An Easy Target?

In a post last year, I talked about a bot in my name, that was in development phase at NYU, and while officially sanctioned, it did open up existential challenges for me. In discussing that bot, I noted that this bot had accessed everything that I had ever written, talked about or valued in my lifetime, and that I had facilitated its path by making that access easy. I will explain my rationale for the open access, and provide you with the links if you want to get to them, hoping to pre-empt those who will try to charge you for that content.

My Open Access Policy

I have said this before, but there is no harm in saying it again, but I am a teacher, first and foremost, and almost every choice I make in my profession life reflects that mindset. A teacher, like an actor or singer, craves an audience, and the larger and more enthusiastic that audience, the better. When I started teaching in 1986, my audience was restricted to those in my physical classroom at NYU's business school, and my initial attempts at expanding that audience were very limited. I had video recorders set up to record my lectures, made three copies of each lecture tape, and put them on the shelves at NYU's library for patrons to check out and watch. The internet, for all of its sins, changed the game for me, allowing me to share not only class materials (slides, exams) but also my lecture videos, in online formats. Though my early attempts to make these conversions were primitive, the technology for recording classes and putting them online has made a quantum leap. In spring 2025, every one of my NYU classes was recorded by cameras that are built into classroom, the conversions to online videos happened in minutes, right after the class is done, and YouTube has been a game changer, in allowing access to anyone with an internet connection anywhere in the world.

As the internet has expanded its reach, and social media platforms have joined the mix, I have also shared the other components that go into my classes more widely, starting with the data on industry averages that I need and use in my own valuations, the spreadsheets that contain these valuations and blog posts on markets and companies and any other tools that I use in my own analyses. While I am happy to receive compliments for the sharing and praise for being unselfish, the truth is that my sharing is driven less by altruism (I am no Mother Theresa!) and more by two other forces. The first is that, as I noted in my post on country equity risk premiums last week, there much of what I know or write about is pedestrian, and holding it in secret seems silly. The second is that, while I am not easily outraged, I am driven to outrage by business consultants and experts who state the obvious (replacing words you know with buzzwords and acronyms), while making outrageous claims of what they can deliver and charging their customers absurd amounts for their advice and appraisals. If I can save even a few of these customers from making these payments, I consider it to be a win.

My Sharing Spots

Everything that I have ever written, worked on or taught is somewhere online, almost always with no protective shields (no passwords or subscriptions), and there are four places where you can find them:

- Webpage: The oldest platform for my content remains my webpage, damodaran.com, and while it can be creaky, and difficult to navigate, it contains the links to my writing, teaching, data, spreadsheets and other tools.

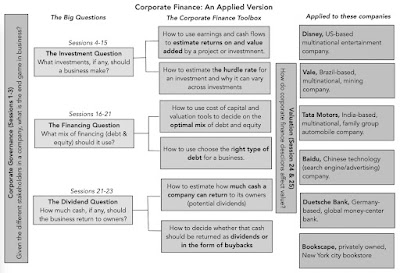

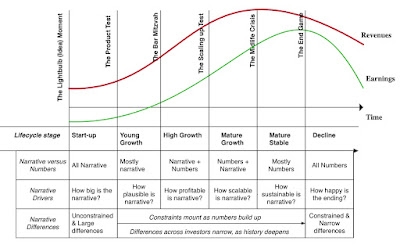

- Teaching: I teach two classes at Stern, corporate finance and valuation, and have four other classes - a lead-into-valuation accounting class, a made-for-finance statistics class, a class on investment philosophies and one on corporate life cycles, and I described these classes in a post on teaching at the start of 2025. You can find them all by going to the teaching link on my webpage, https://people.stern.nyu.edu/adamodar/New_Home_Page/teaching.html including my regular classes (class material, lecture notes, exams and quizzes and webcasts of the classes) in real time, as well as archived versions from previous semesters. In addition, the online classes are at the same link, with material, post- class tests and webcasts of sessions for each class. This is also the place where you can find links to seminars that I teach in the rest of the world, with slides and materials that I used for those classes (though I have been tardy about updating these).

- Data: At the start of every year for the last three decades, I have shared my analysis of data on publicly traded companies, breaking down the data into corporate finance and valuation categories. This link, https://people.stern.nyu.edu/adamodar/New_Home_Page/data.html, will take you to the entry page, and you can then either access the most recent data (from the start of 2025, since I update only once a year, for most datasets) or archived data (from previous years). My raw data comes from a variety of sources, and in the interests of not stepping on the toes of my data providers, my data usually reflects industry averages, rather than company-specific data, but it does include regional breakdowns: US, Europe, Emerging Markets (with India and China broken out individually, Australia & Canada & New Zealand) and Japan.

