Dividend Policy in Corporate Finance

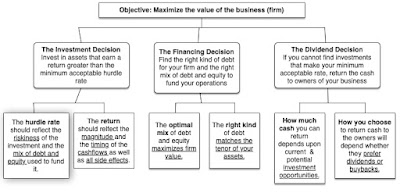

To understand where dividend policy fits in the larger context of running a business, consider the following big picture description of corporate finance, where every decision that a business makes is put into one of three buckets - investing, financing and dividends, with each one having an overriding principle governing decision-making within its contours.

Measuring Potential Dividends

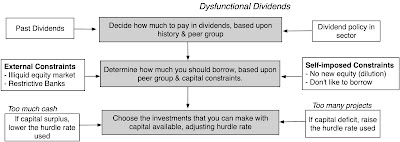

In the discussion of dysfunctional dividends, I argued that some companies pay out far more dividends than they should, but that statement suggests that you can measure how much the "right" dividends should be. In this section, I will argue that such a measure not only exists, but is easily calculated for any business, from its statement of cash flows.

Free Cash Flows to Equity (Potential Dividends)

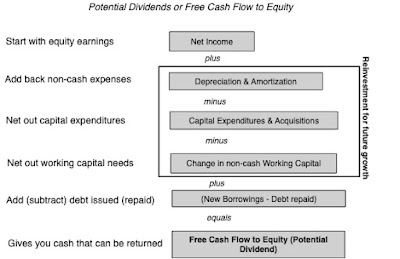

The most intuitive way to think about potential dividends is to think of it as the cash flow left over after every conceivable business need has been met (taxes, reinvestments, debt payments etc.). In effect, it is the cash left in the till for the owner. Defined thus, you can compute this potential dividend from ingredients that are listed on the statement of cash flows for any firm:

Note that you start with net income (since you are focused on equity investors), add back non-cash expenses (most notably depreciation and amortization, but including other non-cash charges as well) and net out capital expenditures (including acquisitions) and the change in non-cash working capital (with increases in working capital decreasing cash flows, and decreases increasing them). The last adjustment is for debt payments, since repaying debt is a cash outflow, but raising fresh debt is a cash inflow, and the net effect can either augment potential dividends (for a firm that is increasing its debt) or reduce it (for a firm that is paying down debt).

Delving into the details, you can see that a company can have negative free cash flows to equity, either because it is a money losing company (where you start the calculation with a net loss) or is reinvesting large amounts (with capital expenditures running well ahead of depreciation or large increases in working capital). That company is obviously in no position to be paying dividends, and if it does not have cash balances from prior periods to cover its FCFE deficit, will have to raise fresh equity (by issuing shares to the market).

FCFE across the Life Cycle

I know that you are probably tired of my use of the corporate life cycle to contextualize corporate financial policy, but to understand why dividend policies vary across companies, there is no better device to draw on.

Dividends and Buybacks: Fact and Fiction

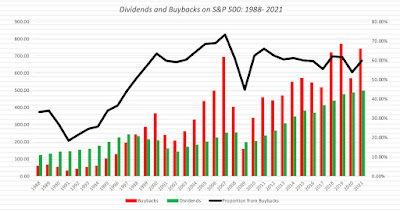

Until the early 1980s, there was only one conduit for publicly traded companies to return cash to owner, and that was paying dividends. In the early 1980s, US firms, in particular, started using a second option for returning cash, by buying back stock, and as we will see in this section, it has become (and will stay) the predominant vehicle for cash return not only for US companies, but increasingly for firms around the world.

The Facts

Four decades into the buyback surge, there are enough facts that we can extract by looking at the data that are worth highlighting. First, it is undeniable that US companies have moved dramatically away from dividends to buybacks, as their primary mode of cash return, and that companies in the rest of the world are starting to follow suit. Second, that shift is being driven by the recognition on the part of firms that earnings, even at the most mature firms, have become more volatile, and that initiating and paying dividends can trap firms into . Third, while much has been made of the tax benefits to shareholders from buybacks, as opposed to dividends, that tax differential has narrowed and perhaps even disappeared over time.

