It is the nature of stocks that you have good years and bad ones, and much as we like to forget about the latter during market booms, they recur at regular intervals, if for no other reason than to remind us that risk is not an abstraction, and that stocks don't always win, even in the long term. In 2022, we needed that reminder more than ever before, especially after markets came roaring back from the COVID drop in 2020 and 2021. While there are many events during 2022, some political and some economic, that one can point to as the reason for poor stock returns, it is undeniable that inflation was the driving force behind the market correction. In this post, I will begin by chronicling the damage done to equities during 2022, before putting the year in historical context, and then examine how developments during the year have affected expectations for the future. I will follow up by looking at the mechanics that connect stock prices to inflation, and examine why the damage from higher inflation can vary across companies and sectors.

Stocks: The What?

We invest in equities expecting to earn more than we can make on risk free or guaranteed investments, but the risk in equities is that actual returns can deviate from expectations. In some years, those deviations work to our benefit and in others, it can hurt us, and 2022, unfortunately, fell into the latter column. In this section, I will begin with a deconstruction of stock returns in 2022 and the year's place in stock market history. I will then provide a template for estimating expected returns on equities, and examine how expected returns changed during the course of the year.

Actual Returns

Your returns on equities come in one of two forms. The first is the dividends you receive, while you hold stocks, a cash flow stream that provides a measure of stability to investors who seek it. The other, and less predictable component, is the price change, which in good years adds to the return as a price appreciation, and in bad years, often overwhelms dividends to deliver negative returns.

The Year in Review

At the start of 2022, the S&P 500 was at 4766.18, up from 3756.07 at the start of 2021. During the course of 2022, the index was staggered by political events, with Russia's invasion of Ukraine upending global economies, and by inflation, which entered the year high, and continued on that path through the course of the year. The graph below shows the S&P 500 at the end of each month, from December 31, 2021 to December 31, 2022, and the resulting monthly returns:

Aggregating over the entire year, the index declined 19.42% in 2022, and while the dividends during the course of the year rose, the dividend yield of 1.41% provided only a minor offset, resulting in total returns of -18.01% on the S&P 500 for the year:

And in historical context

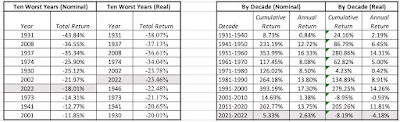

It is undeniable that 2022 was a bad year for stocks, but in historical context, how bad a year was it? I maintain a database of historical returns on stocks, bonds, bills and other asset classes on my webpage, and I looked at the annual returns, by year, starting in 1928 through 2022 for US stocks. In the graph below, I look at the distribution of annual returns over those 95 years, paying special attention to the negative years:

|

| S&P 500 officially came into existence in 1957, but we filled in earlier years using stock return data |

Expected Returns

Markets are driven by expectations, and while expectations for the future can be affected by what has happened in the past, they are still worth exploring. After a year of being pummeled by markets, what are investors pricing stocks to make in 2023 and beyond? And will they be disappointed or delighted by what the year delivers? Those are the questions that investors have to answer today and I will try to provide my perspective in this section.

Actual vs Expected Returns

As you saw in the previous section, actual returns on stocks can be negative, and significantly negative, in some periods, and those negative returns can sometimes extend into decades. Those who invested in the Nikkei at its peak on December 29, 1989, have spent the decades since trying to get back to that level. The notion that stocks always win in the long term is a dangerous one, and while those pushing it claim to have the data on their side, it is worth remembering that the use of US data to make this case is statistically flawed. The US was one of the most successful of global equity markets of the twentieth century, and to use its historical record as the basis for all equity investment in the future strikes me as wrong headed.