- Spreadsheets: I am not an Excel ninja, and while my spreadsheet-building skills are adequate, my capacity to make them look polished is limited. I do share the spreadsheets that I use in my classes and work here, with my most-used (by me) spreadsheet being one that I use to value most companies at this link, with a webcast explaining its usage.

- Books: I have written eleven books and co-edited one, spread out across corporate finance, valuation and investing, and you can find them all listed here. Many of these books are in their third or fourth editions, but with each one, you should find a webpage that contains supplementary material for that book or edition (slides, answers to questions at the end of each chapter, data, spreadsheets backing the examples). This is the only section of the spreadsheet where you may encounter a gatekeeper, asking you for a password, and only if you seek access to instructor material. If you are wondering what is behind the gate, it is only the powerpoint slides, with my notes on each slide, but the pdf versions of these slides should be somewhere on the same page, without need for a password.

- Papers: I don't much care much for academic research, but I do like to write about topics that interest or confound me, and you can find these papers at this link. My two most widely downloaded papers are updates I do each year on the equity risk premium (in March) and country risk premiums (in July). Much of the material in these papers has made its way into one or more of my books, and thus, if you find the books unaffordable, you can get that material here for free.

- Blog posts: I will confess that when I write my first blog post on September 17, 2008, I had no idea what a blog was, what I was doing with it, and whether it would last through the following week. In the years since, this blog has become my first go-to, when I have doubts or questions about something, and I am trying to resolve those doubts for myself. In short, my blog has becoming my therapy spot, in times of uncertainty, and I have had no qualms about admitting to these doubts. During 2020, as COVID made us question almost everything we know about markets and the economy, for instance, I posted on where I was in the uncertainty spectrum every week from February 14, 2020 (when the virus became a global problem, not one restricted to China and cruise ships) to November 2020, when the vaccine appeared. You can get all of those posts in one paper, if you click on this link. While my original blog was on Google, in the last two years, I have replicated these posts on Substack (you need to be a subscriber, but it is free) and on LinkedIn. If you are on the latter, you are welcome to follow me, but I have hit my connections limit (I did not even know there was one, until I hit it) and am unable to add connections.

- YouTube: For the last decade, I have posted my class videos on YouTube, grouping them into playlists for each class. You can start with the link to my YouTube channel here, but if you are interested in taking a class, my suggestion is that you click on the playlists and pick on the one that corresponds to the class. Here, for instance, are my links to my Spring 2025 MBA valuation class and my Spring 2025 Corporate Finance class. Starting about a decade, I have also accompanied every one of my blog posts with a YouTube video, that contains the same material, and you can find those posts in its own (very long) playlist.

- X (Twitter): Some of you have strong feelings about X, with some of those feelings reflecting your political leanings and others driven by the sometimes toxic posting on the platform. I have been a user of the platform since April 2009, and I have used it as a bulletin board, to alert people to content being posted elsewhere. In fact, outside of these "alert" posts, I almost never post on X, and steer away as far away as I can from debates and discussions on the platform, since a version of Gresham's law seems to kick in, where the worst and least informed posters hijack the debate and take it in directions that you do not want it to go.

- Low tech: I am decidedly low tech, and it shows in my sharing. My website looks like it was designed two decades ago, because it was, and contains none of the bells and whistles that make for a modern website. My blog remains on Google blogger, notwithstanding everything I have been told about how using WordPress would make it more attractive/adaptable, and my posts are neither short nor punchy. Every week, I get people reaching out to me to tell me that my YouTube videos are far too long and verbose, and that I would get more people watching with shorter videos and catchier descriptions, and much as I appreciate their offers to help, I have not taken them up on it., In addition, I shoot almost every one of my videos in my office, sometimes with my dog in the background, and often with ambient noise and mistakes embedded, making them definitely unpolished. On twitter, I have only recently taken to stringing tweets together and I have never used the long text version that some professional twitter users have mastered. In my defense, I could always claim that I am too old to learn new tricks, but the truth is that I did not start any of my sharing as a means to acquiring a larger social media following, and it may very well be true that keeping my presence low-tech operates as a screener, repelling mismatched users.

