I was planning to start this post by telling you that Tesla was back in the news, but that would be misleading, since Tesla never leaves the news. Some of that attention comes from the company's products and innovations, but much of it comes from having Elon Musk as a CEO, a man who makes himself the center of every news cycle. That attention has worked in the company's favor over much of its lifetime, as it has gone from a start-up to one of the largest market cap companies in the world, disrupting multiple businesses in the process. At regular intervals, though, the company steps on its own story line, creating confusion and distractions, and during these periods, its stock price is quick to give up gains, and that has been the case for the last few weeks. As the price dropped below $200 today (October 30,2023), I decided that it was time for me to revisit and revalue the company, taking into account the news, financial and other, that has come out since my last valuation in January 2023, and to understand the dueling stories that are emerging about the company.

My Tesla History

When I write and teach valuation, I describe it as a craft, and there are very few companies that I enjoy practicing that craft more than I do with Tesla. Along the way, I have been wrong often on the company, and if you are one of those who only reads valuations by people who get it right all the time, you should skip the rest of this post, because I will cheerfully admit that I will be wrong again, though I don't know in which direction. My first valuation of Tesla was in 2013, when it was a nascent automobile firm, selling less than 25,000 cars a year, and viewed by the rest of the automobile sector with a mix of disdain and curiosity. I valued it as a luxury automobile firm that would succeed in that mission, giving it Audi-level revenues in 2023 of about $65 billion, and operating margins of 12.50% that year (reflecting luxury auto margins). To deliver this growth, I did assume that Tesla would have to invest large amounts of capital in capacity, and that this would create a significant drag on value, resulting in a equity value of just under $10 billion.

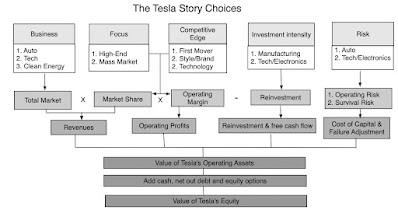

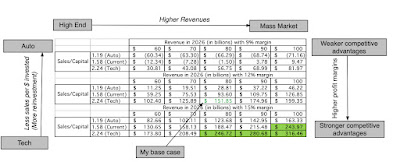

In subsequent valuations, I modified and adapted this story to reflect lessons that I learned about Tesla, along the way. First, I learned that the company was capable of generating growth much more efficiently, and more flexibly, than other auto companies, reducing the capital investment needed for growth. Second, I noticed that Tesla customers were almost fanatically attached to the company's products, and were willing to evangelize about it, yielding a brand loyalty that legacy auto companies could only dream about. Third, in a world where many companies are run by CEO who are, at best, operating automatons, and at worst, evidence of the Peter Principle at play, where incompetence rises to the top, Tesla had a CEO whose primary problem was too much vision, rather than too little. In valuation terms, that results in a company whose value shifts with narrative changes, creating not only wide swings in value, but vast divergences in opinion on value. In 2016, I looked at how Tesla's story would vary depending upon the narrative you had for the company and listed some of the possible choices in a picture:

Tesla Update

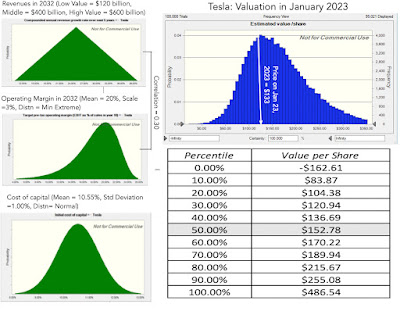

My last Tesla valuation is less than ten months old, and while that is not long in calendar time, with Tesla, it feels like an eternity, with this stock. As a lead in to updating the company’s valuation, it makes sense to start with the stock price, the market’s barometer for the company's health. The stock, which started the year in a swoon, recovered quickly in the first half of the year, peaking around mid-year at close to $300 a share.

