Setting the Table

As with any valuation, the first step in valuing Airbnb is trying to understand its history and its business model, including how it has navigated the economic consequences of the COVID. In this section, I will start with a brief history of the company, move on to reviewing its financials leading into 2020, and then look at how it has performed in 2020. I will end the section by looking at information disclosed in the recent prospectus filing that provides insights into the company’s journey to its initial public offering.

Timeline of Airbnb

Airbnb's roots go back to 2007, when during an industrial design conference in San Francisco, Brian Chesky and Joe Gebbia realized that there were opportunities for homeowners to rent their homes to visitors, and created a company called AirBed & Breakfast. Joined in 2008, by Nathan Blecharczyk, a Harvard graduate and technical architect, AirbedandBreakfast.com was born and later renamed Airbnb. In subsequent years, the company grew, with multiple rounds of funding from venture capital. Along the way, investors in the company rapidly escalated their pricing of the company from $1 billion in 2011 to $10 billion in 2014 to more than $30 billion in 2016. The time line below captures some (but not all) of the highlights in Airbnb’s history:

- Legal Challenges: The company has faced multiple challenges from cities that feel that its business model violates local zoning laws and regulations, and evades taxes. While you can attribute some of this pushback to hotel company lobbying and the inertia of the status quo, there is no doubt that Airbnb, like Uber, pushes regulatory and legal limits, taking action first and asking for permission later. While Airbnb has found a way to co-exist with laws in different cities, the restrictions they face vary widely across the world, with some locations (like New York) imposing much more stringent rules than others.

- Acquisitions: As the number of hosts and guests on Airbnb have climbed over the years, the company has invested in building a more robust platform for its rentals. While some of that money has been spent on internal improvements, much of it has been spent acquiring more than two dozen companies, most of them small, technology businesses.

Business Model

Airbnb's primary business model connects hosts who own houses and apartments with guests who want to rent them for short term stays, while providing a secure and easy-to-use platform for search, reservations, communications and payments. That said, though, it is worth peeking under the hood to see how this business model plays out as revenues and earnings. In the picture below, I look at the Airbnb business model, both in its original form (which still holds for hosts renting their own houses or apartments) and professional hosts (who own multiple units or even operate small hotels), a model it introduced recently and is still transitioning into:

In both versions of the model, Airbnb's revenues come from fees collected on rentals, with both the host and the guest paying in the individual host version, but only the host paying in the professional host version. In 2016, Airbnb extended the model, allowing hosts to offer experiences to their guests, for a fee, with Airbnb keeping 20% of the payment. While the concept was heavily promoted, it has been slow to take off, with only $10 million in sales in 2017, but Airbnb has not given up, hiring Catherine Powell, a Disney theme park executive in 2020, to revamp the business.

The Financials, leading into 2020

The proof of a business is in the numbers, and Airbnb, in addition to posting impressive numbers on hosts, listings and guest nights, has also seen financial results from that growth. In the graph below, I look at gross bookings (the total amount spent by guests on their rentals), revenues to Airbnb from these booking (in dollar values and as a percent of gross bookings) and operating profitability, in dollar and percentage terms:

|

| Source: Airbnb Prospectus (November 16, 2020) |

Taking a closer look at the numbers, here are some preliminary features that stand out:

- Growth is high, but the rate is declining: It may seem churlish too take issue with a company that has grown its revenues more than five fold over a five-year period, but as the company's base gets bigger, its growth rate, not surprisingly, is also declining. By the start of 2020, Airbnb had already become one of the largest players in its market of vacation and travel rentals, a sign of success, but also a crimp on future growth.

- Airbnb's revenue share has stayed stable: As gross bookings have increased, Airbnb's share of these bookings has remained stable, ranging from 12-13% of overall revenues. Note that the shift to the new business model for professional hosts (where Airbnb keeps 14% of the transaction revenue) is relatively recent, and it will take some time for that change to play out in the numbers. In addition, growth in the experiences business will also push this metric upwards, since Airbnb keeps a 20% share of those revenues.

- The company is edging towards profitability: To Airbnb's credit, it is closer to profitability than many of its high profile sharing-economy predecessors (such as Uber and Lyft) and the fact that it was able to report positive operating profits, albeit fleetingly in 2018, without playing the adjusted earnings game (where companies add back stock based compensation and other items to their bottom line to claim fictional profitability) puts them ahead of the pack.

