It is a sign of how volatile the last few weeks have been, that a week like the last one, where index levels move only 2-3% a day, high by historic standards, felt stable. As in prior weeks, I will start this one by looking at how the market action last week played out across asset classes, and within equity, across regions and industries first, but the bulk of this post will be an update on the price of risk, and how it has changed in both bond and stock markets over the last six weeks. In the process, I will compare this six-week periods to the 2008 crisis, which was also global, and shook the faith people had in markets, institutions and companies.

The Markets last week

The market action last week was more muted than it had been in prior weeks, but that is a relative statement, as we still saw big swings in almost every asset class. Using the same sequencing that I have used for the last few weeks, I will start with a review of equity indices globally:

|

| Download raw data |

It was a quiet week for most markets, with the Nikkei and the Sensex being the exceptions, dropping 8,09% and 7.46% respectively. Over the last month, every market has seen double digit negative returns, with Shanghai being the only exception. Moving on to US treasuries, we saw more calm than in prior weeks, with rates staying close to where they were in the previous week:

|

| Download raw data |

The (relative) calm in equity and treasury markets also played out in the corporate bond market, with spreads decreasing slightly for higher rated bonds and increasing marginally for lower rated bonds.

|

| Download raw data |

The commodity markets continued on their wild ride, with oil again diverging significantly from copper:

|

| Download raw data |

Oil prices surged dramatically towards the end of the week, mostly on rumors that Saudi Arabia and Russia would come to an agreement on oil production, but copper prices stayed stable. Completing the analysis, I looked at gold and bitcoin last week:

Both gold and bitcoin saw little price action during the week, not a bad development in a crisis market. In summary, looking at returns across asset classes last week, and comparing those returns to prior weeks, it is clear that last week saw a reduction in the volatility that has characterized previous weeks. It is unclear, though, whether the week is just the calm before another storm, or a true break in the crisis. The next few weeks will tell!

Breaking down the weekly movements

As in prior weeks, I start by looking at publicly traded companies around the world, and looking at how they did, in market capitalization terms, last week, and break down the information by region, sector/industry and classes (PE, momentum, debt etc.). I start with the regional breakdowns:

As with the market indices, it was a week of losses, albeit small ones, in much of the world, with the outliers being Eastern Europe & Russia, which saw a gain of 9.07%, and Japan, which lost 9.38% in market capitalization. Collectively, global stocks lost $1.6 trillion in the week of March 27-April 3, and have lost $22.7 trillion in market capitalization since February 14, 2020, a decline of 25.08%. Moving on to the sector breakdown:

The rise in oil prices pushed up the market capitalization of the energy sector by 6.31%, but most of the other sectors saw losses during the week of 3/27-4/3/20. Incorporating the last week into the data, financial service firms have now taken the dubious lead among sectors, of biggest percentage drop in market capitalization since February 14, 2020, and consumer staples and health care still lead the list of least damaged sectors. Honing down to the industry level and updating the list of ten most hurt and least hurt industries:

|

| Data on all industries |

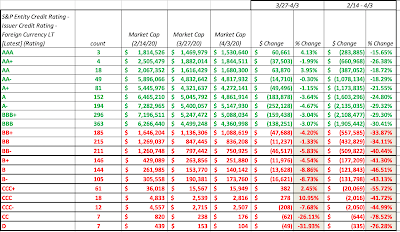

The loser list has many of the same infrastructure industries that showed up in last week’s list, but the winner list has a healthy sprinkling of energy stocks, pushed up by the rise in oil prices during the week. I also did the breakdown, looking at companies in PE classes, momentum classes (based upon price change over the year leading into 2/14/20, net debt classes and dividend/buyback classes) and found that the only categorization where there is significant differentiation in market damage is net debt, where more highly levered companies continue to be punished more than less levered companies. You can find these categorizations and results by clicking on this link. I did extend the analysis to look at companies that have bond ratings, a subset of 2271 Firms out of the total sample of 36,789 firms, and the results reinforce the finding that leverage has the biggest explanatory power for damage from this crisis:

As bond ratings drop, the decline in market value is more precipitous, with the ratings below investment grade (below BBB, in red) being particularly hit.

The Price of Risk

In the last few weeks, as markets have tumbled, I have held back on reporting on a measure that I update every month, which is the equity risk premium. That said, the last six weeks reinforces a lesson that I learned the hard way in 2008, which is that dependence on a static, historical estimate makes no sense in a dynamic, shifting market. In this section, I want to focus on how the price of risk has changed over the last six weeks, and what lessons, if any, we can glean from those changes.