The last four months have tested the stock, and it has given back a significant portion of its gains this year, with the stock dropping below $200 on October 30, 2023. Since earnings reports are often viewed as the catalysts for momentum shifts, I have highlighted the four earnings reports during the course of 2023, with a comparison of earnings per share reported, relative to expectations. The first earnings report, in January 2023, has been the only one where the company beat expectations, and it matched expectations in the April report, and fallen behind in the July and October reports.

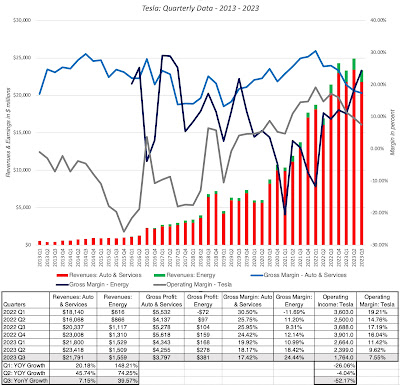

The earnings per share focus misses much of Tesla’s story, and it is instructive to dig deeper into the income statement and examine how the company has performed on broader operating metrics:

In the twelve months, ending September 2023, Tesla reported operating income of $10.7 billion on revenues of $95.9 billion; that puts their revenues well ahead of my 2013 projection of $65 billion, albeit with an operating margin of 11.18%, lagging my estimate of 12.5%. That makes Tesla the eleventh largest automobile company in the world, in revenue terms, and the seventh most profitable on the list, making it more and more difficult for naysayers to argue that it is a fad that will pass. Breaking down the news in the financials by business grouping, here is what the reports reveal:

- Auto business: Tesla's auto business saw revenue growth slow down from the torrid pace that it posted between 2020 and 2022, with third quarter year-on-year revenue growth dropping to single digits, but given the flat sales in the auto sector and a sluggish electric car market, it remains a stand-out. The more disappointing number, at least for those who were expecting pathways to software-company like margins for the company, was the decline in profit margins on automobiles from 2022 levels, though the 17.42% gross margin in the third quarter, while disappointing for Tesla, would have been cause for celebration at almost any of its competitors.

- Energy business: Tesla's energy business, which was grounded by its acquisition of Solar City in 2016, has had a strong year, rising from 4.8% of the company's revenues in 2022 to 6.2% in the twelve months ending September 2023. In conjunction, the profitability of the business also surged in the last twelve months, and while some of this increase will average out, some of it can be attributed to a shift in emphasis to storage solutions (battery packs and other) from energy generation.

- Price Cuts: During the course of 2023, Tesla has repeatedly cut prices on its offerings, with the most recent ones coming earlier this month, The $1,250 reduction in the Model 3 should see its price drop to about $39,000, making it competitive, even on a purely price basis, in the mass auto market in the United States. Some of this price cutting is tactical and in response to competition, current or forecast, but some of it may reflect a shift in the company's business model.

- Full Self Driving (FSD): Tesla, as a company, has pushed its work on full self driving to the forefront of its story, though there remains a divide in how far ahead Tesla is of its competition, and the long term prospects for automated driving. Its novelty and news value has made it a central theme of debate, with Tesla fans and critics using its successes and failures as grist for their social media postings. While an autopilot feature is packaged as a standard feature with Teslas, it offers FSD software, which is still in beta version, offers an enhanced autopilot model, albeit at a price of $12,000. The FSD news stories have also reignited talk of a robotaxi business for Tesla, with leaks from the company of a $25,000 vehicle specifically aimed at that business.

- Cybertruck: After years of waiting, the Tesla Cybertruck is here, and it too has garnered outsized attention, partly because of its unique design and partly because it is Tesla's entree into a market, where traditional auto companies still dominate. While there is still debate about whether this product will be a niche offering or one that changes the trucking market, it has undoubtedly drawn attention to the company. In fact, the company's reservation tracker records more than two millions reservations (with deposits), though if history is a guide, the actual sales will fall well short of these numbers.