That said, when investors buy equities, it would be both irrational and illogical to settle for expected returns that are less than what you can earn on risk free or guaranteed investments, though behavioral finance suggests that both irrationality and illogic are persistent human traits. The premium that investors demand over and above the risk free rate is the equity risk premium, and practitioners in finance have wrestled with how best to estimate that number, since it is not easily observable (unlike the expected return on a bond which manifests as a current market interest rate).

a. Historical Equity Risk Premium

The conventional wisdom, at least as taught in business schools and practiced by appraisers, is that the only practice way to estimate equity risk premiums for the future is to use equity risk premiums earned in the past. Thus, historical risk premiums are viewed as the best estimates for the future, though analysts disagree not only about how far back in time they should go, whether to compare stock returns to T.Bill or T.Bond returns and even on how to compute the historical average return (arithmetic versus geometric averages). The graph and table below provide my estimates of the historical equity risk premiums in the US market:

Implied Expected Returns

There is another approach to estimating expected returns on stocks, and equity risk premiums, and it is forward-looking. It too requires estimate for inputs, but the range of error is magnitudes smaller than with historical premiums. In this approach, I draw on a technique used to compute the yield to maturity on a bond, the discount rate that makes the present value of cash flows on the bond (coupons and face value) equal to the price of the bond, and extend it to equities. To illustrate, I estimate this implied equity risk premium for the S&P 500 at the start of 2023, using the index level as the price that I pay on the index and using market estimates of earnings and dividends/buybacks on the index for the next five years and beyond.

In historical context

In my first data post, I noted the increase in equity risk premiums during 2022 from 4.24% at the start of 2022 to 5.94% at the start of 2023. I posited that any debate about whether the market, as it stands now, is fairly, under or over valued is really one about whether the equity risk premium at the start of 2023 is too high (in which case, the market is under valued) or too low (in which case, it is overvalued). To answer that question, and address the question of where the expected return of 9.82% stands in historical context, I report the expected returns and equity risk premiums for the S&P 500 from 1960 to 2022:

Stocks: The So What?

It is worth noting that in valuation, demanding a higher expected return depresses value today, and the increase in expected returns over 2022 is therefore consistent with the decline in stock prices during the year. In fact, the drop in stock prices of 20% is mild, given the surge in expected returns during the course of the year. There is another reading of this expected return that ties into investment and growth, where the expected return on stocks is the cost of equity that companies need to clear to make investments. In short, an average-risk project with a return on equity of 7%, which would have passed the investment test at the start of 2022, because it was greater than the cost of equity of 5.75%, prevailing at the time, would not pass muster at the start of 2023.

The effects of a higher equity risk premium are also not uniform across all stocks, with higher risk stocks seeing much greater rises in their costs of equity than lower risk stocks. The table below provides the cost of equity distribution across US companies at the start of 2023:

Note that, for the first time in a decade, more US firms have double digit costs of equity than single digit values, and while that may seem shocking to younger analysts, it is a return to what used to be normal in the pre-2008 market.

Stocks: The What Next?

To close this post, I revisited my valuation of the S&P 500 on September 23, 2022, and since much of last year's changes to the risk free rate, earnings expectations and the equity risk premium had happened by then, my value of the index has not changed much. In fact, if you view the current treasury bond rate as reflective of the market consensus on future inflation and rates, and assume that analyst estimates of earning already incorporate the effects of an economic slowdown in 2023 and 2024, the index value comes in at almost the current index level:

|

| Download spreadsheet |

In sum, with analyst estimates of earnings for the next two years powering earnings expectations, and an desired equity risk premium of 5% (close to the average premium in the post-2008 time period), stocks started the new year closer to fair value than being under or over valued.

The market consensus can be wrong, and as the last year has shown, markets can change their minds, and especially so on two variables. The first is inflation, and whether it will recede to pre-pandemic levels or stay elevated, with consequences for both interest rates, nominal earnings growth in the long term and reinvestment. The second is the economy, where talk of recession fills the air but where a whole range of outcomes is possible from no recession to a steep drop off in economic indicators.

|

| Download spreadsheets: Low inflation & no recession, Low inflation & steep recession, High inflation & no recession, High inflation & steep recession |

What should you do with these forecasts? Absolutely nothing, given the track records of these forecasts, but the wide divergence in forecasts comes from different expectations of how the inflation/real economy story will play out. Rather than adopt one of their outlooks, or mine, you should, as an investor, find your point of view and let it drive your investment actions for the year. The first step in being a good investor is to take ownership of your investment decisions, and I hope that my framework/spreadsheet helps you on that path.

No comments:

Post a Comment