itself, but COVID gave the company a boost, as revenue have increased about 250% in the 2020-22 time-period. Just as impressively, the company finally started delivering on its promise of profitability, going from barely making money in 2019 to an operating margin of 16.57% in 2022. While the company still has skeptics, it is no longer a niche player in a big market, and has moved the sector closer to its vision than the other way around.

In its early years, Tesla was dependent on equity issuances for funding growth investments, and its liberal use of options to reward management (and especially Elon Musk) opened it up to criticism. Since both affect share count, I look at the company's net income and earnings per share over its public life:

| |

|

It is true that the number of shares outstanding has quadrupled over the company's lifetime, but the good news is that the net income increases in recent years have outstripped the share count increase, with earnings per share increasing from 25 cents per share in 2020 to $3.74 per share in 2022.

My Tesla History

I have valued Tesla multiple times over the last decade, and while I have been wrong at each turn, I have tried to learn from my mistakes. In this section, I will begin by looking at the evolution of my Tesla value from 2013 to 2021, and then present my updated valuation of the company.

My Tesla Valuations over Time

My first valuation of Tesla was in 2013, and I found the company significantly overvalued then, and in hindsight, there were three errors that I made in that valuation that I systematically found myself repeating in my early valuations.

- Growth potential: I underestimated the company's capacity to grow, by limiting its product reach. In my 2013 valuation, I estimated the potential revenues by assuming that Tesla was more luxury than mass-market automobile, giving it revenues of $64 billion in steady state. (It is worth noting that year 10 in that valuation would be 2023, and Tesla's revenues in 2022 were not that far off at $73 billion, albeit with more potential for growth.) Since that valuation, it is clear that the company's products reach a much broader market than I originally anticipated, and my estimates of Tesla's revenues in steady state have increased over time. In fact, in my most recent valuations, I have assumed that Tesla will not only become a mass-market automobile company over time, but that it will have a dominant market share of the electric car portion of that business.

- Product characteristics: In my early valuations, I viewed Tesla cars as automobiles first and foremost, leading me towards operating margins more suited for a manufacturing company, i.e., single digit values or, at best, just barely double digits. While the experiment is ongoing, it is clear to me that an electric car is both an automobile and an electronic product, with software forming an integral part of a Tesla automobile. That recognition has led me to push margins higher, and that push has been vindicated, at least partly, by the margins the company has been able to deliver in 2021 and 2022.

- Reinvestment needs: The automobile business has always been capital intensive, with companies needing to invest large amounts in new factories to be able to deliver on growth. In my early valuations of Tesla, I assumed that Tesla would have to follow the same path, and that reinvestment translated into large negative cashflows, with a concurrent need to raise new capital, in the growth years. Having watched Tesla reinvest and grow over the last few years, it is clear to me that the company's been able to generate its growth with far less money invested in plant and more in technology and R&D than a typical auto company. That recognition has led me to reduce my estimates of reinvestment at the company, using a higher sales to capital ratio as my vehicle to reflect that reduced investment need.

|

| Download spreadsheet |

A Valuation Update

It is a year and two months since my last valuation of Tesla, and it has been an eventful period for the company, Elon Musk, its founder/CEO and the overall market:

- The Company: At the company level, even as earnings reports delivered progress towards scaling up and becoming more profitable, there have been questions about whether the pathway is becoming more rocky. In its report on the first quarter of 2022, Tesla beat analyst estimates for both revenue growth and profit margins, but acknowledged COVID-related production problems in its Shanghai plant. In its earnings report from the second quarter of 2022, Tesla reported a slowing of revenue growth to 25% (from the heated pace of 2021) and a decline in margins that it attributed to inflation and competition for EV components. The 2022 third quarter report included news that revenues would come in below analyst estimates, both in dollar value and number of cares. The fourth quarter earnings report, delivered yesterday (January 25) confirmed earlier reports of slowing growth and a decrease in profitability (gross and operating), due to supply chain problems, with the company providing guidance that its pricing cuts will put pressure on future margins.