Story and Valuation: Revisit and Revaluation

In my Tesla valuations through the start of 2023, I have valued Tesla as an automobile company, with the other businesses captured in top line numbers, rather than broken out individually. That does not mean that they are adding significantly to value, but that the value addition is buried in an input to value, rather than estimated standing alone. In my early 2023 valuation, I estimated an operating margin of 16% for Tesla, well above auto industry averages, because I believed that software and or the robotaxi businesses, in addition to delivering additional revenues, would augment operating margins, since they are high-margin businesses.

The news stories about Tesla this year have made me reassess that point of view, since they feed into the narrative that Tesla not only believes that the software and robotaxi businesses have significant value potential as stand-alone businesses, but it is acting accordingly. To see why, let me take each of the three news story lines and work them into my Tesla narrative:

- Cybertrucks: The easiest news items to weave into the Tesla narrative is the Cybertruck effect. If the advance orders are an indication of pent-up demand and the Cybertruck represents an extension into a hitherto untapped market, it does increase Tesla's revenue growth potential. There are two potential negatives to consider, and Musk referenced them during the course of the most recent earnings call. The first is that, even with clever design choices, at their rumored pricing, the margins on these trucks will be lower than on higher-end offerings. The other is that the Cybertruck may very well require dedicated production facilities, pushing up reinvestment needs. If Cybertruck sales are brisk, and the demand is strong, the positives will outweigh the negatives, but if the buzz fades, and it becomes a niche product, it may very well prove a distraction that reduces value. The value added by Cybertrucks will also depend, in part, on who buys them, with Tesla gaining more if the sales comes from truck buyers, coming from other companies, than it will if the sales comes from Tesla car buyers, which will cannibalize their own sales.

- FSD: As I look at the competing arguments about Tesla's FSD research, it seems clear to me that both sides have a point. On the plus side, Tesla is clearly further along this road than any other company, not only from a technological standpoint, but also from business model and marketing standpoints. While I do not believe that charging $12,000 for FSD as an add-on will create a big market, lowering that price will open the door not only to software sales to Tesla drivers, but perhaps even to other carmakers. In addition, it seems clear to me that the Tesla robotaxi business has now moved from possible to plausible on my scale, and thus merits being taken seriously. On the minus side, I do agree that the world is not quite ready for driverless cars, on scale, and that rushing the product to market can be catastrophic.

- Price cuts: The Tesla price cuts have led to a divide among Tesla bulls, with some pointing to it as the reason for Tesla's recent pricing travails and others viewing it as a masterstroke advancing it on its mission of global domination. To decide which side has the more realistic perspective, I decided to take a look at how price cuts play out in value for a generic company. The first order effect of a price cut is negative, since lowering prices will lower margins and profits, and it is easy to compute. It is the second order effects that are tricky, and I list the possibilities in the figure below, with value consequences:

In short, price cuts can, and often will, change the number of units sold, perhaps offsetting some of the downside to price cut (tactical), make it more difficult for competitors to keep up or enter your business (strategic) and expand the potential for side or supplemental businesses to thrive (synergistic). This figure explains the divide on the Tesla price cuts, with the pessimists arguing that electric car demand is too inelastic for volume increases that will compensate for the lower margins, and the optimists arguing that the value losses from lower margins will be more than offset by a long-term increase in Tesla's market share, and increase the value from their software and robotaxi businesses.

To bring these stories into play, I break Tesla down into four businesses - the auto business, the energy business, the software business and the robotaxi business. I do know that there will be Tesla optimists who will argue that there are other businesses that Tesla can enter, including insurance and robots, but for the moment, I think that the company has its hands full. I look out the landscape for these businesses in the picture below, looking at the potential size and profitability of the market for each of these businesses, as well as Tesla's standing in each.

Note that the auto business is, by far, the largest in terms of revenue potential, but it lags the other business in profitability, especially the software and robotaxi businesses, where unit economics are favorable and margins much higher. Note also that estimates for the future in the robotaxi and auto software businesses are squishy, insofar as they are till nascent, and there is much that we do not know.My Tesla story for each of these businesses is below, with revenue and profitability assumption, broken down by business:

|

| Download spreadsheet |

No comments:

Post a Comment