My views on ESG are not a secret. I believe that ESG is, at its core, a feel-good scam that is enriching consultants, measurement services and fund managers, while doing close to nothing for the businesses and investors it claims to help, and even less for society. That judgment may be harsh, but as the Russian hostilities in Ukraine shake up markets, the weakest links in the ESG chain are being exposed, and as the same old rationalizations and excuses get rolled out, I believe that a moment of reckoning is arriving for the concept. If you remain a true believer, I will leave it up to you to decide how much damage has been done to ESG, and what comes next.

The ESG Response To Russia

When Russian troops advanced into Ukraine in late February, the reverberations across markets were immediate. Stock, bond and commodity markets all reacted negatively, and at least initially, there was a flight to safety across the world. Since one of ESG's sales pitches has been that following it’s precepts would insulate companies and investors from the risks emanating from bad corporate behavior, both ESG advocates and critics have looked to its performance in this crisis, to get a measure of its worth. I am not an unbiased observer, but the reactions from ESG defenders to this crisis can be broadly categorized into three groups.

1. The Revisionists

In the last decade, as ESG has grown, I have been awed by the capacity of some of its advocates to attribute everything good that has happened in the history of humanity to ESG. If these ESG revisionists are to be believed, if companies had adopted ESG early enough, there would have been no banking crisis in 2008, and if investors had screened stocks for ESG quality, they would not have lost money in the corporate scandals and meltdowns of the last decade. In the last week of February 2022, in the immediate aftermath of this crisis, there were a few ESG supporters who argued that ESG-based investors were less exposed to the damage from the crisis. That was quickly exposed as untrue for three reasons:

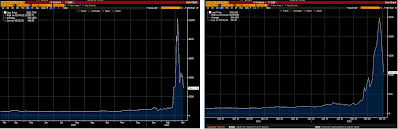

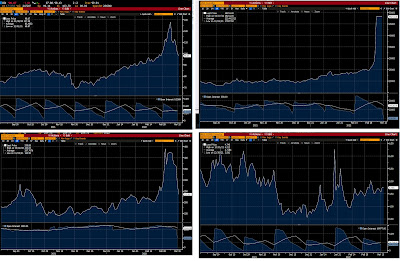

- ESG measurement services missed the Russia Effect: There is no evidence that Russia-based companies had lower ESG scores than companies without that exposure. In my last post, I looked at four Russian companies, Severstal, Sberbank, Yandex and Lukoil, all of which saw their values collapse in the last few weeks. When I checked their ESG rankings on Sustainalytics ranked each on February 23, 2022, each of them was ranked in the top quartile of their industry groups, though they all seem to have been downgraded since, with the benefit of hindsight. In a short piece in the Harvard Law Forum on Corporate Governance, Lev, Demeers, Hendrikse and Joos, highlight the absence of a Russia effect on ESG ratings with a simple comparison of ESG scores of companies with and without Russia exposure:Unlike them, I will not argue that failing to foresee the Russian invasion of Ukraine is an ESG weakness, but it certainly cannot be presented as a strength.

- Following the ESG rulebook after the crisis has been a losing strategy: It is true that the emphasis on climate change that skews ESG scores lower for fossil fuel and mining companies would have kept you from investing in Lukoil and Gazprom, among other Russian commodity companies, but it would also have kept you from investing in other companies in these sectors, operating in the rest of the world. As I noted in my last post on Russia, that would have kept you out of the best performing sector since Russia invaded Ukraine. In short, if there is a lesson that this crisis has taught us, it is that treating fossil fuel producers as evil, when they produce much of the energy that we use, is delusional.

- ESG funds/lenders lost substantial amounts in Russia: Investment funds and lenders who have long touted their ESG credentials do not seem to have been less exposed than non-ESG funds, early reports notwithstanding. A Bloomberg Quint study of ESG funds uncovered that they had $8.3 billion invested in Russian equities on February 23, 2022, almost all of which was wiped out during the next few weeks. In fact, the saving grace for ESG funds has been the fact that Russia did not have a large investable market, for both ESG and non-ESG funds.

- Small presence in Russia: In my last post, I noted that the Russian economy represents a sliver (about 2%) of the global economy. If you add the reality that Russia has a closed economy, with well established barriers to outsiders, most of the US companies pulling out of Russia are not giving up much business to begin with. In fact, for companies like Goldman Sachs, whose primary business in Russia came from acting as intermediaries between Russian businesses/investors and investors in the rest of the world, there is a question of whether any business was left to give up, after sanctions were put in place. The companies with the biggest presence in Russia are oil and commodity companies, primarily involved in joint ventures with Russian entities, where the pull out may be designed to preempt what would have been nationalization or expropriation in the future.

