In my last post, I looked at how the pharmaceutical and biotechnology businesses have diverged, especially in the last decade, and the implications for earnings, R&D and market pricing of these companies. The pharmaceutical business, in particular, faces a new landscape with many companies still stuck with a business model that does not work in delivering value, as growth eases and margins come under pressure. It is no surprise therefore that investors are looking for a drug company with a new business model, and that may explain the meteoric rise of Valeant over the five years, making its recent collapse all the more shocking.

Valeant: The Rise

The best way to illustrate Valeant's rise in the drug business is trace its history in numbers. The graph below looks at the time line of revenues, operating income and net income from 1993 to the the last twelve months ending in September 2015:

As you can see, the inflection point is in 2010, when Valeant went from a company with small, slow-growing revenues into hyper speed, increasing revenues almost ten fold between 2010 and 2015. That increase in revenues was accompanied by increases in operating income and net income, albeit smaller in proportional terms. The story of how Valeant was able to accelerate its growth has been widely told, but the numbers again tell it better.

| Year | R&D | Acquisitions | R&D/Sales | Acquisitions/Sales |

|---|---|---|---|---|

| 2005 | $69.42 | $- | 7.40% | 0.00% |

| 2006 | $77.80 | $- | 7.29% | 0.00% |

| 2007 | $100.61 | $- | 11.94% | 0.00% |

| 2008 | $69.81 | $101.90 | 9.22% | 13.46% |

| 2009 | $47.58 | $- | 5.80% | 0.00% |

| 2010 | $67.91 | $(308.98) | 5.75% | -26.16% |

| 2011 | $65.69 | $2,464.10 | 2.71% | 101.51% |

| 2012 | $79.10 | $3,485.30 | 2.27% | 100.14% |

| 2013 | $156.80 | $5,253.50 | 2.72% | 91.12% |

| 2014 | $246.00 | $1,102.60 | 2.98% | 13.35% |

| LTM | $297.60 | $14,123.20 | 2.98% | 141.46% |

The growth has been driven almost entirely by acquisitions, totaling $26.4 billion since 2010. Looking closer at the 23 acquisitions that Valeant has made since 2013, the company has bought more private businesses (18 out of the 23) than public, though a very large proportion of the total cost can be accounted for with two acquisitions, one of a public company (Salix for $12.5 billion) and one of a private business (Bausch and Lomb for $8.7 billion. Valeant seems to have also paid for almost all of these acquisitions with cash, which raises the interesting follow up question of where they came up with the cash. Again, the answer is in the numbers, with the chart below providing a breakdown of funding sources during the period from 2011-2015, the peak period for Valeant's acquisitions:

|

| Source: Valeant Statement of Cash Flows |

At least during this period, the market liked the Valeant business model of growth through acquisitions, and delivered its verdict by pushing up Valeant's market capitalization and pricing multiples.

Valeant: The Fall

It is perhaps because Valeant rose so quickly from its mid-cap status to become a star that its precipitous fall has been so shocking. The decline started with a report, on October 19, on a court filing in California and picked up steam when it was highlighted on October 21 by Citron, an outfit that has long been critical of Valeant's accounting and operating practices. That report claimed that Valeant had hidden a relationship with shadowy pharmacy entities and that it had used that relationship to cook its books. While some were quick to dismiss the report as motivated by Citron's short position in Valeant, the report triggered scrutiny and Valeant's initial explanations satisfied no one and the market reacted accordingly:

Recognizing that it faced a major market calamity, Valeant called a press conference on October 26, where they tried to clear the air, succeeding only in making it murkier by the time they were done. In the days since, the piling on has begun with even long time investors in the company finding aspects of the company that they had never liked. The stock price dropped below $80 per share on November 5, down more than 60% from its peak in August. In fact, things have gotten so bad that the CEO of Valeant, Michael Pearson, was forced to sell $100 million of his shares in the company to cover a margin call.

Valeant's Business Model

The formula that Valeant used to grow exponentially, i.e., acquiring smaller companies and bringing them under one corporate umbrella, is not new, and given the mixed track record of companies that have tried it, it is not generally greeted with the rapturous response that Valeant received. To add to the puzzle, many of the investors who were drawn to the stock were from the old-time value investing crowd, with the Sequoia Fund and Bill Ackman among its biggest cheerleaders. So, what is it that attracted these presumably hard-headed investors to the Valeant business model?