1. Buybacks are supplanting dividends as a mode of cash return

I taught my first corporate finance class in 1984, and at the time, almost all of the cash returned by companies to shareholders took the form of dividends, and buybacks were uncommon. In the graph below, you can see how cash return behavior has changed over the last four decades, and the trend lines are undeniable;

Note that while the US is the leader of the pack, with 64% of cash returned in buybacks, the UK, Canada, Japan and Europe are also seeing a third or more of cash returned in buybacks, as opposed to dividends. Among the emerging market regions, Latin America has the highest percent of cash returned in buybacks, at 26.90%, and India and China are still nascent markets for buybacks. The shift to buybacks that started in the United States clearly has now become a global phenomenon and any explanation for its growth has to be therefore global as well.

2. Buybacks are more flexible than dividends

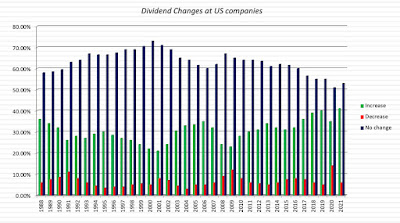

If you buy into the notion of a free cash flow to equity as a potential cash return, companies face a choice between paying dividends and buying back stock, and at first sight, the impact on the company of doing either is exactly the same. The same amount of cash is paid out in either case, the effects on equity are identical (in both book value and market value terms) and the operations of the company remain unchanged. The key to understanding why companies may choose one over the other is to start with the recognition that in much of the world, dividends are sticky, i.e., once initiated and set, it is difficult for companies to suspend or cut dividends without a backlash, as can be seen in this graph that looks at the percent of US companies that increase, decrease and do nothing to dividends each year:

3. There are tax benefits (to shareholders) from buybacks, but they have decreased over time

From the perspective of shareholders, dividends and buybacks create different tax consequences, and those can affect which option they prefer. A dividend gives rise to taxable income in the period that it is paid, and taxpayer have little or no way of delaying or evading paying taxes. A buyback gives investors a choice, with those opting to sell back their shares receiving a realized capital gain, which will be taxed at the capital gains tax rate, or not selling them back, giving rise to an unrealized capital gain, which will be taxed in a future period, when the stock is sold. For much of the last century, dividends were taxed in the US as ordinary income, at rates much higher than that paid on capital gains.

Until last year, there were no differences in tax consequences to companies from paying dividends or buying back stock, but the Inflation Reduction Act of 2022 introduced a 1% tax rate on buybacks, thus creating at least a marginal additional cost to companies that bough back stock, instead of paying dividends. If the only objective of this buyback tax is raising revenues, I don't have a problem with that because it will help close the budget gap, but to the extent that this is designed to change corporate behavior by inducing companies to not buy back stock or to invest more back into businesses, it is both wrong headed and will be ineffective, as I will argue in the next section.

The Fiction

The fictions about buybacks are widespread and are driven as much by ideological blinders as they are by a failure to understand what a business is, and how to operate it. The first is that buybacks can increase or decrease the value of a business, with buyback advocates making the former argument and buyback critics the latter. They are both wrong, since buybacks can only redistribute value, not create it. The second is that surge in buybacks has been fed by debt financing, and it is part of a larger and darker picture of over levered companies catering to greedy, short term shareholders. The third is that buybacks are bad for an economy, with the logic that the cash that is being used for the buybacks is not being invested back in the business, and that the latter is better for economic growth. The final argument is that the large buybacks at US companies represent cash that is being taken away from other stakeholders, including employees and customers, and is thus unfair.

1. Buybacks increase (decrease) value

Value in a business comes from its capacity to invest money and generate cash flows into the future, and defined as such, the act of returning cash by itself, either as dividends or buybacks cannot create or destroy value. It is true that the way in which dividends and buybacks are funded or the consequences that they have for investing can have value effects, but those value effects do not come from the cash return, but from investing and financing dysfunction. The picture below captures the pathways by which the way dividends and buybacks are funded can affect value:

- Leverage effect: If a company that is already at its right mix of debt (see my last post) choose to add to that debt to fund its dividend payments or buybacks, it is hurting its value by increasing its cost of capital and exposure to default risk. However, a firm that is under levered, i.e., has too little debt, may be able to increase its value by borrowing money to fund its cash return, with the increase coming from the skew in the tax code towards debt.