- Risk Surge and Economic Viability: In my last post, I noted the surge in Russia's default spread and country risk premium, making it one of the riskiest parts of the world to operate in, for any business. Many companies that invested in Russia, when it was lower-risk destination, have woken up to a new reality, where even if their Russian projects return to profitability, the returns that they can deliver are well below what they need to make to break even, given the risk. Put simply, exiting Russia makes economic sense for most companies, and it may be cloaked in morality, but it is easy to pick the moral path, when economics and morality converge.

- Suspension versus abandonment: It is telling that many companies that have larger interests in Russia, with perhaps the possibility that investing will become economically viable again, have suspended their Russian operations, rather than abandoning them. These companies will undoubtedly come under pressure from activists, who will try to shame them into leaving, but if that is the best that ESG can do, it is pitiful.

2. The Expansionists

As the evidence has mounted that ESG, at least as constructed, failed to provide protection to companies and investors from the Russia fallout, there are a few in the ESG movement who have argued that the fix is to expand the definition and measurement of ESG to incorporate Russia-like risks. That is easier said than done, though, because as with all things ESG, those risks are in the eyes of the beholder. For some, it will mean bringing in the nature of governments into ESG measures, with companies in countries with authoritarian governments getting lower ESG scores than companies in countries with democratic governments. Even if you believe that expansion is defensible, and that considering political risk when valuing companies is prudent, it will mean that every ESG measurement service will have the unenviable task of assessing political freedom (or its absence) in a company's operating geographies, to evaluate its ESG score. Taking a bigger picture perspective, using the benefit of hindsight to keep expanding ESG to include the missed variables in each crisis will lead to measurement bloat, as it grows more tentacles and adds more dimensions. Ultimately, if ESG tries to measure everything, it ends up measuring and meaning nothing.

On a different note, the events of the recent weeks have also pointed to the elasticity of the ESG concept. In the weeks right after the war started, two Citigroup analysts suggested that companies making weapons be classified as good companies, as long as they were selling them to the “right” side of the conflict. While ESG advocates were dismissive, I think that what the Citigroup analysts were proposing is more in line with the true nature of ESG, an amorphous, anything goes concept that shifts shape and form, depending on who is defining it, and when.

3. The Utopians

There is a group within the ESG movement that has been unfazed by any critiques of ESG or evidence that it has not done what it set out to do. To these true believers, the problems with ESG come from it being misappropriated, mis-measured and misused, and in their view, ESG, done right, will always deliver its promised rewards. I call this group the "if only" chorus, since in their view, if only services measured ESG correctly, if only companies did not indulge in greenwashing, and, if only, ESG funds did not pick under performers, ESG would work at making the world a better place. I believe that their wait for this awakening will be long because:

- ESG mis-measurement is endemic, not transient: Even ESG measurement services are willing to admit that the current ESG ratings for companies are flawed, but they all contend that better measurement is around the corner, premised on two assumptions. The first is that ESG disclosures will improve, as regulators force companies to reveal more about their environmental and social performance, and that this data will improve measurement. The second is that as ESG ages, we will develop consensus on what comprises goodness, and when that occurs, there will be a higher correlation across services. I don't believe that either assumption is realistic. Drawing on the experience with corporate governance and stock based compensation, both areas where the volume of disclosure has ballooned over the last two decades, I would argue that disclosure has actually created more distraction than clarity, and I don't see why ESG will be any different. As for converging on what comprises “good”, why in God’s name, in a world where everything is partisan, would you expect consensus to magically form in the investment community? In fact, if a consensus on measurement occurs across services on how to measure ESG, it will be driven more by marketing concerns (since the differences across ratings is getting in the way of selling the concept) than by learning.

- Greenwashing is an ESG feature, not a bug: There is probably no phenomenon on which there is more handwringing among ESG types than "greenwashing", where companies substitute "looking good" for "doing good". Those complaints, though, ignore an unpleasant truth, which is that greenwashing is exactly the outcome of making ESG a system of scores and rankings. I am willing to take a wager with any ESG true believer that the more ESG services and regulators try to crack down on greenwashing, the more ubiquitous and sophisticated it will become. The largest and most profitable companies will have the resources to game the system better, exacerbating biases that already exist in current ESG scores.