- Process over product: In my writing and teaching, I am often taken to task for not getting to the bottom line (Is the stock cheap or expensive? Should I buy or sell?) quickly, and spending so much time on the why and how, as opposed to the what. Much as my verbosity may frustrate you, it reflects what I think my job is as a teacher, which is to be transparent about process, i.e., explain how I reasoned my way to getting an answer than giving you my answer.

- Pragmatism over Purity: Though I am often criticized for being an “academic”, I am a terrible one, and if there were an academic fraternity, I would be shunned. I view much of an academic research as navel gazing, and almost everything I write and teach is for practitioners. Consequently, I am quick to adapt and modify models to make them fit both reality and the available data, and make assumptions that would make a purist blanch.

- No stock picks or investment advice: In all my years of writing about and valuing markets and individual stocks, I have tried my best to steer away from making stock picks or offering investment advice. That may sound odd, since so much of what I do relates to valuation, and the essence of valuation is that you act on your estimates of value, but here is how I explain the contradiction. I value stocks (like Meta or Nvidia or Amazon or Mercado Libre) and I act (buy or sell) those stocks, based on my valuations, but it is neither my place nor my role to try to get other people to do the same. That said, I will share my story and valuation spreadsheet with you, and if you want to adapt that story/spreadsheet to make it your own, I am at peace with that choice, even if it is different from mine. The essence of good investing is taking ownership of your investment actions, and it is antithetical to that view of the world for me or anyone else to be telling you what to buy or sell.

- No commercial entanglements: If you do explore my content on any of the platforms it is available on, you will notice that they are free, both in terms of what you pay and how you access them. In fact, none of them are monetized, and if you do see ads on my YouTube videos, it is Google that is collecting the revenue, not me. One reason for this practice is that I am lazy, and monetizing any of these platforms requires jumping through hoops and catering to advertisers that I neither have the time nor the inclination to do. The other is that I believe (though this may be more hope than truth) that one of the reasons that people read what I write or listen to me is because, much as they may disagree with me, I am perceived as (relatively) unbiased. I fear that formalizing a link with any commercial entity (bank, consultant, investor), whether as advisor, consultant or as director, opens the door to the perception of bias. The one exception to the "no commercial entranglements' clause is for my teaching engagements, with the NYU Certificate program and for the handful of valuation seminars I teach in person in the rest of the world. I am grateful that NYU has allowed me to share my class recordings with the world, and I will not begrudge them whatever they make on my certificate classes, though I do offer the same content for free online, on my webpage. I am also indebted to the people and organizations that manage the logistics of my seminars in the rest of the world, and if I can make their life easier by posting about these seminars, I will do so.

The Imitation Game

Given that my end game in sharing is to give access to people who want to use my material, I have generally taken a lax view of others borrowing my slides, data, spreadsheets or even webcasts, for their own purposes.

- For the most part, I categorize this borrowing as good neighbor sharing, where just as I would lend a neighbor a key cooking ingredient to save them the trouble of a trip to the grocery store, I am at peace with someone using my material to help in their teaching, save time on a valuation or a corporate finance project, prepare for an interview, or even burnish their credentials. An acknowledgement, when this happens, is much appreciated, but I don't take it personally when none is forthcoming.

- There are less benign copycat versions of the imitation game - selectively using data from my site to back up arguments, misreading or misinterpreting what I have said and reproducing large portions of my writing without acknowledgement. To be honest, if made aware of these transgressions, I have gently nudged the culprits, but I don't have a legal hammer to follow up.

- The most malignant variations of this game are scams, where the scammers use my content or name to separate people from their money - the education companies that used my YouTube videos and charge for classes, the data sites that copy my data or spreadsheets and sell them to people, and the valuation/investment sites that try to get people to invest money, with my name as a draw. Until now, I have tried, as best as I can, to let people know that they are being victimized, but for the most part, these scams have been so badly designed that they have tended to collapse under the weight of their own contradictions.

- What they get right: The Instagram post, which is in shown below, uses language that clearly is drawn from my posts and an image that is clearly mine.Not only does this post reflect the way I write, but it also picked Nvidia and Palantir as the two firms to highlight, the first a company that I own and have valued on my blog, and the second a company that I have been talking about as one that I am interested in owning, at the right price, giving it a patina of authenticity. The video looks and sounds like me, which should be no surprise since it had thousands of hours of YouTube videos to use as raw data. Using a yiddish word that I picked up in my days in New York, I have the give the scammers credit for chutzpah, on this front,, but I will take a notch off the grade, for the video's slickness, since my videos have much more of a homemade feel to them.