The COVID effect

I don’t think anyone expected 2020 to be the year that it was, and even in hindsight, it has been full of unwelcome surprises for individuals and businesses. While there were news stories about the virus for the first few weeks of 2020, they centered either on China or passengers on cruise ships that had been exposed to the virus. Once the virus made its presence felt elsewhere, in February and March, countries responded with partial and full economic shut downs that hurt all businesses. The travel business was particularly exposed, as people curtailed flying and traveling to distant destinations, and Airbnb was hurt badly in 2020, as can be seen in the graphs below:

|

| Source: Airbnb Prospectus |

The graph to the left looks at the effect of COVID on gross bookings and cancellations (in millions of nights), with the net bookings representing the difference. Note that cancellations exceeded bookings in March and April, at the height of the global shutdown, but have come back surprisingly well in the months after. In the graph to the right, you can see the effects on the financials, in a comparison of first nine months of 2019 to the first nine months of 2020, with gross bookings dropping 39% and operating losses almost tripling over the period.

The Prospectus Revelations

If Airbnb had broached the idea of a public offering in March and April, where the numbers were not just dire but potential catastrophic, it is likely that they would have been laughed out of the market. There are two factors that may have led Airbnb to reassess their prospects and file for a public offering now.

- It’s relative: The first is that it was not just Airbnb that felt the pain from the economic shut down. As we will see in the next section, the hotel and travel booking businesses were damaged even more than Airbnb, because of their large asset bases and debt levels. In relative terms, Airbnb might emerge stronger from the COVID crisis, than it was, going into it.

- Rebound:The second is that business returned stronger than most had anticipated in 2020, with third quarter numbers coming in above expectations, and markets rebounded even more strongly with stocks recouping all of their early losses. When Airbnb filed its prospectus with the SEC on November 16, I don't think that there were many who were surprised at the timing.

- Pathway to Profitability: Digging through Airbnb's financials over the last five years, and breaking down the expenses, here is what we see:

Source: Airbnb Prospectus (Nov 16) Note that, at least through the most recent years, there is little evidence of economies of scale, since the direct operating costs have stayed at between 40-42% of revenues and the other costs have, for the most part, been rising. In 2019, the company also reported a substantial restructuring charge that presumably was one-time and extraordinary, but that item bears watching, since it has become a convenient vehicle for companies to hide ongoing operating expenses. - Use of Proceeds: While the details are still being worked out, it is rumored that Airbnb is looking to raise about $3 billion in proceeds on the offering date, and that while some of the proceeds will be used to retire existing debt, most of it will be held by the company to cover future investment needs.

- Share classes: In keeping with the practices of tech companies that have gone public in recent years, Airbnb has shares with different voting rights: class A shares with one voting right per share, class B shares with 20 voting rights per share, and class C & class H shares with no voting rights per share. Not surprisingly, the class B shares will be held by founders and other insiders, allowing them control of the company, even if they own well below 50% of all shares outstanding. It is the class A shares that will be available to shareholders who buy on the offering day, and will remain the most liquid of the share classes thereafter. It is not clear why there are class C shares, other than to give founders, who already have control, even more control in future years, if they feel threatened.

- An ESG twist: It should come as no surprise that in an age where companies are valued on their "goodness", Airbnb is signaling it's intent to be socially responsible, with Brian Chesky making explicit the corporate values for the company, including "having an infinite time horizon" and "serving all of our customers". In addition, the proceeds from the non-voting class H shares will be set aside is an endowment to serve Airbnb hosts, though it is not clear whether the primary intent is to give hosts a stake in the company’s success, or to help them out during periods of need. I remain skeptical about ESG, but will hold off on passing judgment on whether this is just a public relations ploy.

The Hospitality Business

To value Airbnb, we need to start with an assessment of the market that it is targeting and then understand the competition that the company faces. In this section, I will start with a look at the market size and then examine the hotel and booking companies that comprise its competition.

The Market (TAM)

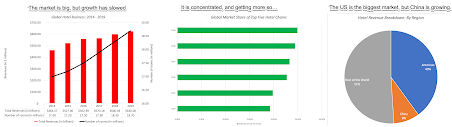

There are two ways in which I can describe Airbnb's total addressable market. One is to look the hotel business globally, which generated in excess of $600 billion in revenues in 2019, with the following characteristics:

We have a substantial market opportunity in the growing travel market and experience economy. We estimate our serviceable addressable market (“SAM”) today to be $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences. We estimate our total addressable market (“TAM”) to be $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences.

In my view, Airbnb's targetable market falls somewhere in the middle, clearly higher than just the hotel business of $600 billion, but below Airbnb's upper end estimate of $2 trillion for this business. That is because there are parts of the world, where the Airbnb model will be less successful than it has been in the United States, either because of consumer behavior or regulatory restrictions. Given how much trouble Airbnb has had in the experiences business, I think Airbnb’s estimate of $1.4 trillion for that business is more fictional than even aspirational.