- ESG Investing underperformance is steady state, not a passing phase: For the last decade, ESG sales pitches were helped out by the seeming over performance of ESG-based investing, though almost all of the out performance could be attributed to ESG's tech focus and sector concentrations. As the market has shifted, and ESG-based strategies are now under performing, ESG investment fund managers are scrambling, trying to explain to clients why this is just a passing phase, and that good days are just around the corner. That is nonsense! In steady state, once the components of ESG that matter get priced in, ESG-constrained funds will deliver lower returns than funds that don't operate under those constraints. As I noted in one of my earlier posts on ESG, arguing that a constrained optimal can consistently beat an unconstrained optimal is sophistry, and the fact that some of the biggest names in the investment business have made these arguments tells us more about them than it does about ESG.

- ESG is not about actual change, but the perception of change: Over the last decade, ESG advocates have argued that even if following ESG precepts does not increase shareholder value or generate higher returns, it does good for society, by stopping bad practices. Some of ESG's biggest "wins" have been in the fossil fuel space, with Engine Number 1's success in forcing Exxon Mobil to adopt a smaller carbon footprint, being presented as a prime exhibit. Under investment pressure, there is no denying that publicly traded oil companies, primarily in the West, have scaled back their search for oil and gas, and sometimes scaled back and sold reserves. The key word here is "sold", since those reserves have often been bought by private equity investors, who have collectively invested more than a trillion dollars in fossil fuel reserves and development over the last decade. Is it any surprise then that despite all of the ESG wins, the world remains overwhelmingly dependent on fossil fuels? In fact, all that ESG activists have managed to do is move fossil fuel reserves from the hands of publicly traded oil companies in the US and Europe, who would feel pressured to develop those reserves responsibly, into the hands of people who will be far less scrupulous in their development. If this is what winning looks like in the ESG world, I would hate to see what constitutes losing!

The Next Big Thing?

When a concept is as widely sold and bought into as ESG, it is unlikely to be abandoned in a hurry, no matter how much evidence accumulates that it does not work or that it has perverse consequences. In my experience, though, hollow concepts that promise the world and deliver little, eventually hit a tipping point, where even the most loyal adherents abandon them and move on. That moment will come for ESG, and if you are an ESG consultant, advisor or measurer, you will need something to replace its place, the next big thing, that you can sell as the answer to every question in business. Playing the role of a cynic, I will offer you a five step process that you can use to develop this "next big thing", which for generality, I will call “it”.

- Give "it" a name: Give your next big thing a name, and pick one that sounds good, and if you want to add an aura of mystery, make it an acronym, with three letters seeming to do the trick, in most cases.

- Give "it" meaning and purpose: As you write the description of the word or acronym, make that description as fuzzy as possible, preferably throwing in the word "long term" and "good for the world" into it, for good measure. (See step 5 for why this works in your favor.)

- Use history to reverse engineer it’s components: Before you add specifics to your description, examine business and investing history, focusing on the most successful, and looking for characteristics that they share in common in terms. To round “it” out, you should also find failures and see what common features bind them together. Then incorporate these characteristics into your description, with the shared features of successful companies as your must-haves, and those of the failures are things to avoid.

- Use self-interest to sell "it": To get the business establishment behind you, draw on its powerful drivers, self interest, greed and self delusion. If you have done your job well in step 3, you will have no trouble gaining institutional support, since you have already primed the pump. Case writers and consultants should have no trouble finding supporting cases studies and anecdotal evidence, academic researchers will unearth statistical evidence that your concept works and investment fund managers will unearth its capacity to create "alpha" in past returns.

- Delay and deflect: If you get pushback from critics or those with evidence that is contradictory, attribute failures to growing pains and argue that what is needed is a doubling down of fidelity to the concept. Since you have provided no clear or even discernible targets, you can always move the goalposts or claim to have accomplished what you set out to, and thus not be held accountable. Finally, use the “goodness” shield, since that makes any questioning of your big idea seem small minded and mercenary.

Conclusion

When I first wrote about ESG two years ago, I did so because I was skeptical of the unquestioning belief that people had in its success. I initially believed that it was a flawed concept that needed fixing , but after two years of interactions with people who claim to know the concept really well, but don't seem to be capable of making solid cases for it, and witnessing its takeover by well heeled entities with agendas, I am convinced that there will soon be room for only two types of people in the ESG space. The first will be the useful idiots, well meaning individuals who believe that they are advancing the cause of goodness, as they toil in the trenches of ESG measurement services, ESG arms of consulting firms and ESG investment funds. The second will be the feckless knaves, who know fully well the void behind the concept, but see an opportunity to make money. I know that those are not edifying choices, but I don't see any good ones, other than leaving the space completely. Good luck!

YouTube Video

Blog Posts on ESG