- Buy low, sell high: I believe that value investors were attracted to Valeant because it seemed to adapt an old-time value investing maxim of buying "cheap and selling expensive" to the drug market. At the risk of over simplifying Valeant's strategy, a central focus of its acquisition strategy was buying companies that owned the rights to "under priced" drugs and repricing to what the market would bear.

- Use debt capacity: One of the enduring mysteries of the drug business, where mature companies have large and stable cash flows from developed drugs, is why these companies do not borrow more to take advantage of the tax code's tilt towards debt. As you can see from the funding pie chart above, Valeant seemed to have no qualms about using its borrowing capacity to fund its acquisitions.

- R&D is not sacred: In my last post on the drug business, I noted the reduced payoff (in growth) to R&D expenditures at pharmaceutical companies and the unwillingness on the part of these companies to draw back their R&D expenditures. Again, Valeant seemed to be one of the few companies in the business that viewed R&D like any other capital investment and scaled it back, as the payoff decreased.

- Quick conversion into earnings: Many acquisitive companies fail at converting great sounding stories into earnings, but Valeant seemed to be exception. Its acquisitions seemed to translate quickly into revenues and operating income, vindicating their strategy, though you had to take the company's word that its acquisition-related expenses were transitional and one-time charges. As an added bonus, Valeant used its acquisition-related expenses to keep its tax bill low, getting tax credits from 2011 to 2013 and keeping its effective tax rate below 10% in the most recent twelve months.

The collapse of Valeant's stock price has created more than the usual second guessing and rewriting of history, with some glee mixed in, given the pedigree of the investors who have lost money on the company. While my deep seated skepticism about acquisitions has meant that I was never tempted to buy Valeant, even in the good times, I understand its appeal to investors. In a business (pharmaceuticals), where inertia and denial seem to drive management decisions at most companies, Valeant looked like an outlier with a business template that worked.

Game Changer?

I have argued in prior posts that big shifts in intrinsic value don't come from earnings surprises or market panics, but from big changes in narrative. The question that investors (both current and potential have to ask about Valeant is whether the company narrative has been altered enough by the news stories that we are reading for it to lose more than half of it's value. If you accept my description of the Valeant business model (acquisitions focused on repricing drugs, funded with debt and quickly converted into earnings), there is reason to believe that a critical portion of the Valeant's business model is broken and cannot be fixed.

- Health care is different: Unlike perfume, soda or an automobile, where charging what the customer will pay is exactly what businesses should aspire to do, it seems inhumane and perhaps even immoral to push prices up 60% or 70% for medicine that patients need. Even if you don't have moral objections to the practice, you may still have issues with it as a citizen and taxpayer, since these costs are spread across all of us through the health insurance system. It is surprised that Valeant has not been subject to more scrutiny for this practice, but it was becoming clear even before the recent blow up that the company was drawing attention, as evidenced by this article in the New York Times on October 14 (a few days before the short seller stories appeared in the press). Now that Valeant is in the public eye, there is no way that, even if this scandal passes, they can return to anonymity. Every drug price increase for a Valeant drug will be held up to scrutiny and subject to second guessing and any target company that want to fight off a Valeant acquisition bid will now be pre-armed.

- Distribution network: The distribution and sale of drugs is different from most other conventional businesses, with doctors, pharmacies and insurance companies all operating in constrained environments, with the constraints becoming more binding with changes in health care laws. Thus, doctors are asked to consider the relative prices of drugs when writing prescriptions and pharmacies are under pressure from insurance companies to consider cost when filling these prescriptions. As I read the news stories about the pharmacies controlled by Valeant, my suspicion is that the company used this convoluted network (see the picture below from the Globe and Mail about Valeant's holdings) to extract higher prices through to insurance companies and patients, rather than as device to cook its accounting books. Now that the relationship has come to light, it is probable and perhaps even likely that if this type of relationship is legal now, it will get more regulated or even banned in the future.