The Players

To make a judgment on Airbnb's future, we need to understand two peer groups. The first is the hotel business, since it is the business that is most at risk of being disrupted by the Airbnb model. The other is the online travel booking business, where there are large players like Expedia and Booking.com which have, at least for segments of their business, made their money by acting, like Airbnb, as intermediaries or brokers connecting guests with hospitality offerers.

1. The Hotel Business

The hotel business is both large and diverse, composed of hotels that range the spectrum from luxury to budget. To get a measure of the business, I have listed the 25 largest publicly traded hotel companies (in market capitalization) in the world below, with Marriott topping the list, with revenues of about $21 billion in 2019:

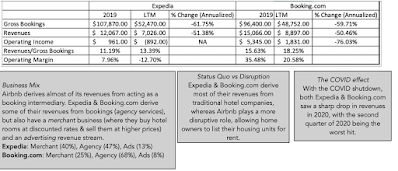

2. The Travel Booking Business

While the hotel business is the one being disrupted the most by Airbnb, it is the travel booking business that is closest to the Airbnb business model. That business is also dominated by large players, with Expedia and Booking.com being the biggest. In the table below, I look at the revenues and operating income at these companies in 2019 and the last 12 months:

While Expedia and Booking.com both generate revenues from operating as middlemen between travelers and hospitality providers, just like Airbnb does, there are two key differences:

- Other businesses: Both Expedia and Booking.com also operate in other businesses that drive revenues and margins. First, they generate revenues by buying blocks of hotel rooms at a discount from hotels, and then reselling them at a higher price, in what they call the "merchant" business. Second, they also derive revenues from online advertising by hotels and travel providers. Expedia gets a much larger share (47%) of its revenues from the merchant business than Booking.com (25%), which may explain its lower margins.

- Status Quo vs Disruption: Both Expedia and Booking.com were designed to make money off the status quo in the hospitality business, and derived all of their revenues until recently from existing hotels and airlines. In reaction to Airbnb's success, both companies have tried to expand into the home and apartment rental businesses, but these listings still represent a small fraction of overall revenues.

The Valuation

To value Airbnb, I will follow a familiar script, at least for me. I will start by telling my Airbnb story, based upon the market it is in and its competition, current and potential, and then use this story as a launching pad for my valuation of the company. I will complete the valuation by looking at its sensitivity to key value drivers and bring in uncertainty into the equation.

Story and Numbers

I believe that Airbnb will continue to grow, while finding a pathway to profitability. Airbnb's growth in gross bookings will come not only from disrupting and taking market share from the hotel business, bad news for conventional hotel companies and travel providers who serves them, but also from continued expansion of non-conventional hospitality providers (home and apartment owners). As it grows, Airbnb's share of those gross bookings is likely to plateau at close to current levels, but its operating margins will continue to improve towards travel booking industry levels, as product development, marketing and G&A costs decrease, not in dollar terms, but as a percent of revenues. While Airbnb is enthusiastic about the experiences business, it is likely to remain a tangential business, contributing only marginally to revenues and profitability. Since Airbnb has a light debt load and is closer to profitability than most of the sharing-economy companies that have gone public in recent years, I will assume that their risk will approach that of the travel business, and that the risk of failure is low. In terms of inputs, this story translates into the following:

- The COVID After-effects: The comeback from COVID will be slow in 2021, with Airbnb seeing revenues return, albeit to less than 2019 levels, while continuing to lose money (with operating margins of -10%).

- Growth in Gross Bookings: In 2019, Airbnb’s gross bookings grew 29.25%, lower than the growth rate in prior years, reflecting its increasing scale. After its recovery from COVID in 2021, gross bookings will continue to grow at a compounded annual growth rate of 25% between 2022 and 2025, and growth will drop down over the following years. In 2031, I expect Airbnb’s gross bookings to climb above $150 billion, about 60% higher than Booking.com’s gross bookings in 2019 and 40% higher than Expedia's gross bookings in that year.

- Revenues as percent of Bookings: Over the next decade, revenues as a percent of gross bookings will increase only mildly from current levels (12%-13) to 14%, sustained by the new host model for professional hosts and the supplemental benefits from Experiences business.

- Target Operating Margin: This will be a key component of Airbnb’s story, and I will assume that the operating margins will improve over the next decade to 25%, lower than Booking.com’s 2019 operating margin of 35.48%, but higher than the margins for Expedia or the hotel business.

- Sales to Invested Capital: While Airbnb has a capital-light model, it’s platform requires new investments in either product development and acquisitions. In 2020, Airbnb's sales to invested capital was 1.82, but the invested capital was negative in the prior year, making it unreliable, and Booking.com had a sales to invested capital of 1.91 in 2019. I assume that Airbnb will be able to generate $2.00 of revenues per dollar of invested capital in the next decade.