Determinants

In a post from earlier this year on the topic, I argued that every risky asset class market has a price of risk, though that price is more observable in some markets than others. The price of risk changes on a day-to-day basis, and is determined by a combination of variables that encompass almost everything going on in the world from uncertainty about future economic growth (more uncertainty -> higher price for risk) to political stability (more instability -> higher price for risk) to worries about catastrophes/disasters (more worries -> higher price for risk) to investor risk aversion (greater risk aversion -> higher price for risk) to information availability/reliability (less reliable and accessible information -> higher risk premiums). I know that I am giving short shrift to weighty topics, and if you are interested in a more in depth assessment of these variables, you can read my 2020 update on equity risk premiums here. (Be warned. It is long and boring, and may put you to sleep, but that may be a good thing..) The more general point though that emerges from identifying the determinants is that changes in these variables will change the prices for risk, and since investing and valuation has to be based upon updated prices for risk, you need measurement approaches that capture these changes.

Bond Market Price of Risk

In the bond market, the price of risk is observable, since as investors see more default risk in the future, and demand higher prices for risk, bond prices drop and interest rates on bonds increase. That is what I chronicled when I reported on the default spreads on bonds in different ratings classes in the last section, and looked at how these spreads changed over the last few weeks of this crisis. It is true that default spreads, for a given default risk class, don't change much in mature markets during periods of stability, and this can be seen in the graph below, where I look at the default spreads on Moody's Baa rated bonds (translating into an S&P BBB rating) since 1960:

|

| Download raw data |

Even during this period, there have been sub-periods of tumult, as evidenced by the change in default spreads in the 2008 crisis. Looking more closely at the the period between September 12, 2008 to December 31, 2008 at the spreads on bonds, here is what you saw:

In 2008, default spreads doubled between September 12, 2008 and December 31, 2008. In the last six weeks (February 14, 2020- April 3, 2020), the default spreads on bonds in every ratings class have widened, not surprising given both the economic damage done by the crisis and the higher likelihood of default and the fear factor:

It is interesting that the default spreads did not show much effect during the first two weeks of this crisis (February 14- February 28), but woke up to the crisis in the third week. Over the six weeks, spreads have almost doubled for the highest risk classes, and have increased significantly even for higher rated bonds.

Equity Market Price of Risk

Unlike the bond market, it is more difficult to measure a forward-looking and dynamic measure of equity risk, though there are short cuts that people have employed. For instance, there are some investors who use the earnings yield (the inverse of the PE ratio) as a rough proxy, arguing that it should be higher, when equity investors are demanding a higher price for risk. There are others who focus on the VIX, a traded measure of volatility that is observable and is a gauge of fear and worry, rising during crisis and market downturns. In the last six weeks, the VIX has gone on a wild ride, as can be seen in the graph below, peaking at 85.47 on March 18, 2020.

While the VIX is an instrument for measuring market fear, it is not a direct measure of the equity risk premium. My preference is an implied equity risk premium, computed by estimating the internal rate of return investors can expect to earn, given what they pay for stocks and expected cash flows in the future, and netting out the risk free rate:

As some of you who have visited my website know, I update this equity risk premium (ERP) at the start of every year, and the graph below summarizes the implied equity risk premiums on the S&P 500 at the start of every year from 1960 to 2020.

|

| Download historical implied ERP |

Note that the equity risk premium stood at 5.20% at the end of 2019, but is has been more volatile since the 2008 crisis, than prior to it. It was during that crisis that I developed the practice of computing the premium on a day-to-day basis to capture the battle between fear and greed that characterize every crisis. In the figure below,I graph the implied ERP from September 12, 2008 (the Friday before Lehman’s collapse) until December 31, 2008:

Note that on September 12, 2008, which was the triggering point for the 2008 crisis, the equity risk premium for the S&P 500 was 4.22% but during the next eight weeks, the ERP rose sharply to reach a high of 7.83% on November 20, 2008, before subsiding somewhat to end the year at 6.43%. One of the limitations that I faced during that period is that while I was able to update the index values and treasury bond rates every day, the earnings and cash flow numbers were being updated with a substantial lag, with the full changes not showing up until several months later.

