The proverbial bottom line for success in business is the capacity to deliver profits, at least in the long term. Even though we live in an age where user platforms and hyper revenue growth can drive company valuations, that adage remains true. In fact, questions about profitability seem to have taken center place again, not only because a market pull back is a reminder that growth, by itself, cannot deliver value, but also because there are still unresolved debates about how much damage the COVID crisis did to earnings power at companies, and whether this damage has been healed, as economies have opened up. In this post, I will look at corporate profitability, in all its different dimensions, and how companies across the globe, and across industries, measured up in the most recent years.

Measuring Profitability

The question of whether a company is making or losing money should be a simple one to answer, especially in an age where accounting statements are governed by a myriad of rules, and a legion of number-crunchers follow these rules to report profits generated by a firm. In practice, though, measuring profitability is anything but straightforward, as accountants have devised multiple measures of profitability, reserving discretion on how to compute each one, and many different ways of scaling these profits, for comparisons.

Accounting Profit Measures

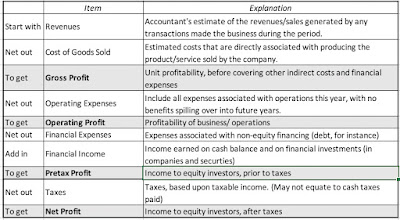

To understand the different measures of accounting profit, let us look at how each measure of profit is computed in an income statement. In the table below, I describe four different measures of earnings in an income statement, from gross profit, the most aggregated profit measure, to net profit, the earnings left for equity investors after taxes:

For non-financial service firms, the gross profit is a measure of what companies earn on the products/services that they sell, net of what it costs them to produce those products/services. Netting out other operating expenses, that are not directly tied to producing the goods and services (such as selling and G&A expenses), from gross profits, yields operating income. Income from financial holdings (including cash balances, investments in financial securities and minority holdings in other businesses) are added back, and interest expenses on debt are subtracted out to get to taxable income. After paying taxes on this income, the residual amount represents net income, the final measure of equity earnings, and the basis for computing earnings per share and other widely used measures of profitability used by equity investors.

Looking across all publicly traded companies, listed globally, and aggregating revenues on all four measures of earnings (gross, operating, taxable, net), by sector, and aggregating the numbers yields the following:

Note that for financial service firms, where debt is raw material (rather than a source of capital) and line between financial and operating assets is difficult to draw, the only measures of income that are relevant are taxable and net income. That said, about 31% of the net profits of all publicly traded firms listed globally in 2021 were generated by financial service firms; that percent is lower in the US and higher in emerging markets. The last few years have been eventful for all companies, with the COVID crisis and ensuing economic shut down causing pain for companies, with recovery coming in 2021, as the global economy opened up again. In the table below, I report the aggregated net income, by sector, from 2017 to 2021 (with the 2021 numbers representing last twelve month numbers, through September 2021):

It is clear that there was substantial damage done to earnings in 2020, across sectors, with energy, consumer discretionary and industrials showing the most negative effects; across all companies, aggregated earnings declined by 15.03% in 2020. In 2021, companies recovered entirely from the damage done in 2021, at least in the aggregate, with earnings in 2021 higher than 2019 earnings, by almost 33%. Real estate and utilities are the two sectors that have not come back fully from the COVID effect, but materials, technology and communication services are now reporting significantly higher earnings that before the shut down.

Profit Margins

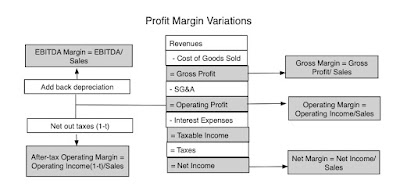

Comparing absolute profits across companies and across time can be difficult, since larger firms will generate more profits than smaller ones, all else held equal. To make comparisons, profits are scaled to common metrics, with revenues and book value of investment being the most common scalar. When profits are scaled to revenues, you get margins, and as with absolute earnings, margins come in various forms, as can be seen below:

In addition to margins based upon income measures (gross, operating, after-tax operating and net), there are other margin variations, with EBITDA and after-tax operating margins coming into play. To get a sense of variation in margins across companies globally, we looked at the distribution of gross, operating and net margins in 2021:

|

| Earnings from LTM 2021, divided by revenues generated during that period |

- First, note that while less than 6% of the 47,606 firms in the sample have negative gross margins, the number is significantly higher for operating margins (43.1%) and net margins (47.3%).