- Cost of Capital & Failure Risk: For the cost of capital, I will assume that Airbnb’s cost of capital will be 6.50%, close to the cost of capital of hotel companies, to start the valuation, but over time, it will rise to 7.23%, reflecting an expected increase in the treasury bond rate from current levels to 2% in 2031. While Airbnb has flirted with profitability and has little debt, it still remains a young, money losing company, and I will assume a 10% chance of failure.

- Share Count: Getting the share count for a company on the verge of going public is always tricky, as preferred shares get converted to common shares, options and warrants are outstanding and additional shares are issued on the offering date. For Airbnb, there is the added complication of a 2 for 1 stock split which occurred only a few weeks prior to the offering. For the moment, therefore, the share count is still a number that is in progress, but the next update on the prospectus should provide more clarity. (Right after I posted this, Airbnb updated their prospectus to reflect a more accurate share count. The value per share should now be closer to the right value)

|

| Download spreadsheet |

Value Drivers and Dealing with Uncertainty

|

| Download spreadsheet |

Previewing the IPO

While we can debate what Airbnb’s value truly is, an IPO is a pricing game. Put simply, rather than operate under the delusion that it is value that drive decisions, it is healthier to recognize that bankers price IPOs, not value them, for the offering, that much of the trading on the offering day and the weeks thereafter is driven by traders, trying to gauge mood and momentum. In this section, I will look at the contours of this pricing game for Airbnb, and implications for investors who may be more concerned about value.To price an IPO, traders look at two places for guidance. The first is the VC pricing of the company in the rounds leading into the public offering. The second is the market pricing of publicly traded companies in the peer groups, companies that investors will compare the company to, in setting prices.

1. Venture Capital Pricing: As mentioned earlier, Airbnb has raised more than two dozen rounds of venture capital over its lifetime, and has been reprised multiple times. In the graph below, I look at the trend lines in Airbnb’s pricing, based upon VC assessments:

The pricing attached to Airbnb climbed dramatically in the first few years, reaching $31 billion in 2016, but then settled into a period of stagnation. In April 2020, at the height of the COVID crisis, the company raised more capital from VC investors, who reduced its pricing to $26 billion.

2. Peer Group Pricing: To price Airbnb, relative to publicly traded companies, I have computed pricing multiples for hotel and booking companies in the table below:Applying any of these multiples to Airbnb’s current operating metrics (revenues, EBITDA or net income) will yield valuations that are too low, because the company is still growing and finessing its business model. To get a more realistic pricing, I apply the multiples to Airbnb’s expected values for these metrics in 2025, and then discounting the future values back to today.

Investment Judgments

In the coming weeks, Airbnb will update its prospectus to reflect more details on its IPO, and bankers will set an offering price per share, based primarily on the feedback that they get from potential investors to different I may be jumping the gun here, but given how well the market has treated capital-light and technology companies this year, I would not be surprised if the market attaches a pricing of all above my estimated value for Airbnb's equity. As a market participant, you have three ways of participating in the Airbnb sweepstakes:

- Get in on the offering: Given the propensity of bankers to under price offerings, and given how the market has been behaving in the last few months, you can try to get a share of the shares at the offering price. This game gets easier to play if you are on the preferred client list at Morgan Stanley or Goldman Sachs, and are allowed access to the offering, but much more difficult, if you are not. Even if you do get in on the offering, there is no guaranteed payoff, because bankers do sometimes over price IPOs, as they did a few times in 2019.

- Play the trading game: In the trading game, value is a minor factor, at best, in whether you succeed. Your success will depend upon gauging the market mood and momentum on Airbnb and getting ahead of it and paying attention to what I call incremental information, small news stories that may have little or even no effect on value but can be consequential for momentum.

- Be an investor: If you are truly a value investor, you should not be ruling out Airbnb just because it is money-losing or a young company facing multiple uncertainties. Instead, you should value Airbnb yourself, and draw up decision rules well ahead of the offering. Since I have my estimated value for Airbnb at $36 billion, I will go first, using the valuation results, by decile, that come from my simulation:

- If equity is priced at <$28 billion (20% percentile): A bargain

- If equity is priced between $28 & $33 (40th percentile) billion: A solid buy

- If equity is priced between $33 (40th percentile) & $38 billion (60thpercentile): A fair value

- If equity is priced between $38 (60th percentile) & $44 billion (80thpercentile): Too richly priced

- If equity is priced > $44 billion: Over valued

As I have argued in prior posts, it is not my preference to sell short on stocks like Airbnb, even if I believe the they are significantly over priced, given how much more powerful momentum is than any fundamentals in driving stock prices.

YouTube Video

Raw Data

Spreadsheets