I decided to do the same day-to-day calculation for the implied equity risk premium, with an augmentation. Rather than allow earnings and cash flows to remain stagnant, in the face of a crisis that will almost certaintly decimate both, I computed a COVID-adjusted ERP as well, with estimated drops in earnings and cash flows. In making these judgments, I did change my estimates across time, starting with a 15% drop in earning in the first two weeks of this crisis, and ending with a 30% drop in earnings for the S&P in the most recent two. Those changes may reflect my slow learning, as the gravity of the crisis magnified each week:

I decided to do the same day-to-day calculation for the implied equity risk premium, with an augmentation. Rather than allow earnings and cash flows to remain stagnant, in the face of a crisis that will almost certaintly decimate both, I computed a COVID-adjusted ERP as well, with estimated drops in earnings and cash flows. In making these judgments, I did change my estimates across time, starting with a 15% drop in earning in the first two weeks of this crisis, and ending with a 30% drop in earnings for the S&P in the most recent two. Those changes may reflect my slow learning, as the gravity of the crisis magnified each week:

|

| Download raw data |

I understand that this crisis is by no means over, and I intend to keep computing the implied equity risk premium daily for as long as I think necessary, but if your estimates are close to mine, the equity risk premium for the S&P 500 was 6.01% (with the adjusted numbers) on April 1, 2020.

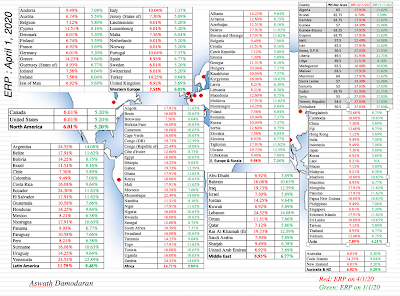

Country Risk Premiums

At the start of each year, I compute equity risk premiums, by country, with the intent of using these numbers when I value companies, and leave them unchanged for the first half of the year. This year, though, the crisis has caused the numbers to change, and in some cases, dramatically. First, the base premium that I use is the US implied equity risk premium which has jumped from 5.20% to 6.01% (see above). Second, the additional risk premiums for countries are based upon sovereign default spreads, which like corporate bond spreads, have widened significantly. My updated basis for computing the country equity risk premiums is below:

My global picture of equity risk premiums at the start of April 2020 is provided below:

|

| Download spreadsheet |

Just to illustrate how much of a difference a few weeks can make to your estimates, I have also included the ERP from January 1, 2020, for comparison. Note that the premiums have not only climbed in every country, but they have increased more in the riskiest countries.

Conclusion

One of the lessons that I learned from the 2008 crisis was to move away from static approaches for computing equity risk premiums, dependent on looking at long periods of history. What I learned during the last three months of 2008 made me switch to using implied equity risk premiums in my valuation and corporate financial analysis, and to compute them on a monthly basis. This crisis has reinforced that practice. I have always found it difficult to grasp how companies can use hurdle rates that are not only set in stone, but set in stone a decade or two ago, even as the market environment shifts and the price of risk changes. The median cost of capital for a global company, which was 7.6% at the start of 2020, is now closer to 8%, with the increase in risk premiums more than compensating for the decline in risk free rates in much of the world and the rise in cost of capital, in US dollar terms, steeper in emerging markets than developed markets.

YouTube Video

Paper on Equity Risk Premiums

Datasets

- Market Changes by Asset Class, 2/14 - 4/03

- Equity Market Changes by Industry, 2/14 - 4/03

- PE, Momentum & Dividend classes, 2/14-4/03

- Equity Risk Premium by day, 2/14 - 4/03

- Updated Equity Risk Premiums, by country (April 1, 2020)

Spreadsheets

Viral Market Update Posts

- A Viral Market Meltdown: Fear or Fundamentals?

- A Viral Market Meltdown II: Pricing or Valuing? Investing or Trading?

- A Viral Market Meltdown III: Clues in the Market Debris

- A Viral Market Meltdown IV: Investing for a post-virus Economy

- A Viral Market Meltdown V: Back to Basics

- A Viral Market Meltdown VI: The Price of Risk

- A Viral Market Meltdown VII: Market Multiples

- A Viral Market Meltdown VIII: Value vs Growth, Active vs Passive, Small Cap vs Large!

- A Viral Market Meltdown IX: A Do-it-Yourself S&P 500 Valuation

- A Viral Market Meltdown X: A Corporate Life Cycle Perspective

- A Viral Market Meltdown XI: The Flexibility Premium

No comments:

Post a Comment