- Second, while it is no surprise that gross margins are significantly higher than operating and net margins, the magnitude of the difference is striking; the median gross margin across all global companies in 2021 is 30.07%, but it melts down to a median operating margin of 5.67% and a median net margins of less than 4%. These margins vary widely across companies, and in the table below, we report on the statistics across sectors:

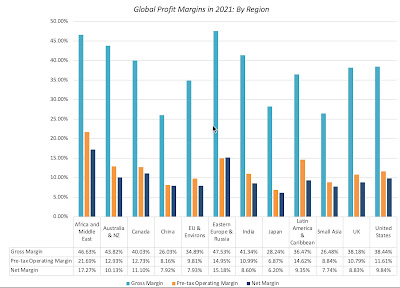

These sectors obviously are broad and each covers a range of industries. If you are interested in industry-level margins, you can find them at this link. In the graph below, I look at differences in margins across geographical regions:

Eastern Europe (including Russia) and Africa contain some risky markets, but firms in those regions have the highest profit margins in the world. One reason is that domestic players in these markets face less foreign competition that companies in the rest of the world. The lowest profit margins in the world are in Asia, with gross margins less than 30% in China, Japan and South East Asia, but India remains an outlier, delivering higher margins. As companies from around the globe look to Asia for growth, the ensuing competition is pushing margins down there, relative to the rest of the world.

Returns on Invested Capital (or Equity)

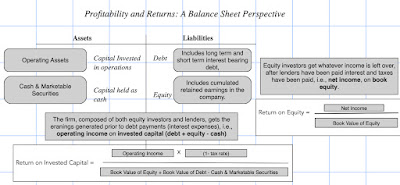

Scaling profits to capital invested in a company provides a different pathway to measuring profitability, with more consequential effects on value. This scaling can either be done from the perspective of just the equity investors in the company, with a return on equity, or from the perspective of all capital providers (debt and equity), with a return on invested capital:

These measures are dependent on accounting estimates of not only earnings, but investment in the firm, in the form of book values of equity and invested capital, and that is their biggest weakness. To the extent that accountants mis-categorize expenses like leases and R&D, returns can be skewed, as can restructuring and one-time charges. With those caveats in place, and with my adjustments to earnings for R&D and lease capitalization, I computed the returns on equity and invested capital for all publicly traded firms at the start of 2022, using earnings in the last twelve months in the numerator and invested capital at the start of those twelve months in the denominator:

As with margins, almost a third of all firms have negative or missing accounting returns and the median return on equity, in US dollar terms, across all global firms is 4.48%, and the median return on invested capital, in US dollar terms, across firms is 6.91%. In my last post, I noted the decline in costs of capital for firms over time, noting that the median cost of capital at the start of 2022 is only 6.33%, across global firms, and argued that companies that demand double-digit hurdle rates risk being shut out of investments. That point is amplified by the accounting returns computations, since it looks like the actual returns earned by firms on their investments don't meet their own expectations.

Implications

It is true that profitability measures, standing alone, give you only a snapshot of a company, in time, but used in context, they are conduits for almost every qualitative factor in investing, and put in a framework, a way of thinking of the value of growth and competitive landscapes.