- The Founder Effect: In all of my valuations of Tesla, I have emphasized that it is a personality-driven company, with Elon Musk representing the company's vision and driving or perceived to be driving its decisions. In fact, in my November 2021 post on Tesla, I explicitly noted that it is almost impossible to value Tesla without bringing in your view of Musk into the valuation: Until recently, even Tesla critics would have conceded that Musk, in spite of his numerous faults, was a net positive to the company. In the last year, even Tesla advocates have starting questioning that belief, partly because Musk's Twitter adventures seem to be taking up much of his time, leaving a perceived vacuum at the helm of the company. That may be an overreaction, and I am not quite ready to come to the conclusion that he is net negative for the company, but it is undeniable that the net Musk effect being negative is not being dismissed. There is also the question of whether Musk will come under pressure to sell Tesla shares to meet demands from Twitter lenders, and how that will play out in markets.

- The Market: The US equity market in January 2023 looks very different from the market at the start of 2022. As I noted in my last post, rising risk free rates and equity risk premiums have pushed up the costs of equity for all companies, and Tesla is not only no exception but is perhaps even more exposed as an above-average risk company. In short, the cost of capital of 6% that I used in November 2021, higher than the median cost of capital of 5.6% for US companies then, no longer is defensible, as the median cost of capital has climbed toward 9.6%.

- First, I left my end revenues for Tesla back to $400 billion, still a reflection of my view that electric cars will become the dominant part of the auto market, and that Tesla still has not only a lead in that market, but will have a significant market share. In fact, Tesla's revenues of $81 billion in 2022 makes this assumption more plausible, not less so Note that this will still give Tesla more revenues than the largest automobile companies in the world, and will require that they make a transition, at least on core models, to a mass market product (with prices to match). I know that Tesla does and can sell more than just cars (energy solutions and software), but these are businesses that, at best, can add tens of billions of dollars to the mix, not hundreds.

- In my November 2021 valuation, I had chosen a target operating margin of 16%, higher than the then-prevailing margin of 12.06%. In 2022, Tesla delivered an operating margin of 16.76% before correcting for R&D, and 18.41% after the correction, though its performance varied widely across the four quarters:

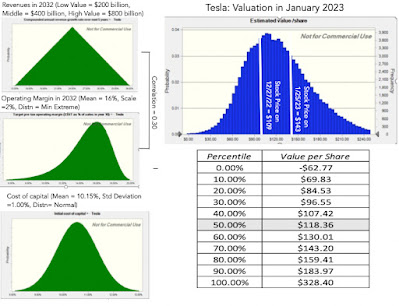

While Tesla's profitability in 2022 has been a pleasant surprise, I have left the target margin at 16% because the forces that pushed the operating margin back down to 16% in the last quarter of 2022, which include price cuts and increasing production costs at their plants, will only intensify as Tesla seeks out market share. There is a niche market story that can be used to justify higher operating margins at Tesla, but that story would be incompatible with it having revenues of $400 billion. - Third, my cost of capital for Tesla has jumped to 10.15%, reflecting a world of higher interest rates and risk premiums:

|

| Download spreadsheet |

Note that my median value is slightly lower than my base case value, mostly because there are more potential upside values than downside value. The bottom line, though, is that the median value, at $120, confirms that the stock is overvalued, at least based on my estimates, at least at its stock price of $143. However, unlike November 2021 or at other points in Tesla's life, the stock is very much in play, and anyone who bought the stock on 12/27/22, when the price hit $109, would have got a reasonable bargain. I am writing this post, in the aftermath of Tesla's earnings report, and the stock is up in the after market, perhaps in reaction to the fact that the company beat its earnings per share forecast, the least meaningful part of any earnings report. To be honest, there is nothing that I see in that report, which is still barebones, that would lead to fundamentally reassess Tesla's value, but clearly the earnings per share beat and the "news is not as bad as it could have been" effect is clearly playing out in Tesla's pricing.

Lessons for Investing

When valuing companies, it is important that you focus on the task at hand, which is to value a company and make an investment judgment on whether you should buy or sell the company, but it is also productive to look for general lessons that you can use in valuing other companies in the future. The Tesla valuation offers me a chance to examine bigger questions including how much a personality (Musk in the case of Tesla) can affect value, when the laws of business catch up with even the most successful disruptors and finally, and most depressingly, how politics has entered investing and business decisions in ways that we will come to regret.