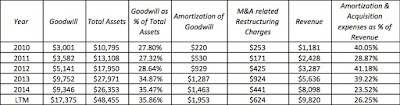

- Accounting games: Part of Valeant’s rise can be attributed to the laziness of analysts, who apply multiples (that they pull from a cursory assessment of the comparable) on pro forma earnings, and some of it to the debris of acquisition accounting (goodwill, impairment of goodwill and acquisition-related restructuring charges). I have written before about the damage that goodwill does to both accounting statements and to good sense, but the degree to which acquisition accounting has muddied up the numbers at Valeant can be captured by looking at how they have taken over Valeant's financials in the last 5 years:

Source: Valiant Financial Statements - Complexity: Valeant is a complex company, and its complexity is brought home by both the bulk of its annual filing (its last 10K from 2014 runs 537 pages) and its detail. That complexity comes partly from its strategy of growing through acquisitions and partly from the accounting for acquisitions, but some of it is clearly by design (with the pharmacy network and chess names for holdings). Complexity is a double-edged sword, though, since in good times, investors assume the best about the things that they do not know or understand and in bad times, the fog created by complexity creates a backlash.

As with every scandal, I am sure that there will be new revelations and news stories in the week ahead, some pointing to accounting problems, some to business model failures and some to legal jeopardy. Even if Valeant emerges unscathed legally from this mess, I just don’t see how they can revert to their old business model, and it is not clear to me that without it, they are anything more than a middling pharmaceutical company.

The Bottom Line

Does the imminent collapse of Valeant's core business model imply that I agree with the short sellers who have used the Enron analogy to argue that this company is a shell worth nothing? No, and here is why. Unlike Enron, a company that used special purpose entities and complex holdings to hide it debt and had no assets with tangible value at the time of its troubles, Valeant pharmacy holdings seem designed more for pricing power than accounting sleight of hand and it owns assets that have real value. Thus, even if Valeant's capacity to grow productively is removed tomorrow, it will still have value as a going concern or as a collection of assets.

Going concern value

If Valeant is able to make it through its troubles intact, one option that is available to it is to become a more conventional drug company, resting on R&D for (low) growth and making money of its established products. To value Valeant in this scenario, here are the assumptions that I made:

Given my perspective on the company, and it is undoubtedly flawed, I don't see Valeant as a significantly under valued stock, in spite of the price drop over the last few weeks. I also don't see it as bubble waiting to burst, a stock heading towards being worth nothing. For the moment, I think will sit on the sidelines and watch.

- Base year earnings: One of the positive effects of suspending an acquisition-driven strategy is that the expenses associated with acquisitions should also dissipate. Consequently, I added back acquisition-related expenses (impairment of goodwill, acquisition charges) to operating income to get to an adjusted operating income for the last twelve months. (Update: As some of you have pointed out, the most twelve months of financials include only six months that include Salix and thus understate revenues and operating income. To remedy this, I need to bring in Salix's revenues and operating income from the last quarter of 2014 and the first quarter of 2015 into my trailing numbers. Unfortunately, Salix did not file a first quarter earnings report for this year, but here is an approximation. In 2014, Salix generated $1.134 billion in revenues but reported an operating loss. If you assume that revenues come in evenly over the year and you allow for the operating margin of 25.51% that Salix earned in 2012 & 2013, you get revenues of about $567 million and operating income of $145 million for the missing quarters. Adding these to the trailing 12 month numbers increases the value per share to $77. A more optimistic take, where Valeant is able to earn its higher operating margin increases the value per share to $81. The bottom line is that bringing in Salix's bump to revenues and operating income, which is likely to create growth in the next twelve months, pushes up value per share but not by enough to change my basic conclusion, which is that the stock is, at best, fairly valued.)

- Pricing backlash: I assumed that the controversy over Valeant's drug pricing strategy will result in roll backs of price increases on some of its drugs, resulting in a permanent drop of 10% in earnings. (Update: Though this number seems to come out of left field (and it is subjective), it comes from lowering Valeant's pre-tax operating margin (prior to adjustments) of 28.3% towards that of other drug companies which is 25.5%; the drop of 2.8% is roughly the 10% drop. I am also assuming that once the losses from prior acquisitions roll off, the tax rate will move up to 20%, lower than the tax rate paid by US pharmaceutical companies, reflecting the company's Canadian base.)

