In my first two data posts for 2025, I looked at the strong year that US equities had in 2024, but a very good year for the overall market does not always translate into equivalent returns across segments of the market. In this post, I will remain focused on US equities, but I will break them into groupings, looking for differences. I first classify US stocks by sector, to see return variations across different industry groupings. I follow up by looking at companies broken down by market capitalization, with an eye on whether the much-vaunted small cap premium has made a comeback. In the process, I also look how much the market owes its winnings to its biggest companies, with the Mag Seven coming under the microscope. In the next section, I look at stock returns for companies in different price to book deciles, in a simplistic assessment of the value premium. With both the size and value premiums, I will extend my assessment over time to see how (and why) these premiums have changed, with lessons for analysts and investors. In the final section, I look at companies categorized by price momentum coming into 2024, to track whether winning stocks in 2023 were more likely to be winners or losers in 2024.

US Stocks, by Sector (and Industry)

It is true that you very seldom see a market advance that is balanced across sectors and industries. This market (US stocks in 2024) spread its winnings across sectors disproportionately, with four sectors - technology, communication services, consumer discretionary and financials - delivering returns in excess of 20% in 2024, and three sectors - health care, materials and real estate delivering returns close to zero:

|

| Sector Returns - Historical (with $ changes in millions) |

I break the sectors down into 93 industries, to get a finer layer of detail, and there again there are vast differences between winning and losing industry groups, based upon stock price performance in 2024:

|

| $ changes in millions |

US Stocks, by Market Cap

For much of the last century, the conventional wisdom has been that small companies, with size measured by market cap, deliver higher returns than larger companies, on a risk-adjusted basis, with the debate being about whether that was because the risk measures were flawed or because small cap stocks were superior investments. That "small cap premium" has found its way into valuation practitioners playbooks, manifesting as an augmentation (of between 3-5%) on the cost of equity of small companies. To get a sense of how market capitalization was related to returns, I classified all publicly traded US companies, by market cap, and looked at their returns in 2024.

|

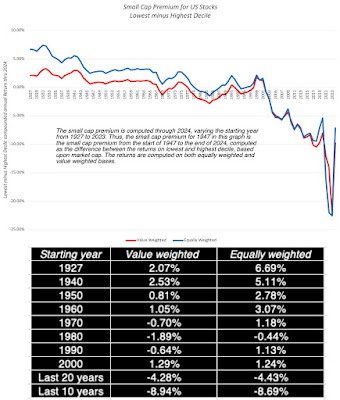

| My small cap premium spreadsheet, based on Ken French data |

In this graph, you can see the basis for the small cap premium, but only if go back all the way to 1927, and even with that extended time period, it is far stronger with equally weighted than with value weighted returns; the 1927-2024 small cap premium is 2.07% with value-weighted returns and 6.69% in equally weighted terms. It should be noted that even its heyday, the small cap premium had some disconcerting features including the facts that almost of it was earned in one month (January) of each year, and that it was sensitive to starting and end points for annual data, with smaller premium in mid-year starting points. To see how dependent this premium is on the front end of the time period, I estimated the small cap premium with different starting years in the graph (and the table), and as you can see the small cap premium drops to zero with any time period that starts in 1970 and beyond. In fact, the small cap premium has become a large cap premium for much of this century, with small cap returns lagging large cap returns by about 4-4.5% in the last 20 years.

The market skew towards large cap companies can be seen even more dramatically, if you break stocks down by percentile, based upon market cap, and look at how much of the increase in market cap in US equities is accounted for by different percentile groupings:

|

| US Stocks: Market Cap Change Breakdown |

Looking across 6000 publicly traded stocks in 2024, the top percentile (about 60 stocks) accounted for 74% of the increase in market cap, and the top ten percent of all stocks delivered 94% of the change in total market capitalization.

Zeroing in even further and looking at the biggest companies in the top percentile, the Mag Seven, the concentration of winners at the very top is clear:

|

| $ changes in millions |

- Momentum story: Momentum has always been a strong force in markets, in both directions, with price increases in stocks (decreases) followed by more price increases (decreases). In effect, winning stocks continue to win, drawing in new funds and investors, but when these same stocks start losing, the same process plays out in reverse. A reasonable argument can be made that increasing access to information and easing trading, for both individual and institutional investing, with a boost from social media, has increased momentum, and thus the stock prices of large cap stocks. The dark side of this story, though, is that if the momentum ever shifted, these large cap stocks could lose trillions in value.

- Passive investing: Over the last two decades, passive investing (in the form of index funds and ETFs) has taken market share from active investors, accounting for close to 50% of all invested funds in 2024. That shift has been driven by active investing underperformance and a surge in passive investing vehicles that are accessible to all investors. Since many passive investing vehicles hold all of the stocks in the index in proportion to their market cap, there presence and growth creates fund flows into large cap stocks and keeps their prices elevated. Here again, the dark side is that if fund flows reverse and became negative, i.e., investors start pulling money out of markets, large cap stocks will be disproportionately hurt.

- Industry economics: In writing about the disruption unleashed by tech start-ups, especially in the last two decades, I have noted the these disruptors have changed industry economics in many established businesses, replacing splintered, dispersed competition with consolidation. Thus, Meta and Alphabet now have dominant market shares of the advertising business, just as Uber, Lyft and Grab have consolidated the car service business. As industries consolidate, we are likely to see them dominated by a few, big winners, which will play out in the stock market as well. It is possible that antitrust laws and regulatory authorities will try to put constraints on these biggest winners, but as I noted in my post on the topic, it will not be easy.