- Investment effect: If a company has a surplus of value-adding projects that it can take, and it chooses not to take those projects so as to be able to pay dividends or buy back stock, it is hurting it value. By the same token, a company that is in a bad business and is struggling to make its cost of capital will gain in value by taking the cash it would have invested in projects and returning that cash to shareholders.

As I noted in my lead in to this section, a company that borrows money that it cannot afford to borrow to buy back stock is not just damaging its value but putting its corporate existence at risk. I have heard a few critics of buybacks contend that buybacks are being funded primarily or predominantly with debt, using anecdotal examples of companies that have followed this script, to back up their claim. But is this true across companies? To address this, I looked companies in the US (because this critique seems to be directed primarily at them), broken down by whether they did buybacks in 2022, and then examined debt loads within each group:

You can be the judge, using both the debt to capital ratio and the debt to EBITDA multiple, that companies that buy back stock have lower debt loads than companies that don't buy back stock, at odds with the "debts fund buybacks" story. Are there firms that are using debt to buy back stock and putting their survival at risk? Of course, just as there are companies that choose other dysfunctional corporate finance choices. In the cross section, though, there is little evidence that you can point to that buybacks have precipitated a borrowing binge at US companies.

3. Buybacks are bad for the economy

The final argument against buybacks has little to do with shareholder value or debt but is centered around a mathematical truth. Companies that return cash to shareholders, whether as dividends or buybacks, are not reinvesting the cash, and to buyback critics, that fact alone is sufficient to argue against buybacks. There are two premises on which this argument is built and they are both false.

- The first is that a company investing back into its own business is always better for the economy than that company not investing, and that misses the fact that investing in bad businesses, just for the sake of investing is not good for either shareholders or the economy. Is there anyone who would argue with a straight face that we would be all better off if Bed Bath and Beyond had built more stores in the last decade than they already have? Alternatively, would we not all have been better served if GE had liquidated itself as a company a decade ago, when they could have found eager buyers and returned the cash to their shareholders, instead of continuing as a walking dead company?

- The second is that the money returned in buybacks, which exceeded a trillion dollars last year, somehow disappeared into a black hole, when the truth is that much of that money got reinvested back into the market in companies that were in better businesses and needed capital to grow? Put simply, the money got invested either way, but by companies other than GE and Bed Bath and Beyond, and that counts as a win for me.

4. Buybacks are unfair to other stakeholders

If the argument against buybacks is that the money spent on buybacks could have been spent paying higher wages to employees or improving product quality, that is true. That argument is really one about how the pie is being split among the different shareholders, and whether companies are generating profits that excessive, relative to the capital invested. I argued in my fifth data post that if there is backing for a proposition, it is that companies are not earning enough on capital invested, not that they are earning too much. I will wager that if you did break down pay per hour or employee benefits, they will be much better at companies that are buying back stock than at companies that don't. Unfortunately, I do not have access to that data at the company-level on either statistic, but I am willing to consider evidence to the contrary.

The Bottom Line

It is telling that some of the most vehement criticism of buybacks come from people who least understand business or markets, and that the legislative solutions that they craft reflect this ignorance. Taxing buybacks because you are unable to raise corporate tax rates may be an effective revenue generator for the moment, but pushing that rate up higher will only cause the cash return to take different forms. Just as the attempts to curb top management compensation in the early 1990s gave rise to management options and a decade of even higher compensation, attempts to tax buybacks may backfire. If the end game in taxing buybacks is to change corporate behavior, trying to induce invest more in their businesses, it will be for the most part futile, and if it does work, will do more harm than good.

YouTube Video

Data Links

- Dividend Statistics, by Industry: US and Global

- Dividends, Buybacks and FCFE, by Industry: US and Global

Data Update Posts for 2023

- Data Update 1 for 2023: Setting the Table!

- Data Update 2 for 2023: A Rocky year for Equities!

- Data Update 3 for 2023: Inflation and Interest Rates

- Data Update 4 for 2023: Country Risk - Measures and Implications

- Data Update 5 for 2023: The Earnings Test

- Data Update 6 for 2023: A Wake up call for the Indebted?

- Data Update 7 for 2023: Dividends, Buybacks and Cash Flows

No comments:

Post a Comment