- Low growth: If Valeant follows the standard pharmaceutical company practice of investing in R&D and hoping for payoffs, its expected growth rate will drop to anemic levels (as suggested by my last post on drug companies). I will assume a 3% growth rate in earnings for the next 10 years, well below the 20% posted by Valeant over the last 5 years, but much of that growth was acquired. (Update: I know that management is forecasting 10% from organic growth. That may very well be true for next year, as the Salix bump kicks in, but it is tough to sustain thereafter, with substantially increasing R&D.)

- R&D spending: I will assume that Valeant will have to invest in R&D to keep this growth going, and in my valuation, that investment will reflect the return on capital of 15.25% that I have estimated for the company (with the adjusted earnings).

- Cost of capital: Factoring in both the good side of Valeant's high debt ratio (the tax effected cost of debt) and the bad side (higher cost of debt and equity) and the revenue exposure for Valeant (75% from developed markets, 25% from emerging markets), I estimate a cost of capital of 7.52%.

|

| Spreadsheet with valuation |

Sum of the parts

If this scandal has legs and not only lingers, but creates legal problems that taint Valeant as a corporation, there is a second option. Just as Valeant’s rise in value was built on additions, you could create a reverse strategy where value is generated by subtraction. Thus, Valeant could sell itself piece by piece (drugs and divisions) to the highest bidders, since each piece will be worth more to an untainted buyer than it would be worth to Valeant. If this is the optimal path, it will be interesting to see if this team that has built the company up over the last five years is willing to set aside hubris and break it down over the next few years.

The Bottom Line

The Valeant story reinforces many of my existing biases against companies that grow primarily through acquisitions. I am willing to concede that this strategy can pay off, if companies maintain discipline, but my experience with these companies is that they inevitably hit a wall, either because they become too large to stay disciplined or because the accounting creates too many opportunities to obfuscate and hide problems. While Valeant's attempt at creating a new model for a drug business may have failed, that does not make the existing drug company model a success either. The search has to go on!

YouTube Version

Blog posts in this series

Spreadsheets

The Bottom Line

The Valeant story reinforces many of my existing biases against companies that grow primarily through acquisitions. I am willing to concede that this strategy can pay off, if companies maintain discipline, but my experience with these companies is that they inevitably hit a wall, either because they become too large to stay disciplined or because the accounting creates too many opportunities to obfuscate and hide problems. While Valeant's attempt at creating a new model for a drug business may have failed, that does not make the existing drug company model a success either. The search has to go on!

YouTube Version

Blog posts in this series

Data Attachments

Spreadsheets

17 comments:

Great article Aswath. I suggest that you sign up on Seeking Alpha and post your article there so that it reaches a wider audience.

Excellent piece. Thank you.

However, Valeant doesn't have to be a zero, with the undisclosed entities being purely shells to qualify as "Enron-like, in my opinion.

If you read the PBM contracts with pharmacies, you will see that a huge amount of the prescription volume pushed through the "Philidor network" is going to be charged back as refunds, with penalties. Don't think for a minute that Valeant is going to be legally insulated from Philidor for the legal liabilities of these. Too interlocked on too many levels for that to be possible.

Once the costs of Philidor's illegal prescription reimbursement activity is fully quantifiable, and the consequences flow back to Valeant's bottom line, you will reconsider this point.

Yes, Valeant has assets that are valuable. Lest we not forget, Enron bought Portland General Electric. However, without a massive reliable, durable cash-generating revenue stream, its debt burden on overpriced acquisitions will encumber it for years. As Valeant's existing portfolio erodes, with pushback coming from multiple directions, including generic competition, adjustment of the marketplace (see pop-and-drop stories), impossibility of getting arms-length specialty pharmas to be as aggressive as captive Philidor was, anti-Trust and political pressure, etc., their earning power will continue to erode.

Let's not forget they don't own a pipeline of new drug candidates. They have no way to replace revenue losses except by more acquisitions. And there won't be any more of those either.

The obvious question would be whether VRX is worth more as a sum of the parts valuation for sale to strategic bidders.