The Value Premium?

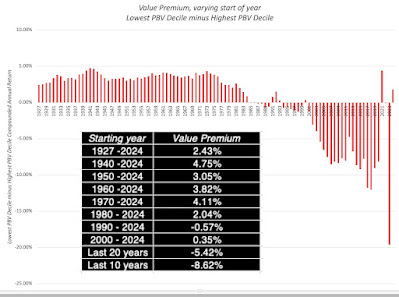

Just as the small cap premium acquired standing as conventional wisdom in the twentieth century, the data and research also indicated that stocks that trade at low price to book ratios earned higher returns that stocks that trade at high price to book ratios, in what was labeled as the value premium. As with the size premium, low price to book (value) stocks have struggled to deliver in the twenty first century, and as with the small size premium, investors have waited for it to return. To see how stocks in different price to book classes performed in 2024, I looked at returns in 2024, for all US stocks, broken down into price to book deciles:

|

| Deciles created based on price to book ratios at start of 2024 |

|

| My value premium spreadsheet, based on Ken French data |

- Price to book ≠ Value: It is true that using low price to book as an indicator of value is simplistic, and that there are multiple other factors (good management, earnings quality, moats) to consider before making a value judgment. It is also true that as the market's center of gravity has shifted towards companies with intangible assets, the troubles that accountants have had in putting a number on intangible asset investments has made book value less and less meaningful at companies, making it a poorer and poorer indicator of what a company's assets are worth.

- Momentum: In markets, the returns to value investing has generally moved inversely with the strength of momentum. Thus, the same forces that have strengthened the power of momentum, that we noted in the context of the fading of the small cap premium, have diluted the power of value investing.

- Structural Shifts: At the heart of the premium earned by low price to book ratios is mean reversion, with much of the high returns earned by these stocks coming from moving towards the average (price to book) over time. While that worked in the twentieth century, when the US was the most mean-reverting and predictable market/economy of all time, it has lost its power as disruption and globalization have weakened mean reversion.

Since the fading of the small cap and value premiums can be traced at least partially to the strengthening of momentum, as a market force, I looked at the interplay between momentum and stock returns, by breaking companies into deciles, based upon stock price performance in the previous year (2023), and looking at returns in 2024:

|

| Deciles formed on percentage returns in 2023 |

As you can see, barring the bottom decile, which includes the biggest losers of 2023, where there was a strong bounce back (albeit less in dollar terms, than in percent), there was a strong momentum effect in 2024, with the biggest winners from last year (2023) continuing to win in 2024. In short, momentum continued its dominance in 2024, good news for traders who make money in its tailwinds, with the caveat that momentum is a fickle force, and that 2025 may be the year where it reverses.

Implications

The US equity market in 2024 followed a pathway that has become familiar to investor in the last decade, with large companies, many with a tech focus, carried the market, and traditional strategies that delivered higher returns, such as investing in small cap or low price to book stocks, faltered. This is not a passing phase, and reflects the market coming to terms with a changed economic order and investor behavior. There are lessons from the year for almost everyone in the process, from investors to traders to corporate executive and regulators:

- For investors: I have said some harsh things about active investing, as practiced today, since much of it is based upon history and mean reversion. A mutual fund manager who screens stocks for low PE ratios and high growth, while demanding a hefty management fee, deserves to be replaced by an ETF or index fund, and that displacement will continue, pruning the active management population. For active investors who hold on to the hope that quant strategies or AI will let them rediscover their mojo, I am afraid that disappointment is awaiting them.

- For traders: Traders live and die on momentum, and as market momentum continues to get stronger, making money will look easy, until momentum shifts. Coming off a year like 2024, where chasing momentum would have delivered market-beating returns, the market may be setting up traders for a takedown. It may be time for traders to revisit and refine their skills at detecting market momentum shifts.

- For companies: Companies that measure their success through stock market returns may find that the market price has become a noisier judge of their actions. Thus, a company that takes a value destructive path that feeds into momentum may find the market rewarding it with a higher price, but it is playing a dangerous game that could turn against it.

- For regulators: With momentum comes volatility and corrections, as momentum shifts, and those corrections will cause many to lose money, and for some, perhaps even their life savings. Regulators will feel the pressure to step in and protect these investors from their own mistakes, but in my view, it will be futile. In the markets that we inhabit, literally any investment can be an instrument for speculation. After all, Gamestop and AMC were fairly stolid stocks until they attracted the meme crowd, and Microstrategy, once a technology firm, has become almost entirely a Bitcoin play.

I recently watched Timothy Chalamet play Bob Dylan in the movie, A Complete Unknown, and I was reminded of one of my favorite Dylan tunes, "The times they are a-changin". I started my investing in the 1980s, in a very different market and time, and while I have not changed my investing principles, I have had to modify and adapt them to reflect a changed market environment. You may not agree with my view that both the small cap and value premiums are in our past, but it behooves you to question their existence.

YouTube Video

- Data Update 1 for 2025: The Draw (and Danger) of Data!

- Data Update 2 for 2025: The Party continued for US Equities

- Data Update 3 for 2025: The times they are a'changin'!

- Data Update 4 for 2025: Interest Rates, Inflation and Central Banks!

- Data Update 5 for 2025: It's a small world, after all!

- Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

- Data Update 7 for 2025: The End Game in Business!

- Data Update 8 for 2025: Debt, Taxes and Default - An Unholy Trifecta!

- Data Update 9 for 2025: Dividend Policy - Inertia and Me-tooism Rule!

Datasets

No comments:

Post a Comment