1. Personality-driven Companies

In entertainment, sports, politics and business, we live in a personality-driven world, where individuals are given more attention than institutions. This is not a new phenomenon, but social media has furthered this trend, by giving influential people platforms and megaphones to reach tens of millions of followers. Some of the highest profile corporations in the last decade have tied their business stories to their founders, making it difficult to separate one from the other. In many cases, this has helped, not hurt, these companies, as Jack Ma drew investors and customers to Alibaba with his enthusiasm and energy, and no one sold Tesla to customers and investors better than Elon Musk. In both cases, though, we are discovering that there is a downside to personality-driven companies, since as human beings, these personalities come with good and bad qualities. There is no doubt in my mind that Elon Musk has enough vision to power a dozen companies, but he is also easily distracted and sometimes eccentric, but that is the package that drew people to the company a dozen years ago, when the company was started, that engineered its ascent to trillion-dollar market cap status, just a couple of years ago, and is now, at least in the eyes of some, weighing down the company.

Good founders find ways to build businesses that outlast them, as Bill Gates did at Microsoft and Jeff Bezos at Amazon, but that required them to set aside egos and to overcome their desire for control. With Tesla, I still believe that Musk's vision is critical, but it is essential for Tesla's long term success that he takes two actions. The first is to stop being the spokesperson for the company on all things small and large, and allow others in the company to find their voices. The second is to either build a management team that can run the company without him, if that team does not exist, or if it does, to give more visibility and front-stage status to the members of that team. I will wager that many investors in Tesla would be hard pressed to name its CFO or others in its top ranks, and that is an indication of how completely Musk has dominated the Tesla conversation.

2. The Universal Laws of Business and Economics

When looking at businesses, it is worth remembering the business rules that have always governed success and failure, and recognize that while there are some companies that can deviate from these rules for a period of time, they eventually find themselves subject to them. I capture these business rules in what I call my valuation triangle, shown below:

Put simply, most businesses that want to grow faster have to accept that this higher growth will come with more risk (because it will require entering riskier geographies or marks segments), will need more investment in capacity (to be able to deliver on that growth) and often require accepting lower operating margins (because you may have to cut prices to sell more). For most of the last decade, Tesla has seemed to be impervious to these rules, showing a capacity to deliver revenue growth with rapidly rising margins in a competitive electric car business, and doing so with far less reinvestment than other automobile companies.

That said, though, there are indications that the company, while still delivered wondrous results, is finding itself coming back to earth. The recent report that the company plans to cut prices for its cars in the United States may be a transitory change in policy, but it is more likely a reflection of the reality that customers, for whatever reasons, are now willing to at least look at other carmaker's offerings, if the price is right. In the same vein, the challenges that Tesla is facing in its manufacturing plants and with supply chains are familiar problems that all manufacturing companies face, and reflect the fact that it it Tesla no longer a niche company with absolute pricing power, selling to a fanatically loyal customer base. My guess is that the stories, while more negative than positive, will even out over time, and that Tesla will be able to stay ahead of its competitors, but for those investors and analysts who are used to Tesla posting super normal performance, it may take time to stop treating normal performance as a negative surprise.

3. Everything is political

In a world where where you shop, to where you eat and even which sports teams you cheer on depend on which side of the political divide you fall on, is it any surprise that politics is now affecting business and investing choices as well? It is one reason why I have argued against bringing ESG into companies and investing, because there is almost no social issue that an ESG-measuring service can defensibly bring into a score, without a backlash. In the case of Tesla, the politics of the moment are undeniably an issue, and I would argue that where your political views will have more of an effect on whether you think Tesla is under or over valued than any of its operating numbers. It is amusing to see Tesla advocates become adversaries overnight, mostly because their politics have diverged from Musk's, and Tesla opponents become its defenders, because they are in political agreement with Musk. As should be clear from my many posts on Tesla, I fall in the muddled middle when it comes to Musk. I believe that he is a visionary, not so much because Tesla is at the cutting edge of technology, but because he has changed the automobile business and our driving choices fundamentally. There are qualities that I admire in him, and qualities that I do not, but I think that as a society, we are better off with him than without him. That said, I would like to think that my decisions on whether to buy or sell Tesla will be unaffected by my personal views on Musk, but that may be just my delusion speaking.

YouTube Video

Spreadsheet links

No comments:

Post a Comment

Given the amount of spam that I seem to be attracting, I have turned on comment moderation. I have to okay your comment for it to appear. I apologize for this intermediate oversight, but the legitimate comments are being drowned out by the sales pitches and spam.