There are highly motivated active investors involved who can sway or remove current management, which doesn't seem extremely entrenched through shareholdings.

One would surmise they won't be satisfied with the current market price, however well-founded in the current environment.

If Valeant is nothing more than a "middling" drug company, and something i would agree with, then I think your intrinsic valuation may actually be on the optimistic side. An examination of trading multiples for middling drug companies would put a price upon the stock of closer to $50.

Supporting the view that the company may be middling is that it appears that they are not the "top dog" in many areas where the generate lots of sales such as Dermatology and Opthamology, at least here in the US. It may be there is greater value in some of their overseas business which would provide greater support for a DCF valuation vs. an estimation of Price via industry multiples.

I see no reason to buy a company that is not an industry leader in any category, constrained by a debt load and does no reinvestment. Better to buy stock of a drug company whose stock has gone no place, but has a nice dividend in place, a buyback program, and a degree of optionality via its pipeline of drugs in the hopper that may prove meaningful such as the PCSK-9 cholesterol drugs and PD-11 cancer drugs.

Great post title! I am not as optimistic regarding the value of the company as you might be as your intrinsic value appears to infer a EV/Sales multiple higher than the industry average. Your numbers i believe would translate in to a 5.4 multiple and the industry avg appears to be lower at 4.7x with some middling mediocre companies as low as 3.3x.

In light of some of what has been written about the company pushing prices of acquired product lines or companies, the accountants at year end will have an interesting challenge regarding goodwill impairment. Without looking at specifics it is hard to conclude the extent of any impairment, but based on headline news it is hard for me to see how the accountants will not require write downs. That of course does not affect your intrinsic value estimate, but it will cause "mood and momentum" investors to sell the stock pushing the price down further.

Dr.Damodaran,

What different knowledge bases did you use for this analysis? I'm a new student to finance and looking to get into valuation, buy side m/a.

Just trying to break down classes used in this... Example financial accounting knowledge, corp finance knowledge, biotechnology economics , valuation.. etc.

The model here is unrealistic. The problem is you are assuming no generic competition - or that is the implication in your terminal value DCF and, seperately, your growth scenario. For example, given the companies business model, they are unlikely to continue growing organically in the long run since they have no accumulated R&B base. Further, given their approach to pricing, it is likely that they are encouraging generic competition in the medium term. Furthermore, growing inorganically might also be an issue - see the market price of their bonds. Both of these negate the ability to use a terminal value DCF, especially one with perpetual growth.

As you will recognize, that means the valuation presented here is, perhaps, overstated. Of course, I would argue that we also need a small risk adjustment for the considerable political risk here. This is good practice in many situations (e.g., liquidity discounts) and almost always results in more accurate analysis.

According to what Valeant themselves say, their revenue growth is driven more by sales growth than price increases. No mention of sales growth in your post though. Is it because you think they are simply lying when they say that this is the more significant driver of their revenue growth?

Given your dislike of companies that grow through acquisitions I guess you must have a real problem with publishers. These are the most purely acquisition-based companies of all, making all their money by buying up and selling the works of others (authors). Yet the publishing industry is hugely profitable…

To my mind, Valeant is like a publisher in the pharma world. Its business model is and will continue to be successful for the same reason that publishing businesses in general are successful.

(In some regards it is also like the budget airline of the pharma world – another very successful business model.)

-- Your baseline figure depends on the company reporting those "acquisition-related charges" correctly. For a serial acquirer, it's too easy and lucrative to bury normal operating expenses in here. Lucrative because the market then disregards these costs, awards the company a higher valuation than deserved, and thus enables even more debt- or equity funded acquisitions in the future.

-- Instead of assuming a 3 percent revenue growth over, what, the next 20 years, I think it's not unreasonable to expect a DECLINE of 5-10 percent per year. Why? Because Valeant will gradually lose all that pricing power on exisiting products while the company cannot get new products due to inability to do new acquisitions and the lack of R&D.

-- Many of Valeant's products already have generic competition and Philidor was a way around that. Insurers will stop that "specialty pharmacy" loophole (now sooner rather than later), requiring a generic prescribed in all channels if available. Generic competition will only increase going forward with no new business to replace it.