- What they struggled with most: The scam does mention that Palantir is "overhyped", a word that I use rarely, and while it talks about the company’s valuation, it is cagey about what that value is and there is little of substance to back up the claim. Palantir is a fascinating company, but to value it, you need a story of a data/software firm, with two channels for value creation, one of which looks at the government as a customer (a lower-margin, stickier and lower growth business) and the other at its commercial market (higher margin, more volatile and higher growth). Each of the stories has shades of grey, with the potential for overlap and conflict, but this is not a company where you can extrapolate the past, slap numbers on revenue growth and profitability, and arrive at a value. This post not only does not provide any tangible backing for its words in terms of value, but it does not even try. If these scammers had truly wanted to pull this off, they could have made their AI bot take my class, construct a plausible Palantir story, put it into my valuation spreadsheet and provide it as a link.

- What they get wrong: To get a sense of what this post gets wrong, you should revisit the earlier part of the post where I talk about my sharing philosophy, and with as much distance as I can muster, here are the false notes in this scam. First, this scam pushes people to join an investment club, where I will presumably guide them on what to buy or sell. Given that my view of clubs is very much that of Groucho Marx, which is that I would not be belong to any club which would admit me as a member, the notion of telling people which stocks to buy cuts against every grain of my being. Second, there is a part of this scam where I purportedly promise investors who decide to partake that they will generate returns of 60% or higher, and as someone who has chronicled that not only do most active investors not keep up with the market, and argued that anyone who promises to deliver substantially more than the market in the long term is either a liar or fraud, this is clearly not me.

An AI Protective Shield

I did think long about writing this post, wondering whether it would make a difference. After all, if you are a frequent reader of this blog or have read this post all the way down to this point, it is unlikely that you were fooled by the Instagram post or video. It remains an uncomfortable truth that the people most exposed to these scams are the ones who have read little or none of what I have written, and I wish there were a way that I could pass on the following suggestions on how they can protect themselves against the other fakes and scams that will undoubtedly be directed at them.

- "Looks & sounds like" not good enough: Having seen the flood of fake AI videos in the news and on social media, I hope that you have concluded that “looks and sounds Iike” is no longer good enough to meet the authenticity test. This remains AI’s strongest suit, especially in the hands of the garden variety scammer, and you should prepare yourself for more fake videos, with political figures, investing luminaries and experts targeted.

- Steer away from arrogance & hype: I have always been skeptical of the notion that there is “smart” money, composed of investors who know more than the rest of us and are able to beat the market consistently, and for long periods. For the most part, when you see a group of investors (hedge funds, private equity) beating the market, luck is more of a contributor as skill, and success is fleeting. In a talk on the topic, I argued that investors should steer away from arrogance and bombast, and towards humility, when it comes to who they trust with their money, and that applies in spades in the world of AI scams. Since most scammers don’t understand the subtlety of this idea, screening investment sales pitches for outlandish claims alone will eliminate most scams.

- Do your homework: If you decide to invest with someone, based upon a virtual meet or sales pitch, you should do your homework and that goes well beyond asking for their track records in terms of performance. In my class on investment philosophies, I talk about how great investors through the ages have had very different views of markets and ways of making money, but each one has had an investment philosophy that is unique, consistent and well thought through. It is malpractice to invest with anyone, no matter what their reputation for earning high returns, without understanding that person’s investment philosophy, and this understanding will also give you a template for spotting fakes using that person’s name.

- Avoid ROMO & FOMO: In my investing classes, I talk about the damage that ROMO (regret over missing out) and FOMO (fear of missing out) can do to investor psyches and portfolio.

- With ROMO (regret over missing out), where you look back in time and regret not buying Facebook at its IPO price in 2012 or selling your bitcoin in November 2013, when it hit $1000, you expose yourself to two emotions. The first is jealousy, especially at those who did buy Facebook at its IPO or have held on to their bitcoin to see its price hit six digits. The second is that you start buying into conspiracy theories, where you convince yourself that these winners (at least in the rear view mirror) were able to win, because the game was fixed in their favor. Both make you susceptible to chasing after past winners, and easy prey for vendors of conspiracies.

- With FOMO (fear of missing out), your overwhelming concern is that you will miss the next big multi-bagger, an investment that will increase five or ten fold over the next year or two. The emotion that is triggered is greed, leading you to overreach in your investing, cycling through your investments, as most of them fall short of your unrealistic expectations, and searching for the next “big thing”, making you susceptible to anyone offering a pathway to get there.