Business Buzz Words

Buzzwords and catchy phrases has long been part of business, with consultants and experts offering them as recipes for corporate turnarounds, and companies using them to justify everything from acquisitions to significant business course changes. While their allure is understandable, their casual usage can lead to money ill-spent and catastrophic mistakes, and I have long argued that the best way to bring discipline to decision making is to convert these buzzwords into numbers that drive value. Put simply, every action, no matter how consequential it is framed as being, can affect value in one of three ways: by changing the growth trajectory for revenues, by altering the profitability of the business model or by modifying the risk in the business. Just to illustrate, I have a looked at some of widely used buzzwords with a link to profitability:

| Buzzword | Profitability Effect | Reasoning |

|---|---|---|

| Powerful Brand Name | Higher operating profit margins, relative to peer group | Brand name allows you to charge higher price for the same products. |

| Economies of scale | Operating margin improves as revenues increase | Costs grow at a slower rate than revenues |

| Superior unit economics | High gross margins | Extra unit costs little to produce, relative to price. |

| Strong competitive advantages | High return on capital, relative to peer group | Barriers to entry earn and sustain high returns |

| Canny borrower | High return on equity, relative to return on capital | Benefits from difference between return on capital and after-tax cost of debt. |

| Tax player | After-tax operating income is close to pre-tax operating income | Lower effective tax rate, across all income. |

Note that I have steered away from the fuzzier phrases, such a "great management", which could mean everything or nothing, or "ESG", where goodness is not only in the eye of the beholder, but finding a link to anything that drives value resembles a wild goose chase.

A Life Cycle View

If you have been reading my posts for a while, you know that I find the corporate life cycle a useful device in explaining everything from what companies should focus on, in corporate finance, to the balance between stories and numbers, when investor value companies. Profit margins and returns also follow the life cycle, albeit with wide differences across firms:

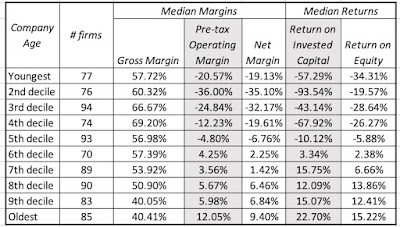

As you can see, young companies tend to be money-losers, and margins improve as companies make it through to maturity, before dropping as companies decline. Accounting returns follow a similar path, though they tend to peak a little later in the cycle, before declining in the last stages of the life cycle again. I am aware that there are many who disagree with my life cycle view of companies, but one way of testing whether it is a reasonable approximation of the real world is to look at the data. In the table below, I report on profit margins and accounting returns for firms, broken down by corporate age (measured from the founding year to 2021), across global companies at the start of 2022:

|

| Corporate Age = Years since founding |

It is just one table, but the patterns of margins/returns matches a life cycle view, low for young companies, rising as companies mature, before declining as companies age.

The largest sector, in the US, in terms of market capitalization, is information technology and I have argued that tech companies age in "dog years", with compressed life cycles. The tech sector in the United States is composed of some companies like Apple, Microsoft, HP and Intel, which are ancient by tech company standards, and other companies like Uber, Palantir and Zoom, young and money-losing, that have gone public just in the last few years. In the table below, I break down US tech companies into age cohorts, based upon corporate age (measured from founding year), and looking at profitability measures across these cohorts, in the table below:

|

| All companies in S&P technology sector |

The Value of Growth

As investor tastes have shifted from earnings power to growth, there has been a tendency to put growth on a pedestal, and view it as an unalloyed good, but it is not. In fact, growth requires trade offs, where a company invests more back into itself in the near term, denying payouts (dividends or buybacks) to its investors, during that period, for higher earnings in the future. Not surprisingly, then, the net effect of growth will depend on how much is reinvested back, relative to what the company can harvest as future growth. While a full assessment of this value will require making explicit assumptions about growth and reinvestment, there is a short hand that is useful in making this assessment, and that is a comparison of the returns that a company makes on its investments to the cost of funding those investments. If you use accounting returns as a proxy for project returns, and the costs of equity and capital as measures of the costs of funding, you can compute excess returns to equity investors, by comparing return on equity to the cost of equity, and excess returns to all capital providers, by netting cost of capital from return on invested capital:

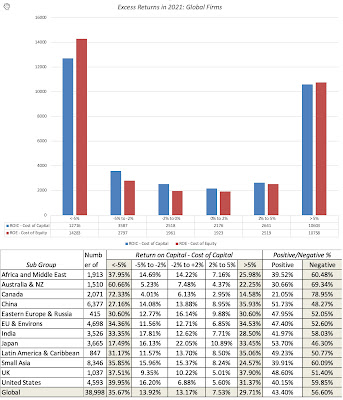

Using the accounting returns and costs of equity/capital that I computed for all publicly traded firms at the start of 2022, I looked at the distribution of excess return measures across companies in the graph below:

Close to 57% of firms globally earn returns lower than their funding costs, and while this may be temporary for some, it has become a permanent feature for many businesses. If you believe that the poor returns that you see in this table are a residue of COVID and economic short downs, I would suggest that you look at data that I have, on excess returns, going back almost a decade, and you will see similar results in the pre-COVID years. I will use this data to draw three broad conclusions:

- Low Hurdle Rate ≠ Positive Excess Returns: The notion that lower interest rates, and the resulting lower hurdle rates that companies face, has been a boon for business is clearly not supported by the facts. If anything, as rates have decreased over the last decade, and costs of capital for companies hit historic lows, companies are finding it more difficult to earn returns that exceed their costs of capital.

- Good and Bad Businesses: It is an undeniable truth that some businesses are easier to generate value in, than others, and that a bad business is one where most of the companies operating in it, no matter how well managed, have trouble earning their costs of capital. Using the excess returns estimated from 2021, I estimated the excess returns (ROIC - Cost of capital) in 94 industry groups, and the ten "best" and "worst" industries, in terms of median excess return, are listed below:

If you look at the worst businesses, there are a couple that show up every year, like airlines and hotel/gaming, where COVID exacerbated problems that are long term and structural. The airline and hotel businesses are broken, and have been for a long time, and there is no easy fix in sight. Biotechnology companies can claim, with some justification, that their presence on the bad business list reflects the fact that many in the sector are young companies that are a breakthrough away from being blockbuster winners and that they will resemble the pharmaceutical business (which does earn positive excess returns), in maturity. I am sure that there will be ESG advocates who will claim credit for fossil fuel and mining businesses that show up in the worst business list, but not only will their rankings change quickly if oil and commodity prices rises, but the best business of all, in 2021, in terms of delivering excess returns, is the tobacco business, not a paragon of virtue. While the technology boom has created winners in information and computer services, building-related businesses (from materials to furnishings to retail) and chemical companies also seem to have found ways to deliver returns that exceed their costs.Excess Returns, by Industry (US, Global) - Disruption's Dark Side: Among the bad businesses, note the presence of entertainment, a historically good business that has seen its business model disrupted, by new entrants into the business. Netflix, in particular, has upended how entertainment gets made, distributed and consumed, and in the process, drained value from established players. While this is a phenomenon that has played out in business after business, over the last two decades, there are a couple of common themes that have emerged in the excess return data. Disruption, almost invariably, leads to lower returns for the status quo, i.e., the disrupted companies in the business, but disruptors often don't end up as beneficiaries. Consider the car business, where ride sharing has destroyed cab and traditional car service businesses, but Uber, Lyft, Didi, Grab and Ola all continue to lose money. Put bluntly, disruption is easy, but making money on disruption is difficult, and disruption creates lots of losers, but does not necessarily replace them with winners.

If I were to sum up my findings, it would be to conclude that generating value from running a business has become more difficult, not less, in the last two decades and that while there are companies that seem to have found pathways to sustainable, high earnings, most companies are involved in trench warfare, fighting disruptors and facing significantly more macro economic risk in their operations.

YouTube Video

Datasets

- Profit Margins, by Industry (US, Global, Emerging Markets, Europe, Japan, Australia & NZ)

- Return on Capital, by Industry (US, Global, Emerging Markets, Europe, Japan, Australia & NZ)

- Excess Returns, by Industry (US, Global, Emerging Markets, Europe, Japan, Australia & NZ)

No comments:

Post a Comment