---> Bottom line: Any valuation that implies that insurers will pay thousands of dollars for some cream that is not more effective than a $10 generic CONTINUOUSLY over the next 20 years - contradicts common sense. Valeant's revenue base is simply unsustainable.

Dr. Damodaran,

The problem, in my view, is not amortization of goodwill. It is amortization of intangibles. Rather than expensing R&D on the income statement, R&D is instead acquired; this is why Valeant gets away with 3% of revenues -- because it's a different line item. The aggregate purchase cost incorporates prior R&D in the form of intangibles. In economic terms, the sticker price on an acquisition is equivalent to capitalizing prior R&D. What difference does it make whether you expense R&D immediately or capitalize it during an acquisition? Economically, none. But in accounting terms, a lot.

There is no way to justify Valeant's valuation during the time Sequoia/Ackman purchased it, unless you add amortization back in. Unfortunately, amortization is a real expense. It's a false belief that EBITDA, EBITA, or any variant of "-A" represents cash available to investors. It is cash in accounting form, but not in economic fact. This is analogous to how depreciation is cash in accounting form, but not in economic fact.

Demonstrated below is "Cash EPS" as reported by management, a metric deeply cherished by management that dictates compensation. In parentheses is the % of cash EPS that is actually amortization:

2011: $2.93 (amortization $1.82 = 62%)

2012: $4.51 (amortization $3.04 = 67%)

2013: $6.24 (amortization $5.68 = 91%)

2014: $8.34 (amortization $4.61 = 55%)

As you can see that this is the single biggest thing to understand in interpreting Valeant, because amortization is the biggest component of the earnings.

Readers on this forum would benefit from careful scrutiny of accounting standards for capitalization and amortization of software companies' R&D, and a thorough evaluation of how these parameters may be stressed/broken. Valeant, through purchase accounting, has managed to capitalize R&D and amortize it in a similar fashion.

Respectfully,

Jathin

I would be curious if you apply the same valuation methods (adapted for company specifics like R&D pipeline) how far apart are the valuation and the market price for the big players.

Definitely not Enron but the assets it has are impaired.

Break up value - considering the price paid for acquisitions was in an environment of pricing power (which probably led VRX to pay more than value ie Turing and Diapram) what do you estimate the pieces are worth now. Will the pieces have litigation exposure from VRX?

It seems the links to your valuation models are broken?

The NYU server was hacked and went down for several hours. That is why the spreadsheets would not download.

Hi Professor, being a fan: one more time again "chapeau bas" for this masterpiece analysis. Astonishing blend of numbers and narrative. By and large, to me, Valeant Mgmt have done a great job: the tax inversion, the serial acquisitions, the re-pricing arbitrage etc. are "coups de maitre". I have 2 questions for you:

1) Being a regular reader of your blog, for my sake, I would like to understand the rationale behind the ongoing bashing of acquisitions; in that specific case, why Valeant should dismiss an acquisitive business model that created so much value over the last 5 years and focus on an R&D centric model that seems to have reached its limitations (ref. to the ratio of revenue growth to R&D as a % of sales). My understanding is that there are no more slam dunks R&D wise in the pharma space;

2) Ref. to the piecemeal path, I do not understand why your labelling it as a SOTP; to me, it is more of a liquidation value.

Many thanks.

Cheers,

Othmane

Having read the Outsiders, I can also understand why many of these value focused fund managers liked Valeant so much. I also find it hard that the company was able to do accounting manipulations. However you have correctly mentioned that hiking drug prices is something that people would frown upon. Really loved this post of yours.

Asif Khan

Any new thoughts about Valeant?

VRX has disaster written all over it.

EVERYTHING VRX does is overly complex. Its entire business model depends on gimmicks. For example 1) the use of Philador ( a company they paid for but did not take ownership) as middle man to raise prices and extract more from insurance companies 2)The new deal with Walgreens where the pharmacy is simply a distributor and does not have control of pricing 3) the new 6 person team to fill in for the ailing CEO 4) no investment in R&D or product pipeline but relies solely on raising prices of existing rolled up drugs.

Nothing this company does is normal or standard when there really is no reasonable rationale other than it is house of cards trying to hide its true nature.

Post a Comment